Yesterday we had...

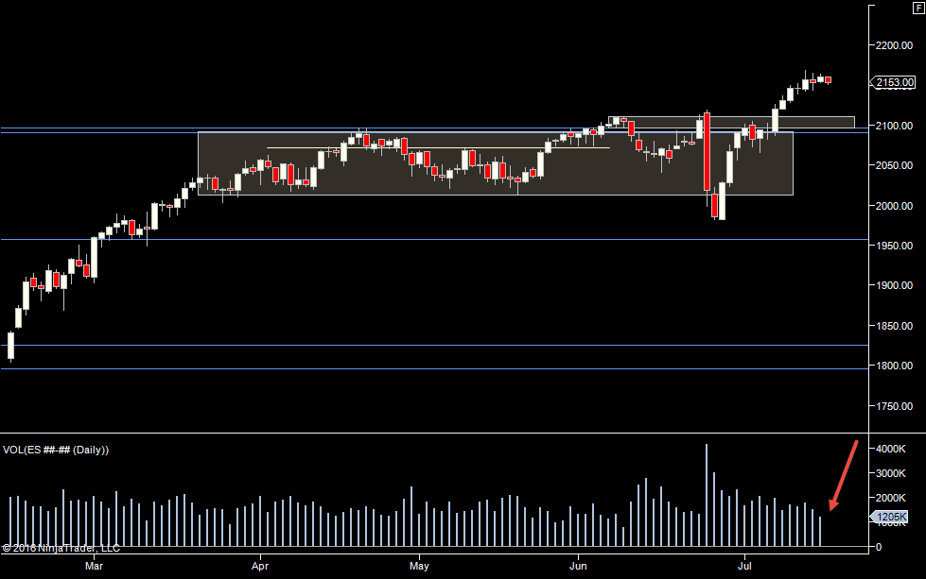

and we can see volume really dropped off yesterday. There was no break, so same deal today.

From yesterday

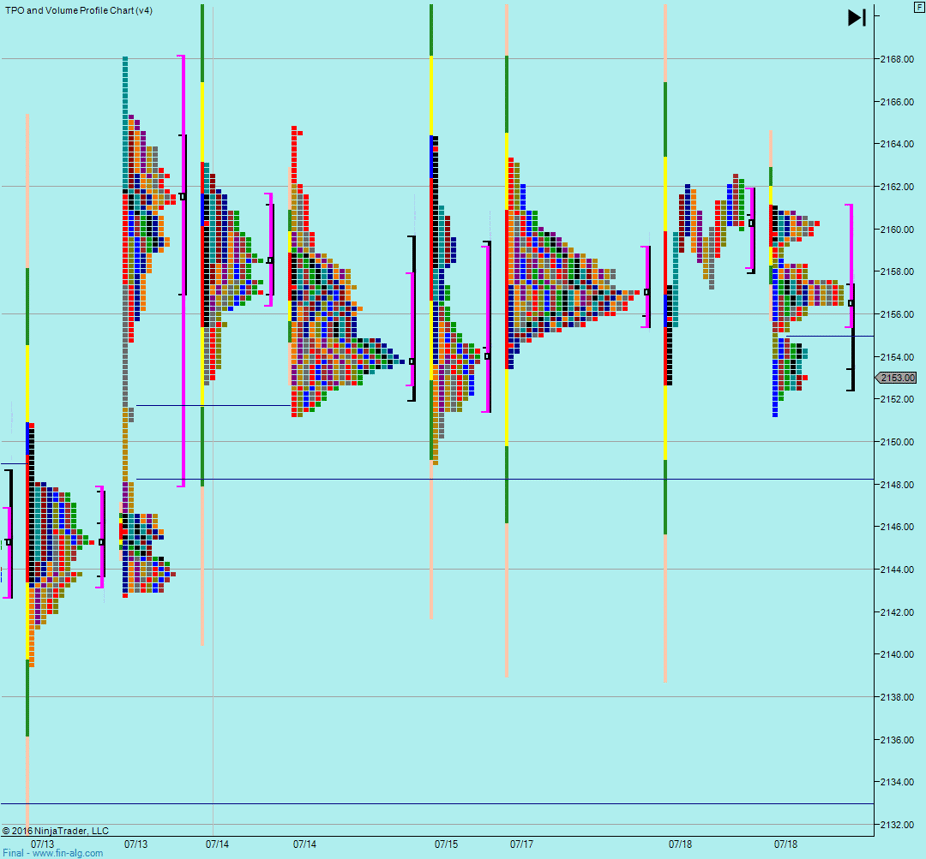

Same today - 62.50 was yesterdays high but we only made it as far down as 52.75 - still, that's ranges for you....

