Futures trading can be a lonely business if you do it from home. So it’s good to talk to other traders. I was chatting with the head of a new Prop trading firm in London yesterday (as you do) and the topic got round to the market action we have right now. We got onto the discussion of transitions and how some people were better at spotting them than others. He knows one trader that can watch a dull market for weeks and then the moment it picks up, hes right on it. In tune with the new conditions almost immediately. That is a rare skill. We’ll consider that in more detail shortly.

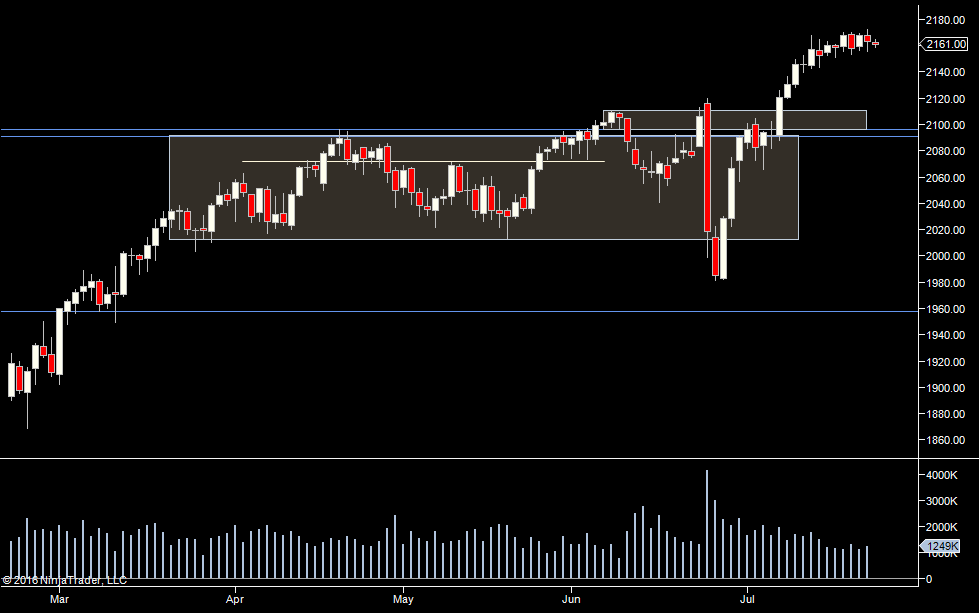

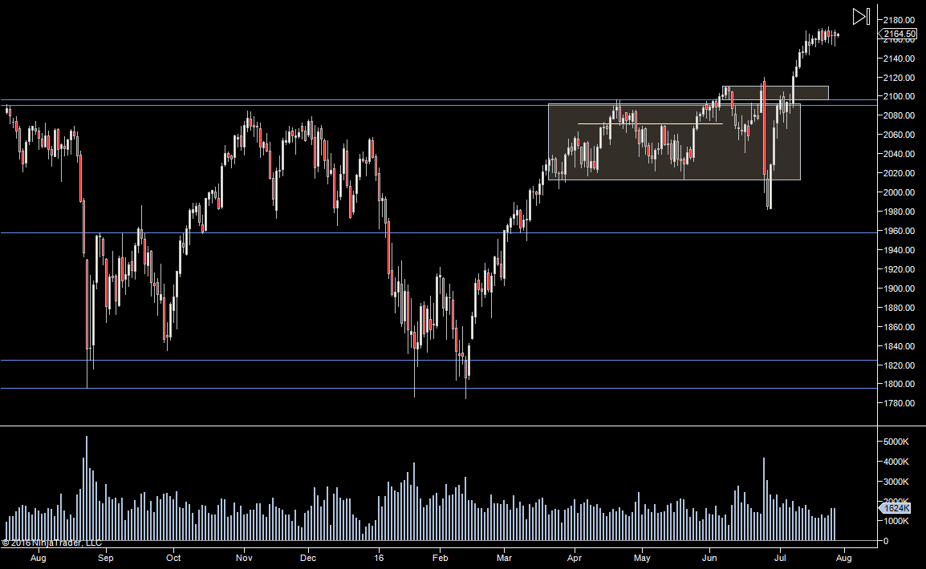

Our challenge is this directionless market. From a long term perspective, futures trading has been pretty good. We went from around 1980 to 2170. From a short term perspective the market has no direction.

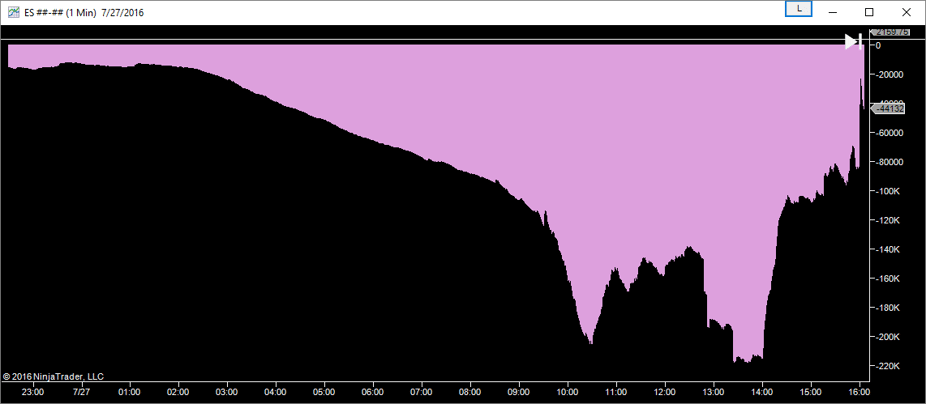

Futures trading volume is still decent. I’d be expecting volumes as low as 800k per day (including overnight) at the low end of summer.

