Yesterday we had:

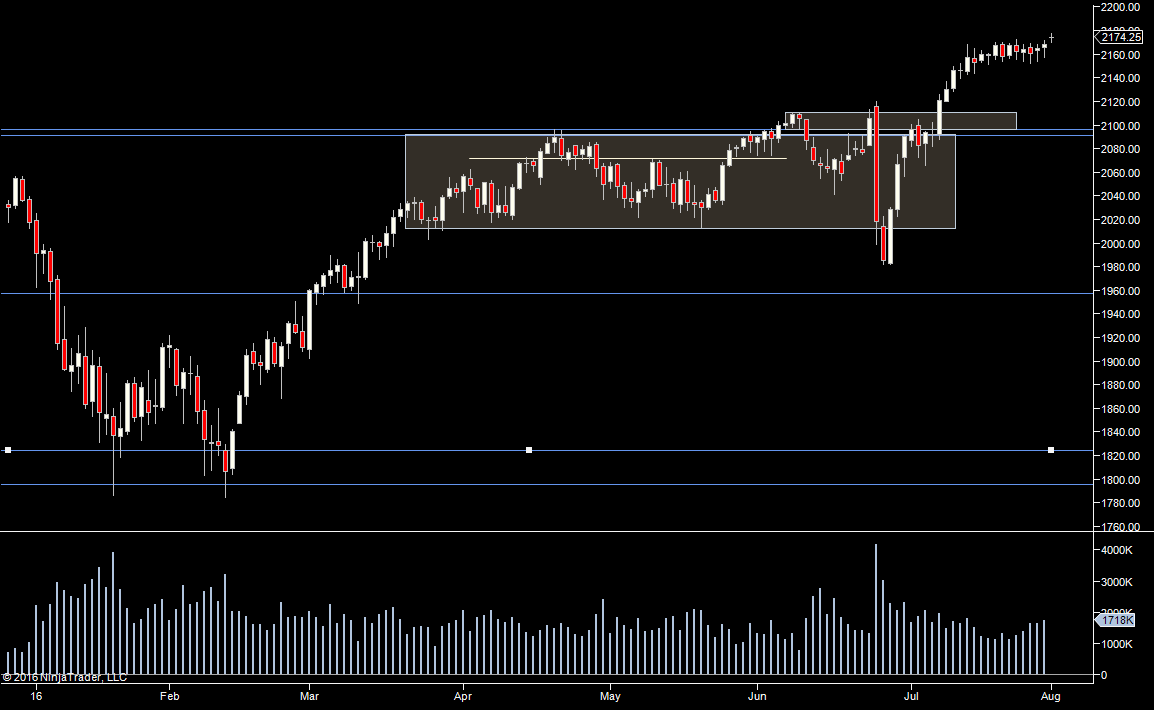

And it seems we couldn't! Back to the range. Although maybe an extended one.

Yesterday, we basically pushed into last weeks value area and traversed to the the other side of it (last weeks VAL was 59 and we got down to 59.75). We have pushed through that overnight.

Yesterday a few nice moves off the open but then rangebound in the afternoon. So back to the mode we were in last week....

Plan

Look for a move off the open because it might be all you get. If missed, consider scaling in as it could be a one way move.

If volume drops and/or NQ/YM start moving in different directions – presume we are reverting to chop

If the market chops around early on, try to stay focused for the break.

If the market chops after a decent (e.g. 8-10 point) move. Consider we may be done for the day.

Obviously if volume comes back into the market, VIX increases and we see a decent swing we can look for continuations

This range is getting old so it could break any time - it's like a coiled spring. We aren't seeing a lack of volume - no days below 1M contracts yet.

Weekly Numbers

Range 2152–> 2172.50

Value 2159 -> 2167.50

S1 – 2156, R1 – 2176.50

Daily Numbers

Range 2159.75 -> 2172.75 (day) / 2177.75

Value 2161 -> 2167

Globex 2157.50-> 2171

Settlement – 2164.50

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50

Plan

Look for a move off the open because it might be all you get. If missed, consider scaling in as it could be a one way move.

If volume drops and/or NQ/YM start moving in different directions – presume we are reverting to chop

If the market chops around early on, try to stay focused for the break.

If the market chops after a decent (e.g. 8-10 point) move. Consider we may be done for the day.

Obviously if volume comes back into the market, VIX increases and we see a decent swing we can look for continuations

This range is getting old so it could break any time - it's like a coiled spring. We aren't seeing a lack of volume - no days below 1M contracts yet.

Weekly Numbers

Range 2152–> 2172.50

Value 2159 -> 2167.50

S1 – 2156, R1 – 2176.50

Daily Numbers

Range 2159.75 -> 2172.75 (day) / 2177.75

Value 2161 -> 2167

Globex 2157.50-> 2171

Settlement – 2164.50

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50