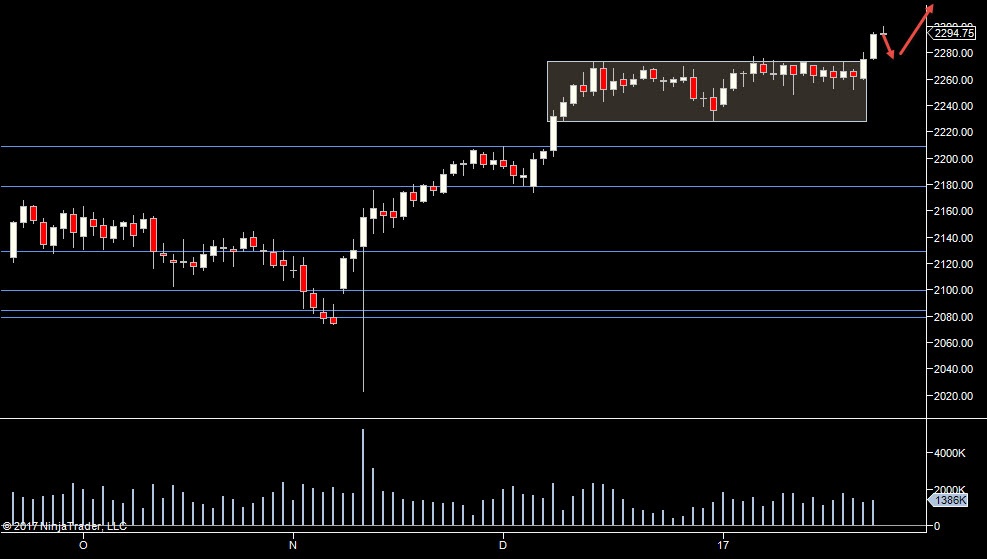

As we discussed last week, if we can test the high of the old range and start to push up, I think that gives us a good chance of a high participation move up. If not and we drop back into the range, I expect we'll spin around in the old range some more. Those are the 2 scenarios I'm looking at medium term.