Futures Trading Medium Term

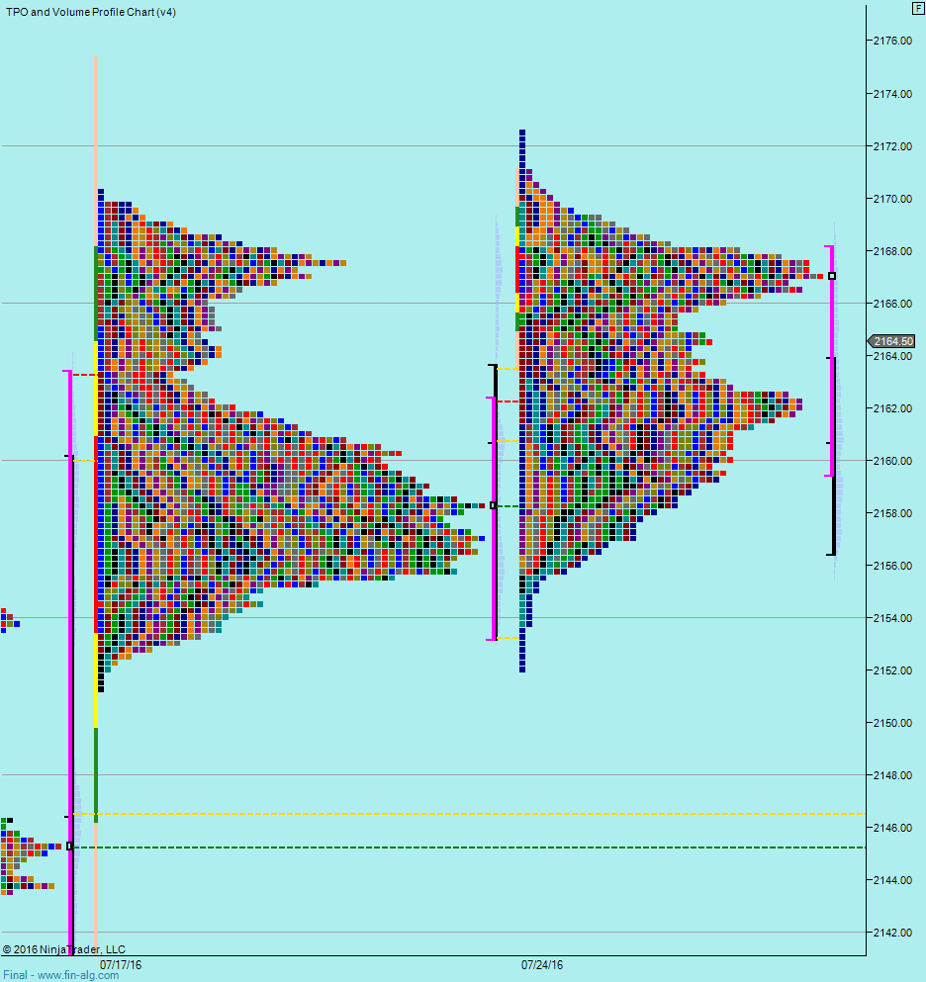

The medium term (weekly profiles) don’t look so great. This week we have done nothing but trade around last weeks profile. That’s great on the days where we hit the extremes of last weeks range but not so good if we are trading in the middle of it.

