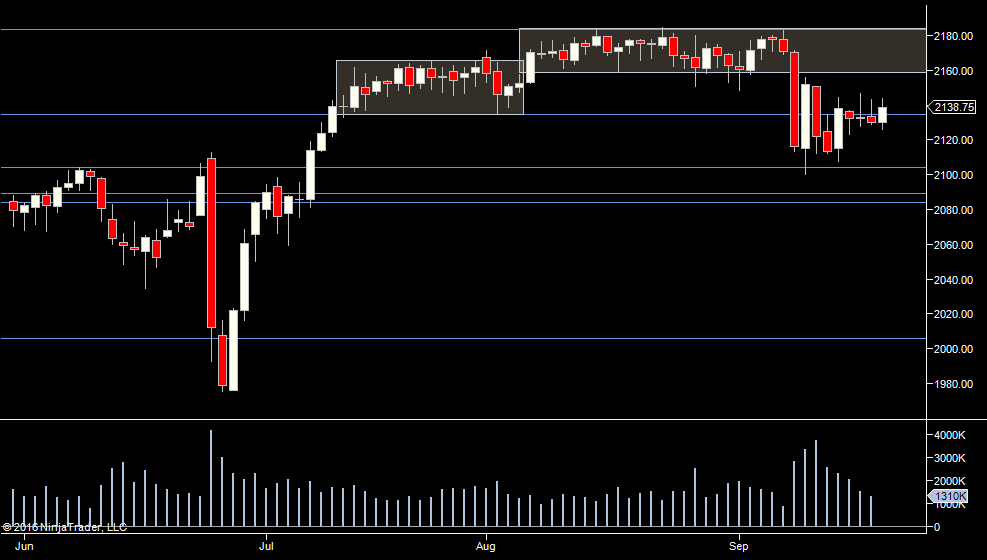

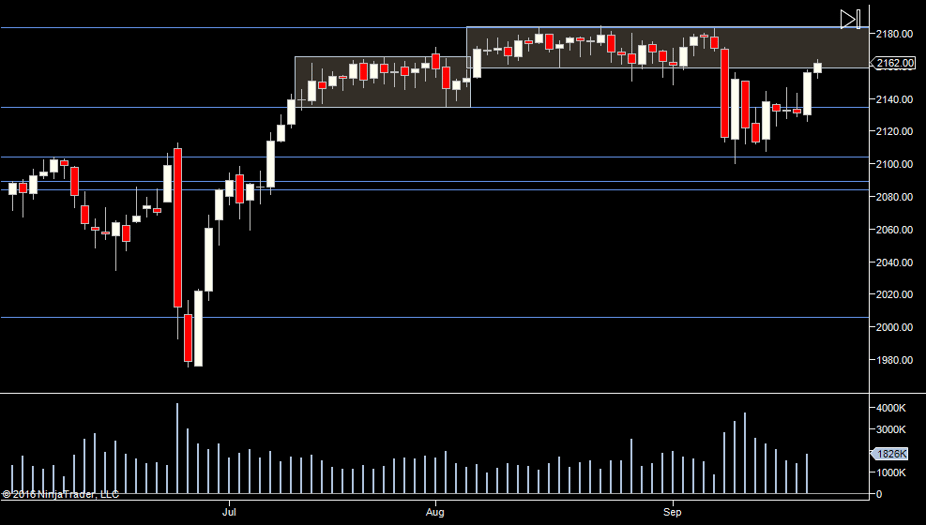

The FOMC 'pop' took us to within 5 ticks of the summer range. We are back in it now, but only in overnight trade, so first order of the day is to see if we can work our way to the other side (2184) and maybe onwards to 2200.