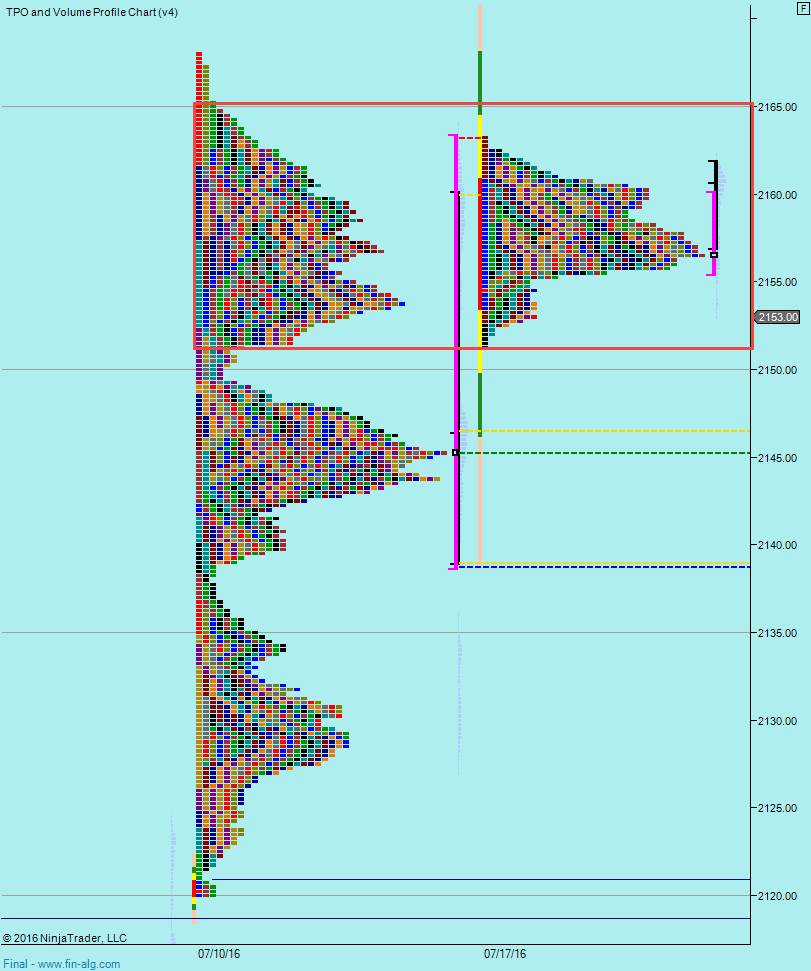

Not much to see here - although it's worth looking at yesterdays value area as we go into today - give it a few ticks leeway there as we have a probe down just below that in the afternoon yesterday.

Plan (this may look familiar as it's copied from yesterday....

- Market is in a range - waiting for a breakout.

- look for absorption at the extremes, around 62.50 at the top, around 51.50 below. As with all ranges, we have to live with the fact it could fall short or poke through and turn around

- Consider a break with high volume to be real and try to get in on a restest of the 51.50-62.50 area

- if retest on a break is missed, slap self in the head and stalk a pullback only if volume is still heavy on the side of the break (just worried we'll run out of steam if we do break)

Weekly Numbers

Range 2120 – 2168

Value 2138.75- 2163.25

S1 – 2130.75, R1 – 2169.75

Daily Numbers

Range 2152.75 -> 2162.50 / 2163.25

Value 2158.25 -> 2161.75

Globex 2151.25 -> 2161

Settlement – 2160

Today only – 2150, 2139

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50