The Challenge – Transitions

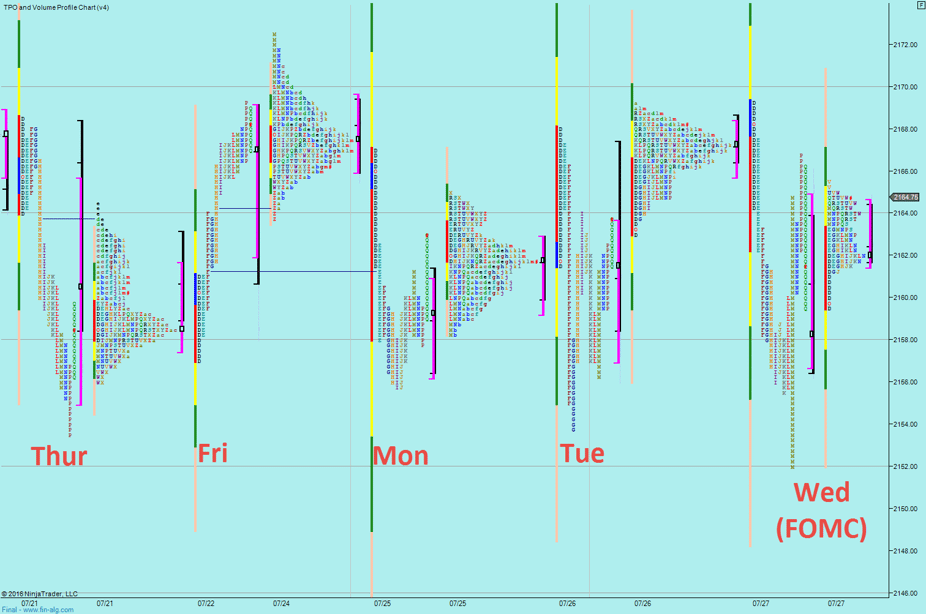

Each letter represents 30 mins of trading. Click the image to view full size.

The challenge right now is best considered by looking at the past 5 days. The profiles with the day under then represent the day session (the time the underlying stock markets were open).

Thursday – Opened and stuck in a 4 point range for over 2 hours. Then the market broke down.

Friday – Market went up from the open and then got stuck in a 3.5 point range for 3.5 hours.

Monday – Broke straight down off the open, then went into a sloppy range that lasted the rest of the day.

Tuesday – A more volatile day for index futures traders. We managed to test the extremes of the prior week before breaking down and testing the lows of the prior week.

Wednesday – a volatile day with good moves trading ahead of and behind the FOMC.

Tuesday and Wednesday were both good days to be futures trading. They are the sort of “day trader days” that we like because they swing nicely in both directions. Thursday, Friday and Monday were trickier because of the transitions from range to trend and vice versa.

Why do Transitions Pose a Problem in Trading?

Traders (certainly myself) get used to the market switching gears periodically. You get to expect certain type of activity when the market opens.

Where index futures trading becomes more tricky is when major behavioral transition occur intraday. .

Days where we open with low volume, very small range – on these days (like Thursday last week), the action is sloppy and you can lose focus. There is not much going on, so you can very easily get bored, start checking email or just having your eyes glaze over. It is hard for some people to keep their concentration. So when the market does break, it is extremely easy to miss it.

Days where we more right off the open – like Monday, catch us by surprise because overall we know the markets are a bit slow. So we come into the day with low expectations. As such, we can get caught off guard by a move off the open. By the time we realize what’s happening, we are chasing a trade and getting caught in the chop. Friday was like this to some extent, we had a probe down off the open but then we marched up and spent hours chopping around.

As volume likely continues to reduce in the coming month, this will become more of an issue unless we address it head on.

Low Volatility Futures Trading Approach

If you want to trade these days, we have to consider a couple of things.

1 – When a market moves sideways, especially if it does so close to the open, it is basically building short term positions in that area. You CAN trade around that area, fading the highs and lows. These are good trades. Eventually there will be a break. This could happen after many hours. It could range all morning and break in the afternoon. The key skill in trading the eventual major move for the day is your ability to stay focused.

2 – Always watch for a break off the open. There may be a test one way and then a break. The test is often of a volume cluster from overnight. If you miss this break, and the market reverts to a range and volume drops, then you might want to think about stopping for the day.

In other words, we are going to have days with just 1 major swing. It may come before or after a range but if you miss it, then the day has passed you by.

Chasing the swing

If you do miss the swing, or the start of it then one approach is to scale into a trade in that direction. Just trade a small size and if it works add some more. That way you aren’t ‘all in’ until you have some move on your side. If you end up positioned into the chop, you are in a better position to work your way out of it.

CSI – Cumulative Sheep Index

The “CSI” is a tongue-in-cheek name for an indicator that shows relative volume. At any time it shows you how much above or below average we are in terms of volume. In this case, relative to the last 60 days.

Traders are like sheep – when a move comes in and it becomes clear, they jump on it. At first just one or two sheep move but then the others see it and the whole herd is going one way.

With this in mind, all that matters here is not the absolute number but whether it’s going up (more sheep coming in right now), down (less sheep coming in right now) or sideways (average).

Using this, along with correlated markets helps you to identify if a move really has some power behind it or if overall interest is dropping off.

Plan for today and the week ahead

- An eye on overnight volume for a clue as to how much participation will come in.

- Look for a move off the open because it might be all you get. If missed, consider scaling in as it could be a one way move.

- If volume drops and/or NQ/YM start moving in different directions – presume we are reverting to chop

- If the market chops around early on, try to stay focused for the break.

- If the market chops after a decent (e.g. 8-10 point) move. Consider we may be done for the day.

Obviously if volume comes back into the market, VIX increases and we see

Weekly Numbers

Range 2152–> 2172.50

Value 2159.50 -> 2168

S1 – 2156.75, R1 – 2174.25

Daily Numbers (for 28th June)

Range 2152 -> 2169.25

Value 2156.75 -> 2164.75

Globex 2159.50 -> 2165.50

Settlement – 2160.50

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50