Yesterday we had

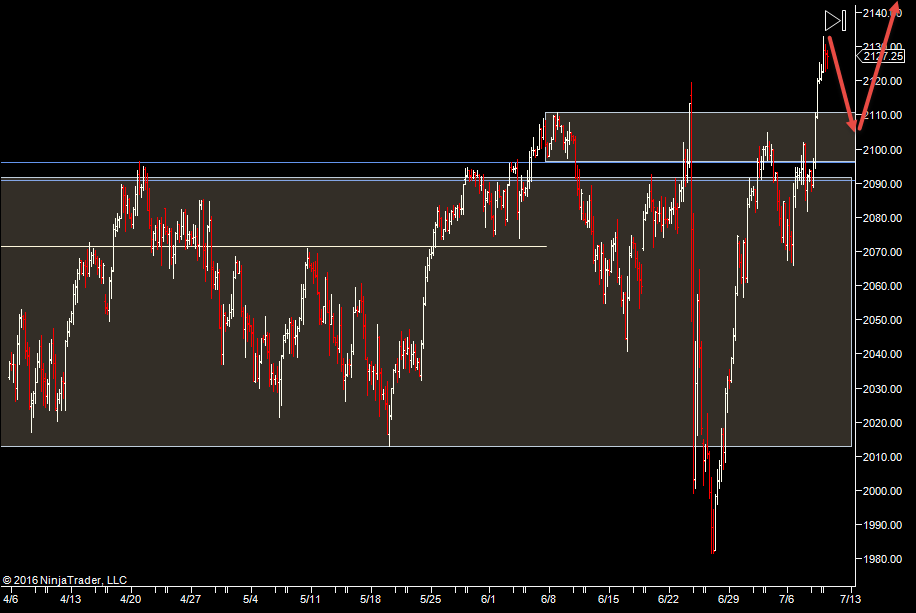

Same deal again today. Yesterday we pulled back to the prior days high and from there we saw speculators jump in.

We still have 2101.25 to look out for below, so if there is a larger pullback, I'll be watching there for support.

The profiles show what we'd expect, progression upwards. Obviously we'll still swing both ways intraday but I'll be watching the regular daily values (high/low/value) to see if buyers step in.

This is yesterdays action. You can see the green line at the bottom, that's the prior days high. The bottom frame contains the cumulative delta. What you can see

- big shift up in delta as we move up from the green line

- large amount of contracts traded in the push up from the green line (168,000)

- large size swing in the push up from the green line (36 ticks).

That is typical of speculators jumping on a move and what this prep is all about.

- Watching areas other people will have their eye on

- looking out for lots of speculators to jump on board when the level holds

- taking a chunk out of that move.

Lesser moves do occur when we move away from less popular levels as less people have an eye on those levels.

Plan

- looking for the market to find support at a key level (or thereabouts) and for volume to come in

- upside biased but with an eye on the market taking a break for the day

Weekly Numbers

Range 2065.75 – 2125.50

Value 2077.25– 2101.25

S1 – 2018.25, R1 – 2137.50

Daily Numbers

Range 2120 / 2125.25 > 2136.75

Value 2129.75 -> 2135.75

Globex 2128.50 -> 2141.75

Settlement – 2130.25

Key Levels: 2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50