Yesterday we had

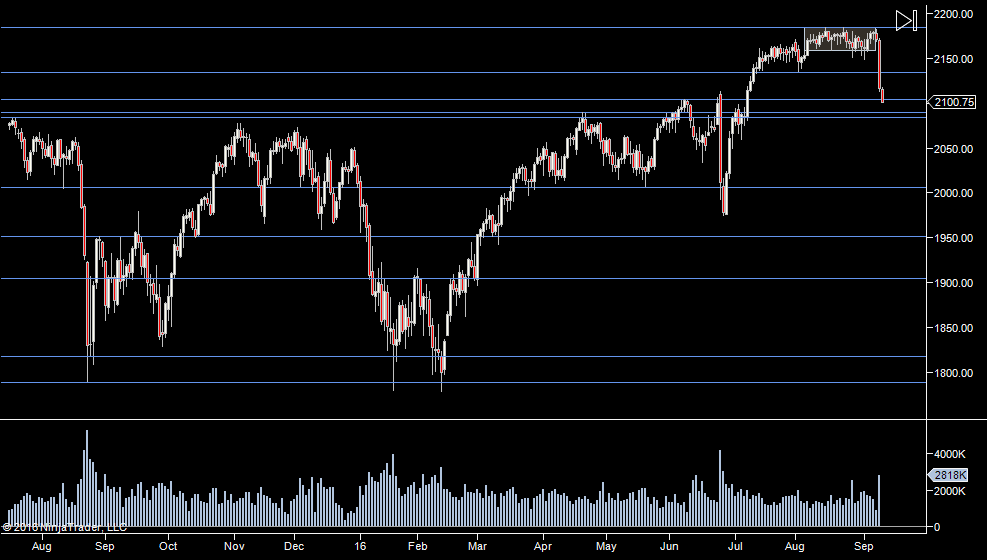

And it was the snap back up we had. If we look at the long red box, this shows the attempts up towards 2100 we'd had earlier this year before finally breaking to the upside. On Friday/Sunday evening we tested that area. It's the first test of 2100 since thebreakout.

Above us we have the upper summer time range. So for today, I have a few scenarios.

1 - We have tested the old highs and we are now on the way up towards 2200

2 - We are at the start of a new shift down and so the test of the old range will hold and that will bring sellers in

So for today, I'm just considering that scenario. The move down spooked a lot of people who then announced that the sky was falling. Then as we moved up yesterday, they all announced that apparently it was an optical illusion. So I think the key prices are 2100 and the range (2158.75-2184).

There's little point considering the weekly profiles after a drop like that. So I'm not too worried about weekly levels for the next couple of days.

Plan

- Potentially volatile day.

- No bias, looking for a break of yesterdays range/overnight range as points to play off

- Expecting selling if we fail to get hold through 58.75 (rejection of the upper range and potential confirmation of a sell off)

- Otherwise looking to follow the volume

Weekly Numbers

Range - not using weeklies after Fridays move

Value

Daily Numbers

Range 2100.25 / 2110.50 -> 2156

Value 2121 -> 2147.75

Globex 2135.50 -> 2151.51

Upper Range - 2158.75-2184

Settlement – 2152

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75