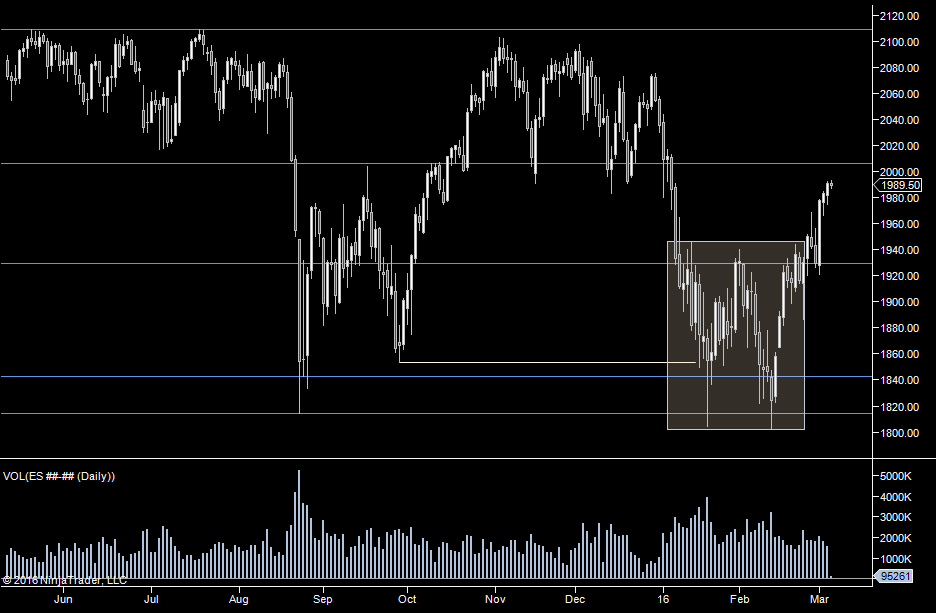

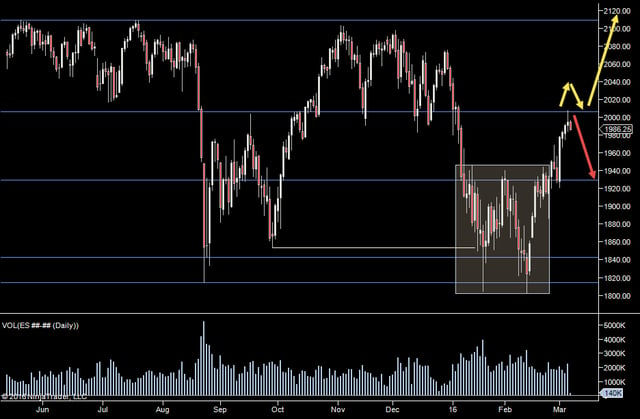

We managed to get to our 2006 level - just through it to 2007.50 and then we fell back to 1990. So today looking to see if we are headed back to the old range or if we get through 2006 again, hold it and start heading to 2100. I have no bias either way going into today.