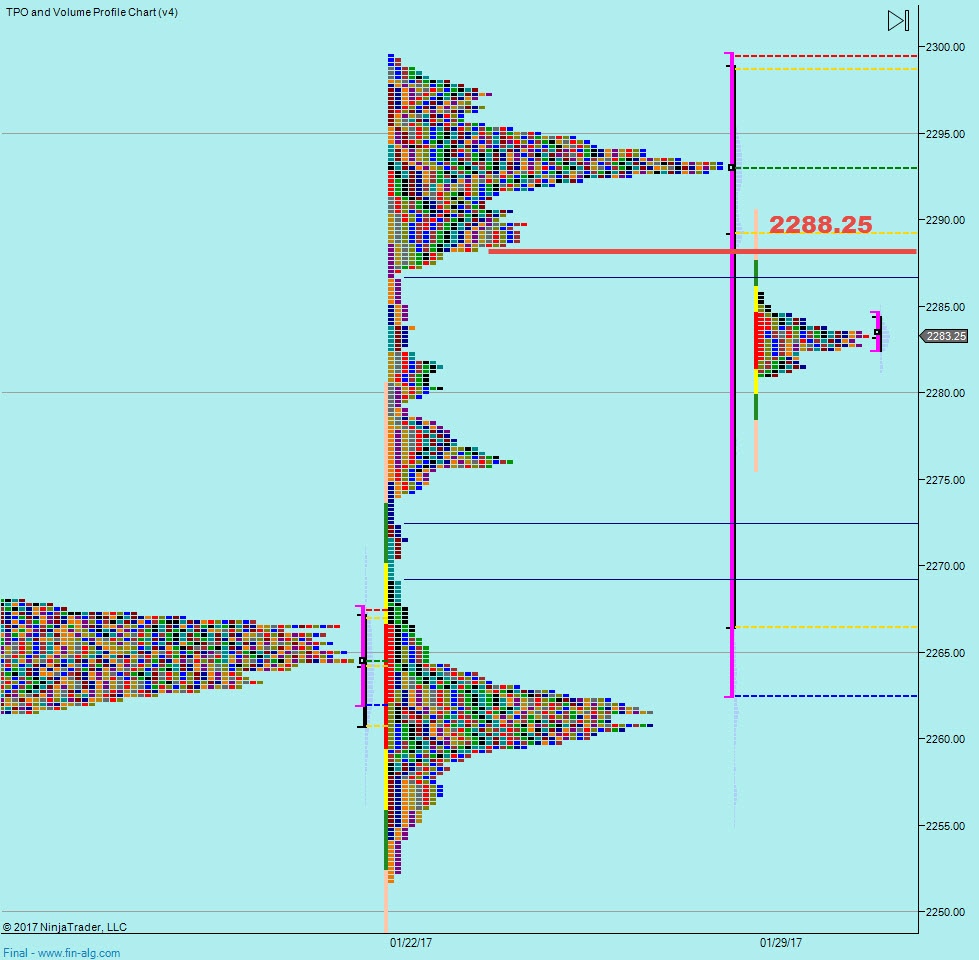

If we do push up, beware as we approach 2288.25 as we have a big step there to the downside, there's not much trade all the way from here down to 65, so be careful long as there's not much holding this up.

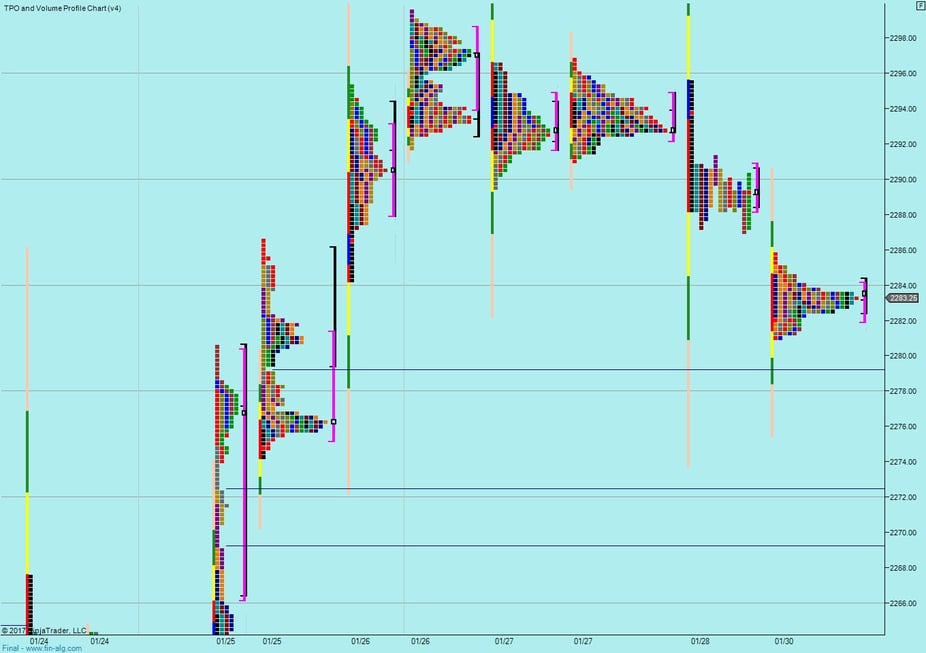

Not much to add here, it's a small gap down today, so we could see a reaction upwards off the open. That may be just a rebalance of overnight activity.

Plan

- a 'go with' day - just go with whichever way it breaks

- will be more aggressive long if we hit 2270 first

- very careful on longs off the open as it might be a short term rebalance

- go with any volume to the short side down to 2265

- no longs too close to 2288.25

Weekly Numbers

Range - 2251.75 -> 2299.50

Value 2262.50 -> 2299.50

S1 - 2306.25, R1 - 2261.50

Daily Numbers

Range 2287 -> 2295.50 / 2296.75

Value 2288.25 -> 2290.75

Globex 2281 -> 2285.75

Settlement – 2289

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

- a 'go with' day - just go with whichever way it breaks

- will be more aggressive long if we hit 2270 first

- very careful on longs off the open as it might be a short term rebalance

- go with any volume to the short side down to 2265

- no longs too close to 2288.25

Weekly Numbers

Range - 2251.75 -> 2299.50

Value 2262.50 -> 2299.50

S1 - 2306.25, R1 - 2261.50

Daily Numbers

Range 2287 -> 2295.50 / 2296.75

Value 2288.25 -> 2290.75

Globex 2281 -> 2285.75

Settlement – 2289

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5