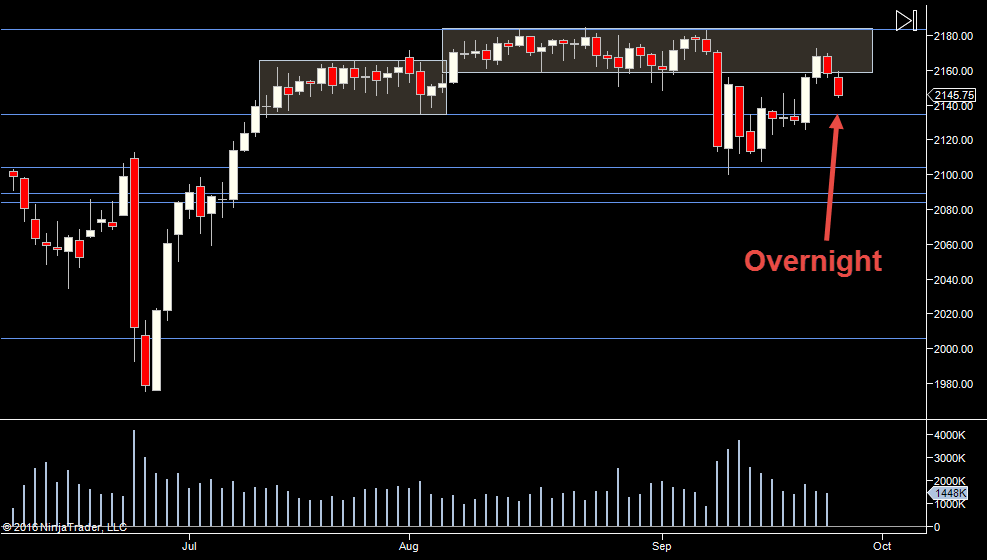

An unclear day from a long term perspective. We have rejected the upper range which has us potentially hitting 2100 and continuing the range from the past few weeks.

An unclear day from a long term perspective. We have rejected the upper range which has us potentially hitting 2100 and continuing the range from the past few weeks.

But there will also be people looking at this from the perspective of a the green line which still has us moving up.

The best days for me are when we have fewer opinions at play. Then when a move is initiated, it's obvious which opinion is playing out.

