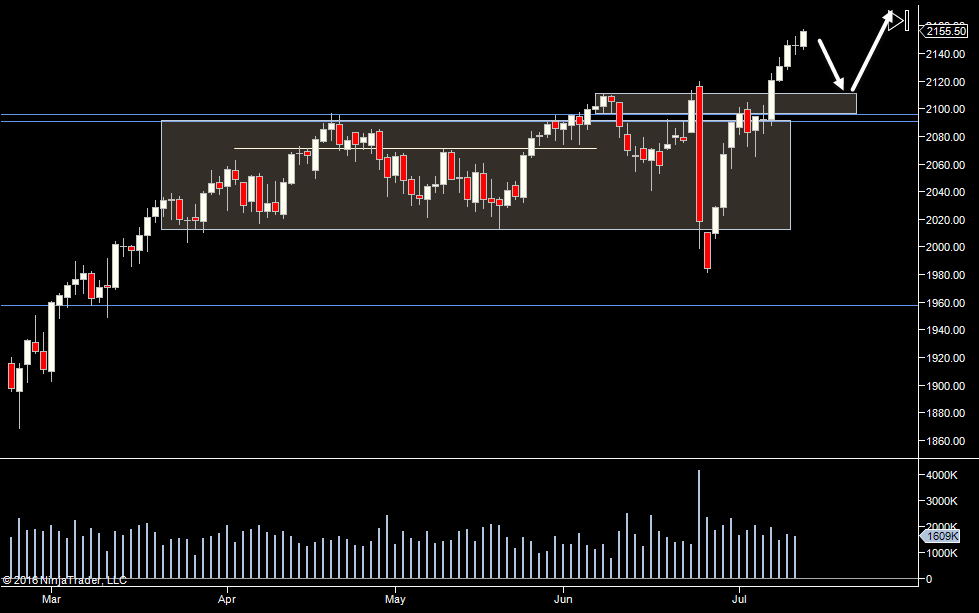

Still working upwards but not with much excitement. I'm still looking for us to drop back and test the old highs or build some volume for us to move up from.

After yesterdays move up overnight we basically sat in a range and now we have a triple distribution week. So looking for 2150 for support and if not, I think it's likely we'll start filling out the range. So in that case, we'd be looking to hit 2139 and then rotate upwards.

We can see the big pop up overnight which was followed by fairly poor action and we didn't really get to any significant prices. Today we look set to open slightly lower than yesterdays close.

Plan

- Looking for a pullback to 2150 - if that fails, expect to see 2139 before rotating up - basically just filling in the weeks profile

- if we move up off the open, will be looking to go with any volume that comes in above yesterdays high

- not to interested in going long into yesterdays day session high (2163) on a move up from the open - need to

- wary of a headfake above 2163

- end of the week - could be dull...

Weekly Numbers

Range 2120 – 2168

Value 2135.75- 2165.25

S1 – 2018.25, R1 – 2137.50

Daily Numbers

Range 2142.75 / 2152.75 -> 2163 / 2168

Value 2156.50 -> 2161.50

Globex 2142.75-> 2159

Settlement – 2157.25

Today only – 2150, 2139

Key Levels: 2110.75 ,2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50