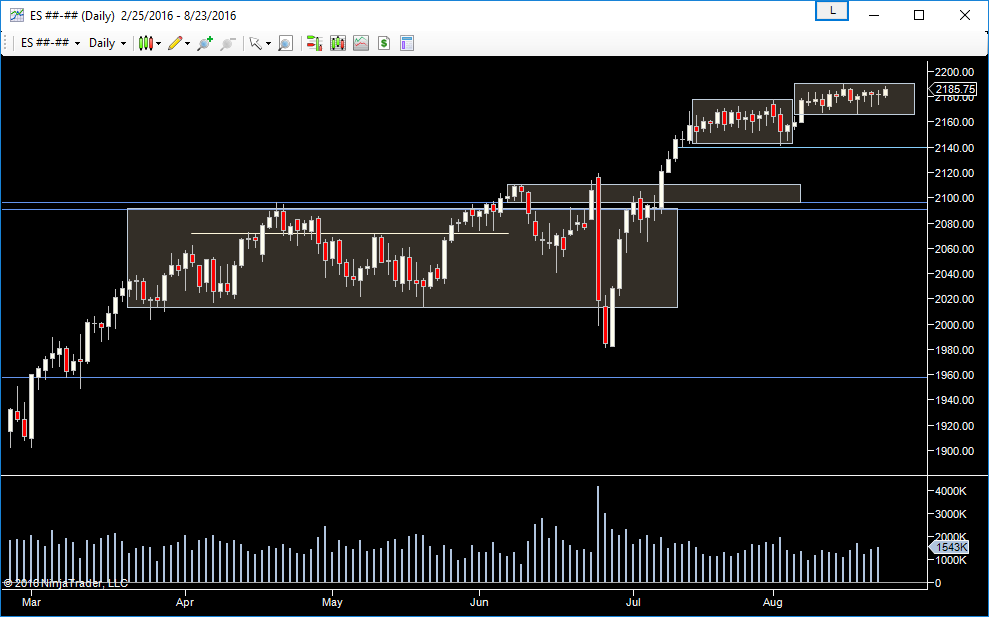

Very low volume yesterday, just over 1.1 million traded. All my horizontal lines disappeared off my chart too - which means it's probably my lucky day.

Not much to see here, still trading around last weeks range.

Yesterday followed our game plan, looking to fade the market at 90.75 (we actually pushed 3 ticks through) but it took a while before we got a break,so whilst the "bigger picture plan" - the market did work - the better trade was fading the high volume nodes that developed intraday.

Obviously, that strategy would have worked better in the morning but we hit the extremes of that intraday range many times.

Plan

- expectation is for continuation down to towards last weeks low/value low (even though it appears to have stalled overnight) 2165.50/2176.50

- if we push through the range take continuation trades only on exceptional volume

- otherwise look to play to the other side of value.

- looking for early trades as there is a high chance of choppy action later on

- on the lookout for intraday high volume nodes to trade around, especially if volume is in the same range as yesterday

Weekly Numbers

Range 2173.50 –> 2191.50

Value 2176.50-> 2185.50

S1 – 2167.75, R1 – 2193

Daily Numbers

Range 2179.25 / 2184.25 -> 2191.50

Value 2186.25 -> 2189.75

Globex 2180.75 -> 2187.75

Settlement – 2185.25

Range Levels – 2143.50-2177.75, 2165.50->2190.75

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50

Plan

- expectation is for continuation down to towards last weeks low/value low (even though it appears to have stalled overnight) 2165.50/2176.50

- if we push through the range take continuation trades only on exceptional volume

- otherwise look to play to the other side of value.

- looking for early trades as there is a high chance of choppy action later on

- on the lookout for intraday high volume nodes to trade around, especially if volume is in the same range as yesterday

Weekly Numbers

Range 2173.50 –> 2191.50

Value 2176.50-> 2185.50

S1 – 2167.75, R1 – 2193

Daily Numbers

Range 2179.25 / 2184.25 -> 2191.50

Value 2186.25 -> 2189.75

Globex 2180.75 -> 2187.75

Settlement – 2185.25

Range Levels – 2143.50-2177.75, 2165.50->2190.75

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50