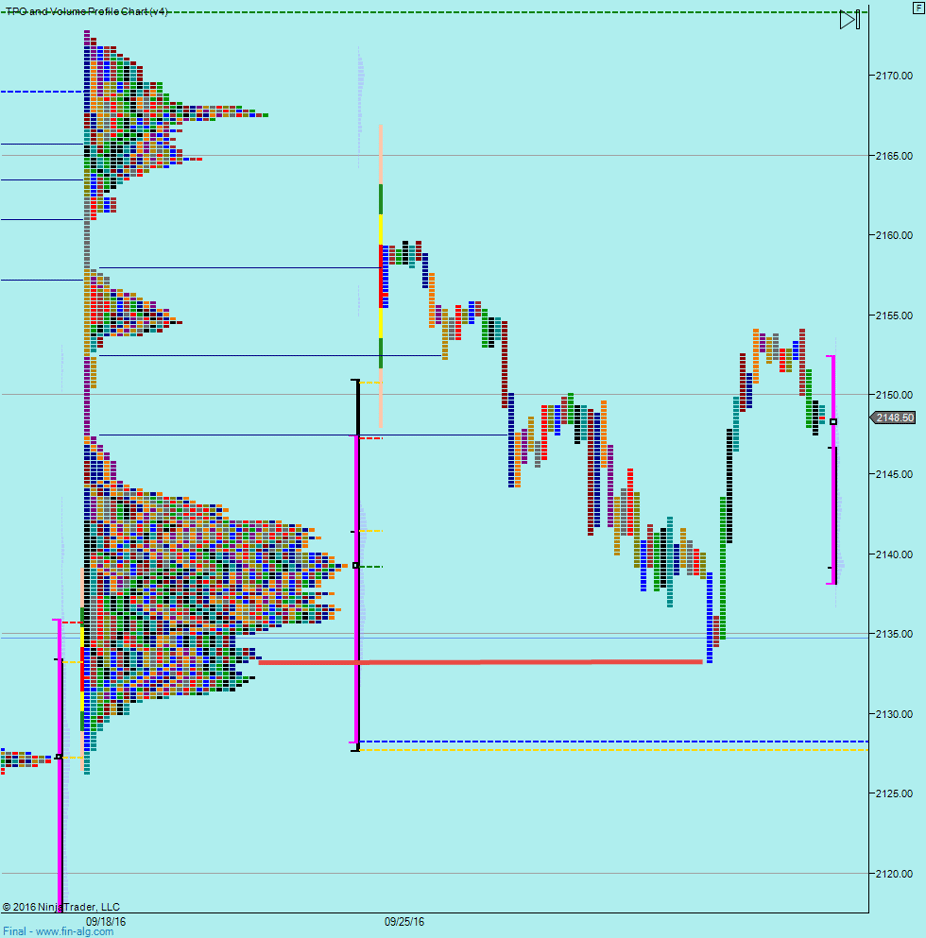

Yesterday we nearly made it to the bottom of the large distribution area from last week and we rejected it - so that's actually good from a continuation up point of view.

A big move overnight after a small move yesterday.

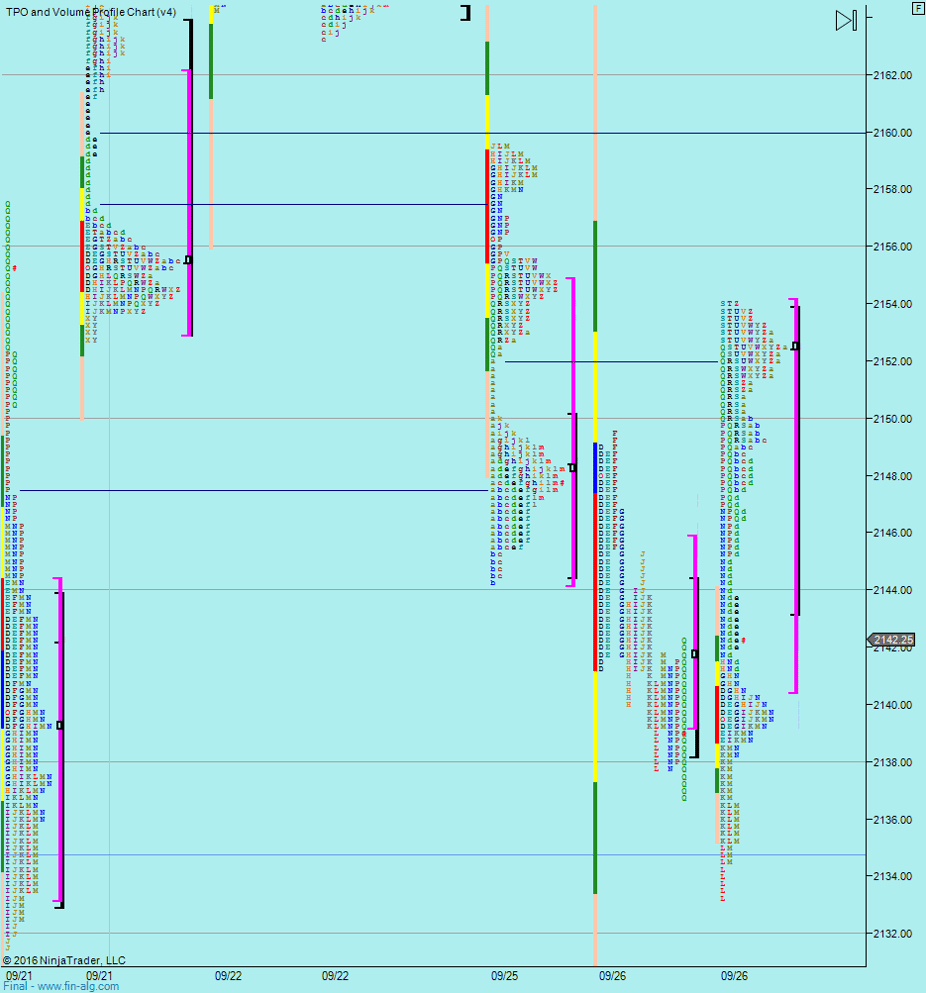

Plan

- No bias

- Going to wait to see what develops, we've been over this area too many times in the past few months.

- There is a small chance of upside speculators getting excited on a push up based on a "trending upwards" market but I'm not too hopeful.

- Will try for an early trade off either overnight high volume areas of yesterdays/overnight extremes.

- Will then look for any ranges forming to fade

- But basically, not expecting too much in terms of decisive moves - a wait & see day

Weekly Numbers

Range 2126.25 -> 2172.75

Value 2128.25 -> 2147.25

S1 - 2132.75, R1 - 21577.75

Daily Numbers

Range 2136.75 -> 2149.50 / 2159.50

Value 2139.25 -> 2145.75

Globex 2133.25 -> 2154

Upper Range - 2158.75-2184,

Settlement – 2139.75

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75