Trading December contract now.

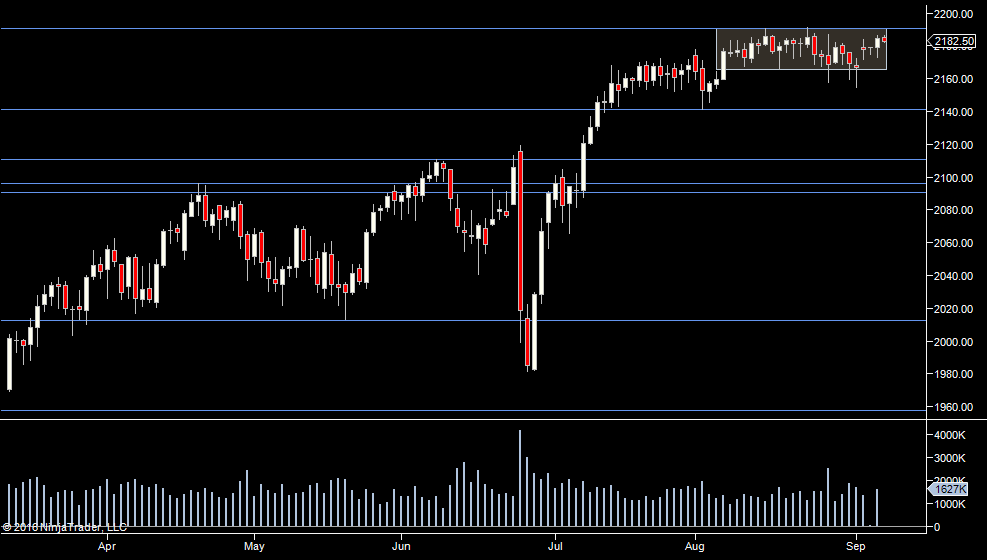

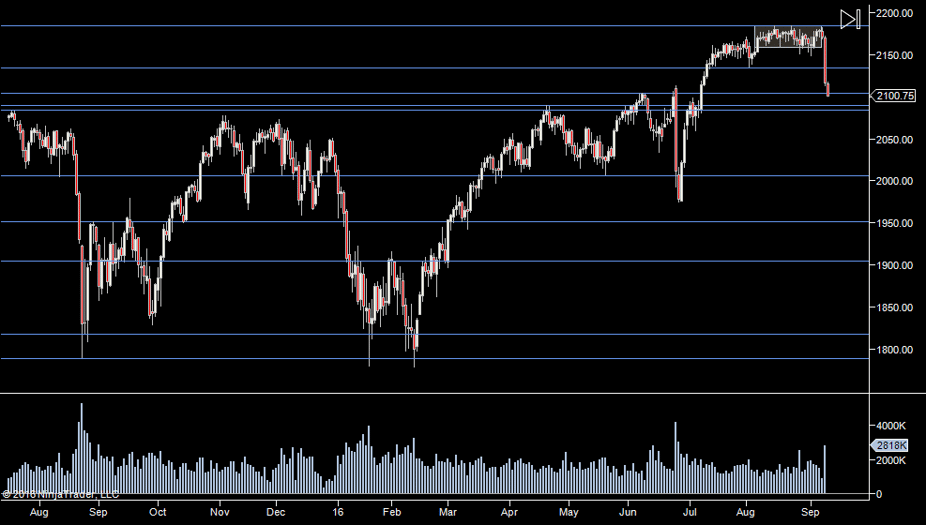

Big drop and huge volume on Friday. Today is 'officially' the day that volume comes back into the markets. So the last of the absent traders will be back.

After a big move day, we often get a push in the opposite direction, so a snap back up has to be one of our scenarios today. We also need to keep an eye on the market depth. If it's very low - in the low 100's, then it's going to be volatile and stops need to be adjusted accordingly.