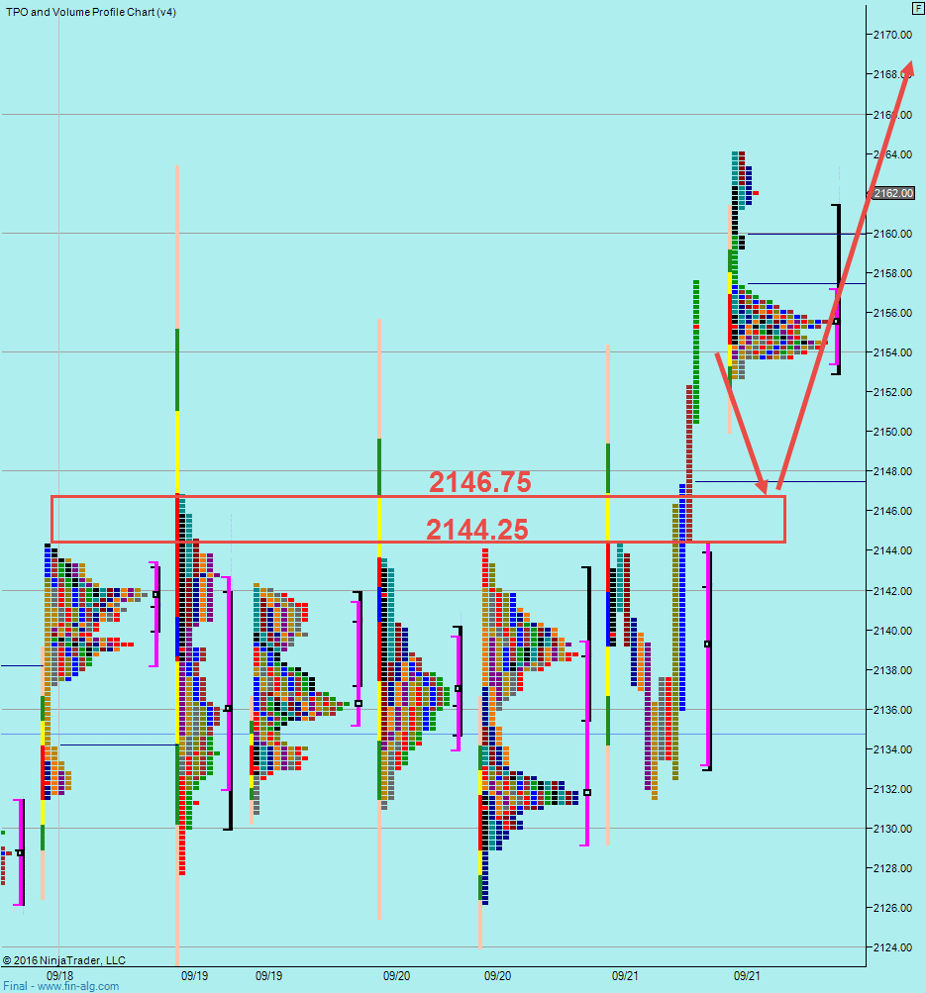

Most of the trade this week was below 44, so that's a line in the sand today.

If we look at the daily picture we can see session highs from 44.25-46.75. So if we do drop down, I'll be looking here for a hold - basically a retest of the highs of the past week and a half.

Plan

- No bias - first order of the day is to maintain the move into the summer range, so above 58.75.

- If it drops down, looking at 44.25-46.75, if that holds, I'll be looking to take advantage of a pop up as I believe buyers will come in with volume.

- If that 44.25 doesn't hold - presume we are back into the range of the past week and a half and a trip to 2100 over the next few days.

Weekly Numbers

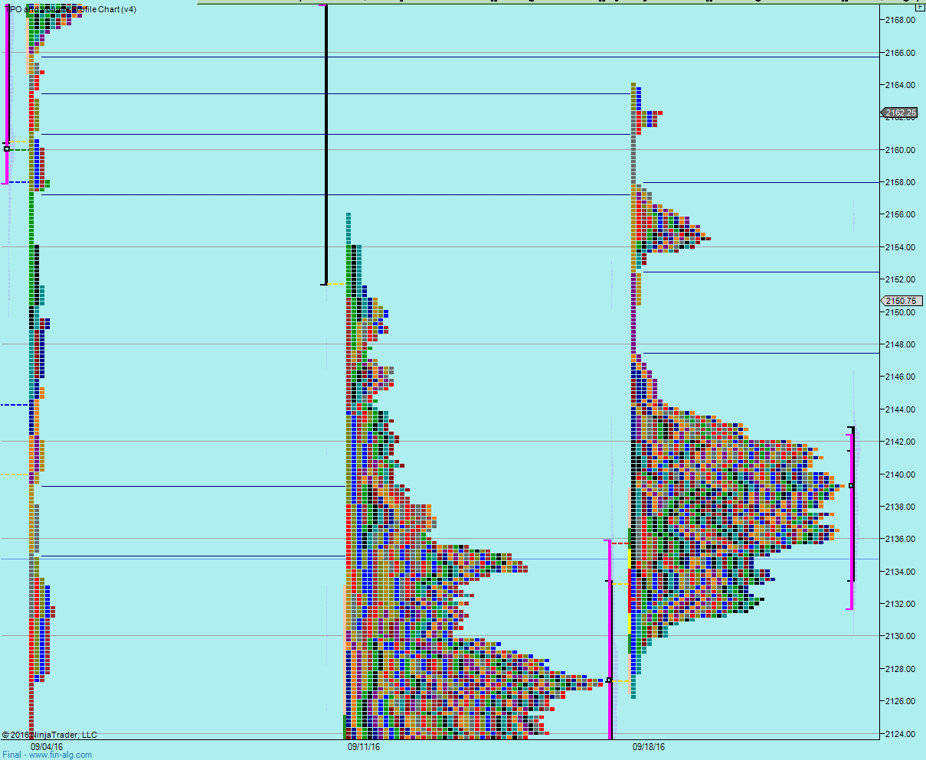

Range 2126.25 -> 2164

Value 2131.75 -> 2142.25

S1 - 2110, R1 - 2155.50

Daily Numbers

Range 2126.25 /2131.50 -> 2157.50

Value 2133.25 -> 2157.50

Globex 2152.75 -> 2165

Upper Range - 2158.75-2184,

Today - 2144.25-2146.75

Settlement – 2162.25

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75

Plan

- No bias - first order of the day is to maintain the move into the summer range, so above 58.75.

- If it drops down, looking at 44.25-46.75, if that holds, I'll be looking to take advantage of a pop up as I believe buyers will come in with volume.

- If that 44.25 doesn't hold - presume we are back into the range of the past week and a half and a trip to 2100 over the next few days.

Weekly Numbers

Range 2126.25 -> 2164

Value 2131.75 -> 2142.25

S1 - 2110, R1 - 2155.50

Daily Numbers

Range 2126.25 /2131.50 -> 2157.50

Value 2133.25 -> 2157.50

Globex 2152.75 -> 2165

Upper Range - 2158.75-2184,

Today - 2144.25-2146.75

Settlement – 2162.25

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75