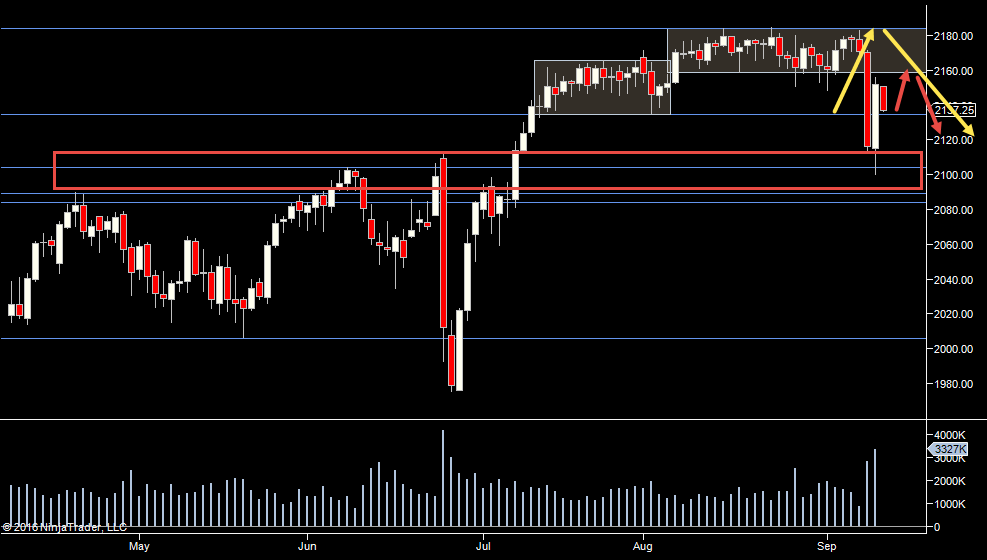

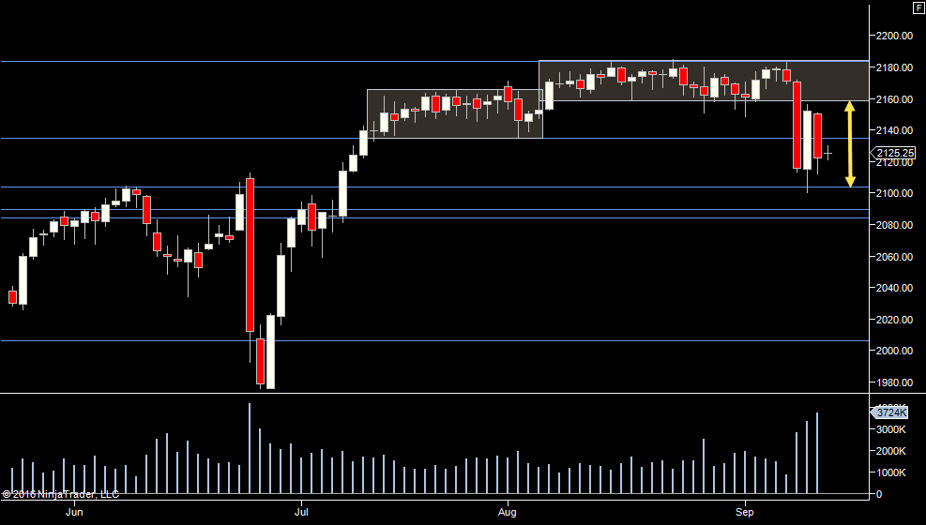

A very indecisive market. As per yesterday, I think it's about the range (2158.75) above and the 2100 below. We are narrowing slightly, so we have to be wary that we may range in this area. Still, it's really whipping around with large volume, so it's clear that people are willing to jump on a move. Just not yet on a move outside of that range. So an eye on them still.