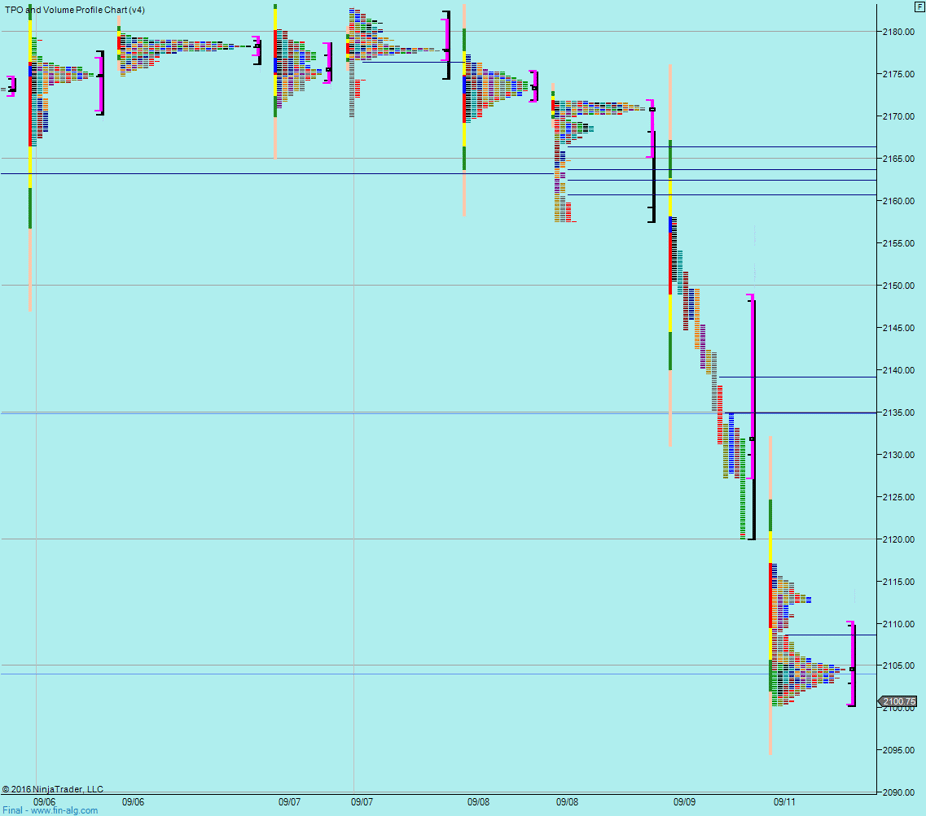

Note that 2104 is a key level and we have paused around there for now. That gives another reason for traders to jump on any move up.

There's little point considering the weekly profiles after a drop like that. So I'm not too worried about weekly levels for the next couple of days.

We've gapped down overnight and them taken another 15 point drop. So it does look bearish for now.

Plan

- US traders will set the tone, so despite the continuation down, look out for a snap up off the open

- Trade in any direction that has volume. People will of course jump into the downside if they think we are due another sell off

- look to scale into trades, add more as you are proven right. That way getting caught out by volatility won't hurt too much

Weekly Numbers

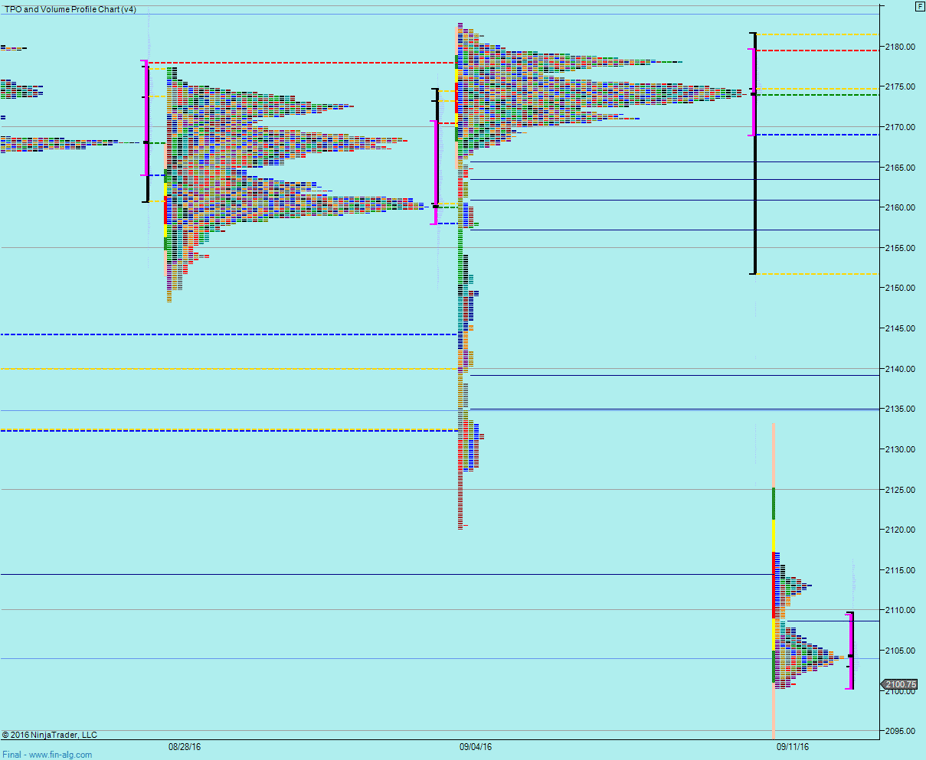

Range - not using weeklies after Fridays move

Daily Numbers

Range 2120 -> 2158 / 2171.75

Value 2127.25 -> 2148.75

Globex 2181.75 > 2100.15

Settlement – 2116

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75

Plan

- US traders will set the tone, so despite the continuation down, look out for a snap up off the open

- Trade in any direction that has volume. People will of course jump into the downside if they think we are due another sell off

- look to scale into trades, add more as you are proven right. That way getting caught out by volatility won't hurt too much

Weekly Numbers

Range - not using weeklies after Fridays move

Daily Numbers

Range 2120 -> 2158 / 2171.75

Value 2127.25 -> 2148.75

Globex 2181.75 > 2100.15

Settlement – 2116

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75