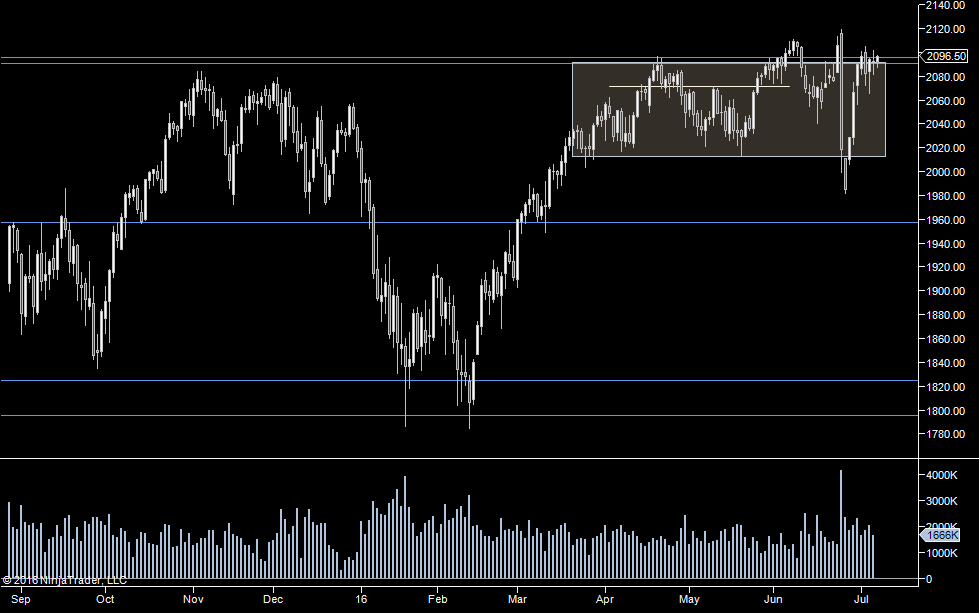

We finally got a decent pop upside, so hopefully we are now on our way to 2200. So for me the game today is to look for signs of continuation to the upside.

Ideally, we'd see a pullback to the old highs which is really anywhere from 2096.50-2110.75. That in my opinion would give speculators more confidence to jump in on the long side.

Based on last weeks profile, 2101.25 saw a very big step in the profile with very little trading above, so a fall back to that area would be idea.

Not much to get from the daily profiles but I will be watching Fridays highs/lows/valuer

Plan

- We may fail downside, in which case it'll be downward move with high volume

- if not presume any downside move is a test & that a test off a key level will bring in volume to the long side

- any move up off the open could be a grind we have already tested Fridays value area, so our test may already be done. If so, we might not get the same response as an intraday test but prepared to just jump on any up move off the open.

Weekly Numbers

Range 2065.75 – 2125.50

Value 2077.25– 2101.25

S1 – 2018.25, R1 – 2137.50

Daily Numbers

Range 2087.50 / 2103.50 -> 2125.50

Value 2109 -> 2122

Globex 2120 -> 2133

Settlement – 2120.50

Today only 2096.50-2110.75 (area for pullback)

Key Levels: 2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50