Well - we got our break as per yesterdays prep and plenty of people did indeed jump on the move. A couple of very clear opportunities on the way down too - first one was 2 attempts to push up through the open price. The first failed, the second failed after a couple of ticks.

Later on we had a pullback to a step in the profile which also held. So textbook ES action.

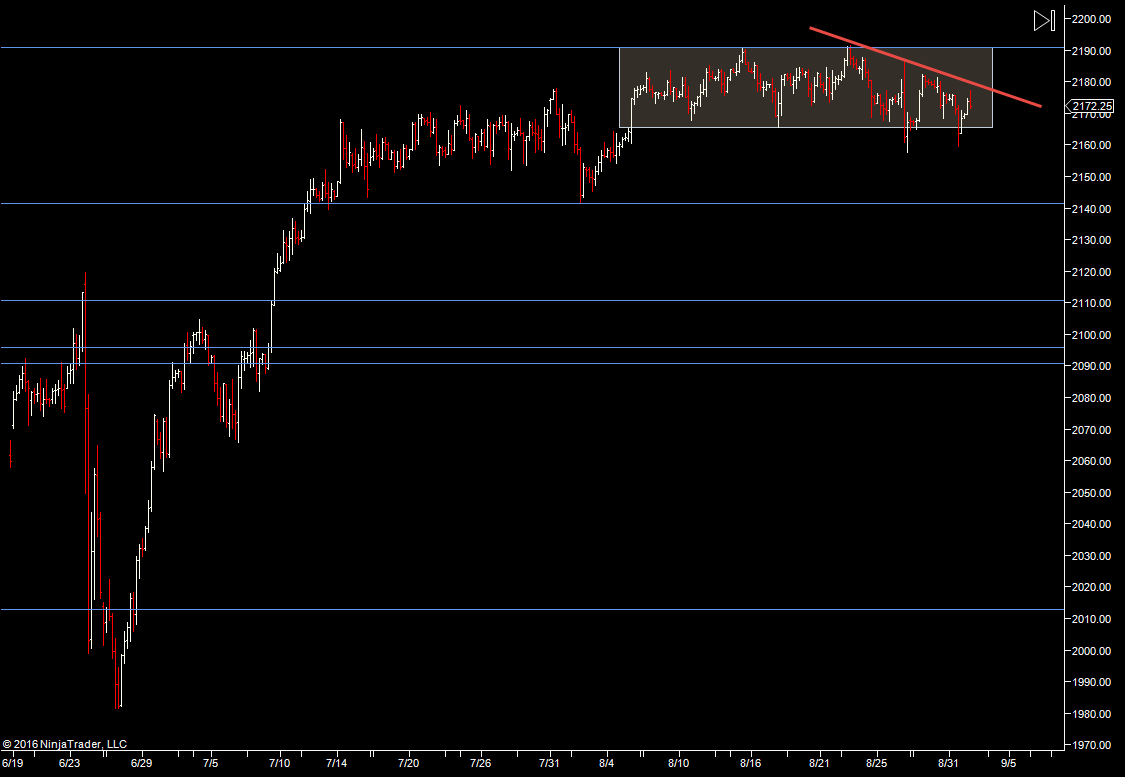

But now we are back in the range - so today is all about whether we can continue down or not. We have employment numbers at 8:30 am and if they are good - it's not too helpful for shorts.

From a weekly perspective - not much happened, we probed past last weeks low. Nothing to get excited about.

And from a daily perspective we actually closed a few ticks above the open. So we got volatility but returned to the range.

Plan

- Be wary of low participation especially if we move upside

- Look for another push down with good volume.

- If volume is low off the open let it build for 15 mins as per yesterdays plan

- No real bias - just hoping for downside moves as I feel that is where we have the best chance of participation

Weekly Numbers

Range 2154.75 –> 2182.25

Value 2164.50 -> 2176.50

S1 – 2153.50, R1 – 2187.50

Daily Numbers

Range 2154.75 -> 2172.35 / 2177.25

Value 2160.50 -> 2169.50

Globex 2164.75 -> 2169.25

Settlement – 2167.25

Range Levels – 2143.50-2177.75, 2165.50->2190.75

Key Levels: 2190.75, 2141.50, 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50

Plan

- Be wary of low participation especially if we move upside

- Look for another push down with good volume.

- If volume is low off the open let it build for 15 mins as per yesterdays plan

- No real bias - just hoping for downside moves as I feel that is where we have the best chance of participation

Weekly Numbers

Range 2154.75 –> 2182.25

Value 2164.50 -> 2176.50

S1 – 2153.50, R1 – 2187.50

Daily Numbers

Range 2154.75 -> 2172.35 / 2177.25

Value 2160.50 -> 2169.50

Globex 2164.75 -> 2169.25

Settlement – 2167.25

Range Levels – 2143.50-2177.75, 2165.50->2190.75

Key Levels: 2190.75, 2141.50, 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50