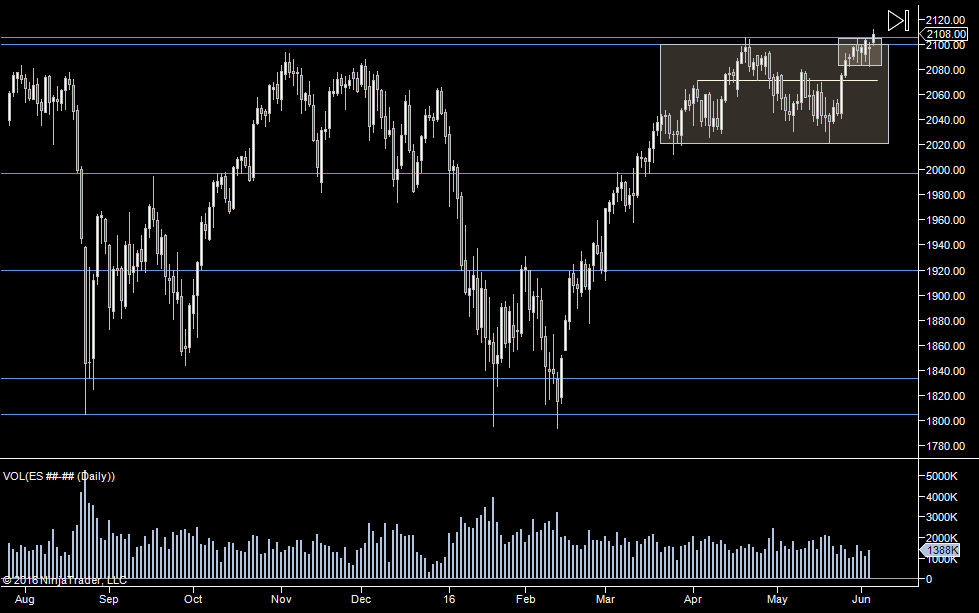

Volume still declining as is volatility. We are trading in new territory and at the moment not really building significant volume anywhere, so not much to stop us going down if sellers do come in. So far, a couple of days grind above the new highs is hardly inspiring.

We are also going into rollover tomorrow, so that will have an impact. Rollovers have historically been lackluster days but the past few quarters they have had good moves. I suspect we'll be back to a slow roll this time.

I'm still looking at last weeks high/value high as potential support. Not really seeing much from this weeks profile to lean on.

The profile makes yesterday look fairly decent but a closer look shows a lot of overlap in the TPOs (30 min periods) which meant it chopped up more than a nice trend up. Overall the market was very thick, with much of the time showing 1000+ on the DOM.

Yesterday we had

Early on (about 9:48), we has 5339 contracts trade at 2110.25/2110.50 - which was a good example of a high volume node that developed. To be honest, you could play those long or short. The fact that you have so much volume at 2 prices means that:

- the reaction will be much larger than the stop (as one side pukes out)

So that's the sort of thing to look out for, more because of the R:R than it being high probability. Contextually the fact that we were low volume, had NQ & YM doing different things meant a fade was appropriate.

So the plan today - is once again

- no bias

- if we open in yesterdays value area - look for shorts of VAH, YH

- on any moves down, watch the 2105-2106 area (and 2104.25) for a hold for some more upside activity

- other than that, just take cue from the volume and jump on breaks of any high volume nodes that develop

Weekly Numbers

Range 2094 -> 2118

Value - 2103 -> 2117

S1 - 2085.75 R1 - 2107.25

Daily Numbers

Range 2106.50 / 2109.25 -> 2118

Value 2112.50 -> 2110.75

Globex 2106.50 -> 2117

Settlement - 2110.25

Long Term 2105.25, 2100, 1996.75, 1920, 1833.75, 1804.75