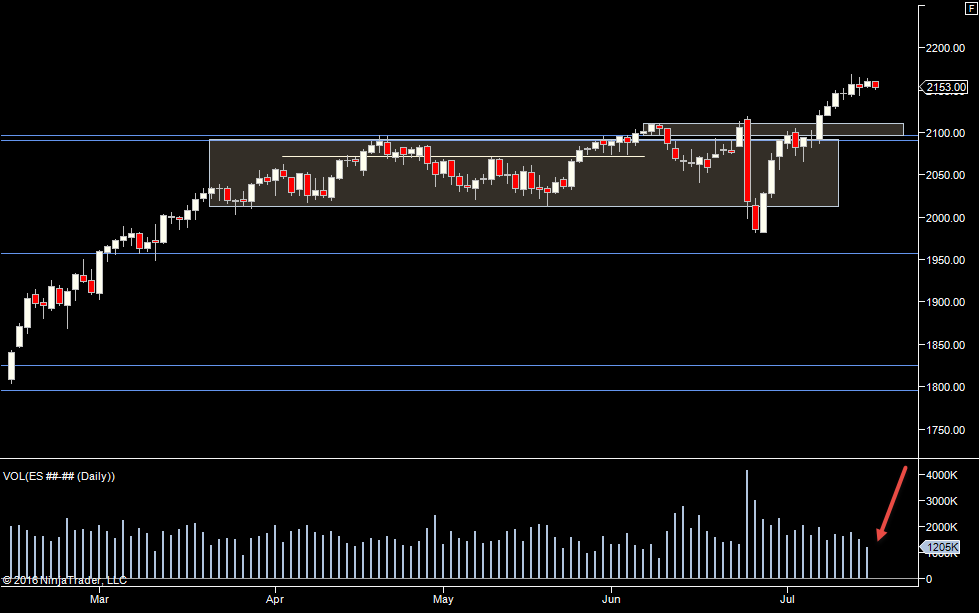

We've probed the top of the range overnight. No signs of a break yet. Yesterday we just traded 1.1 million contracts.

We have a very narrow value area so far this week, so I'm sticking with the same plan - play around the range till we have a clear break.

This range should not hold much longer - it would be rare to be in such a range for 7 or 8 trading days. We should pop out of this range, shake out the positions of traders in the range and then put in a run in one direction or the other. Failure to do that will probably mean we are looking at a summer slow down - but I think it's too early to call right now.

The daily profiles don't help at all really, just confirm the range and that the overnight "pop" to the upside isn't anything new so far.

Plan

- Market is in a range - waiting for a breakout.

- look for absorption at the extremes, around 68.00 at the top now we have pushed up, around 51.50 below. As with all ranges, we have to live with the fact it could fall short or poke through and turn around

- If we do have a strong push up, look for the market to fall back to 2160.75 (developing weekly VAH), if that holds, expect volume to the upside.

Weekly Numbers

Range 2151.25 –> 2167.25

Value 2155.25 -> 2160.75

S1 – 2130.75, R1 – 2169.75

Daily Numbers

Range 2151.25 /2152.25-> 2158.50 / 2161

Value 2153.50 -> 2156.50

Globex 2155.25 -> 2167.25

Settlement – 2158.75

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50