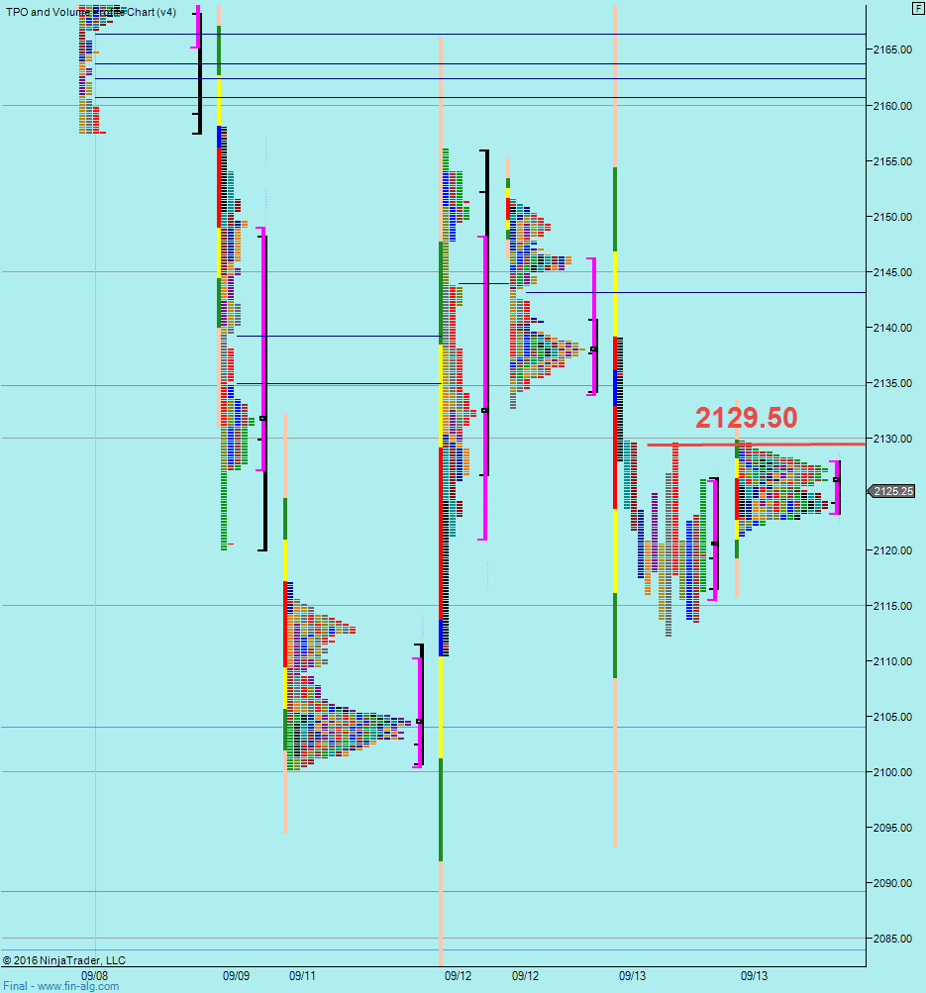

I like the way we topped out around 2129.50 yesterday afternoon and haven't managed to break it overnight. Worth keeping an eye on that today.

The past few days haven't been days where you could do much in the way of finessing an entry. It's been better to scale in as a move progressed.

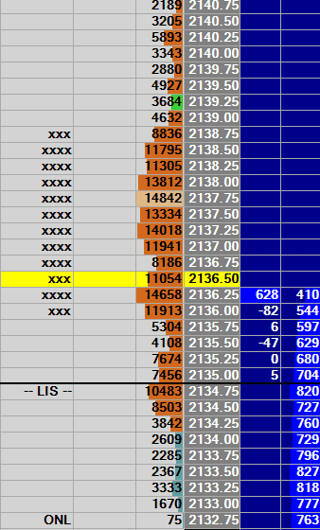

Yesterday we build a lot of volume from 2136-2138.75 into the open. Here's a pic just before the open....

What happened in the day session, an initial push down, then we moved up to move a few ticks through that high volume area a tick or two, failed to stay above it and then the market took a dive. So actually good from a price action perspective.

Plan

- No bias going in, I still think we could break either way

- Going in with the expectation of high volatility but will change that if the volume is lower today

- If it looks volatile, I'll wait for an excuse for one side to come in (like a tick through 29.50 and a fail to hold) and then scale

- Basically looking for a level to break or hold & then follow the volume looking trying to exploit a larger move

- Obviously that plan goes out the window if the market starts slow - but I'm still wary of going all in because yesterdays start wasn't that fast. Trying not to get sucked in to a trade that suddenly sweeps against.

Weekly Numbers

not using weeklies this week

Daily Numbers

Range 2112.25 -> 2139 / 2151.50

Value 2115 -> 2126

Globex 2121.25 -> 2129.75

Upper Range - 2158.75-2184

Settlement – 2128

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75