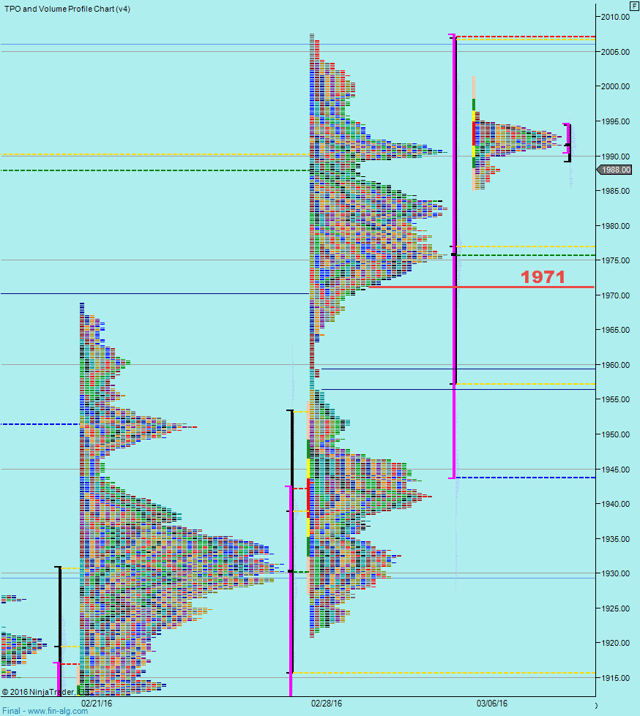

Last weeks profile has an upper distribution which has a low of 1971. So an eye on that as we move down, 1985 is also of interest from the profile.

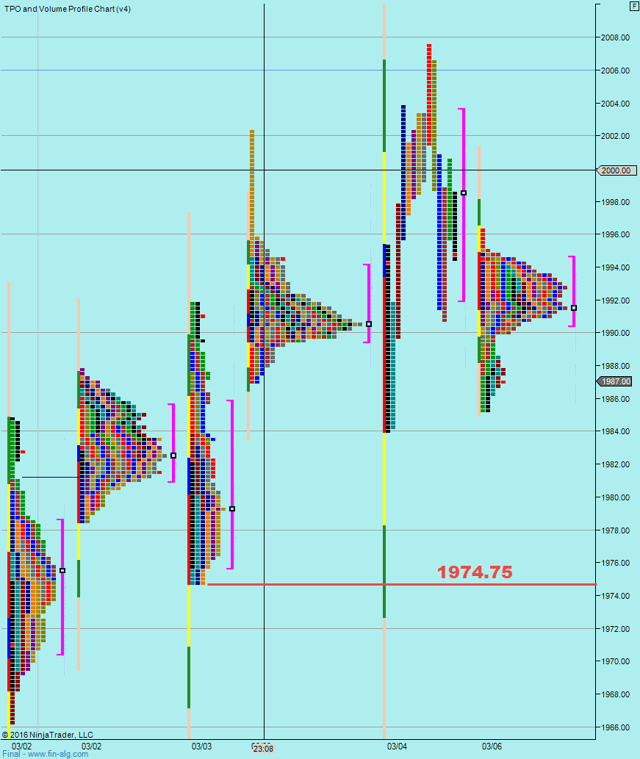

To the downside we also have Thursdays low at 1974.75. Below those levels , it appears we can get to 1945 fairly quickly.

So into today - looking for support to the downside somewhere from 71-74. If we pop up, wary at 2006. If we do move down, volume will be key in telling us whether lots of speculators are making bets to the downside, considering the up move done.

If we see average volume today - then I'll consider the direction unresolved and upside still on the table even if we do move to the downside. It was a big move up and a long time coming. So a bit of profit taking is expected.

Weekly Numbers

Range 1920.75 ->2007.50

Value - 1943.75 -> 2007.25

S1 - 1945 R1 - 2026

Daily Numbers

Range 1984 -> 2007.50

Value 1992 -> 2003.50

Globex 1985.25 -> 1996.25

Settlement - 1995

Today only - 1974.75, 1971, 1985

Long Term 2109.25, 2006, 1929.25, 1843, 1814, 1773.75

So into today - looking for support to the downside somewhere from 71-74. If we pop up, wary at 2006. If we do move down, volume will be key in telling us whether lots of speculators are making bets to the downside, considering the up move done.

If we see average volume today - then I'll consider the direction unresolved and upside still on the table even if we do move to the downside. It was a big move up and a long time coming. So a bit of profit taking is expected.

Weekly Numbers

Range 1920.75 ->2007.50

Value - 1943.75 -> 2007.25

S1 - 1945 R1 - 2026

Daily Numbers

Range 1984 -> 2007.50

Value 1992 -> 2003.50

Globex 1985.25 -> 1996.25

Settlement - 1995

Today only - 1974.75, 1971, 1985

Long Term 2109.25, 2006, 1929.25, 1843, 1814, 1773.75