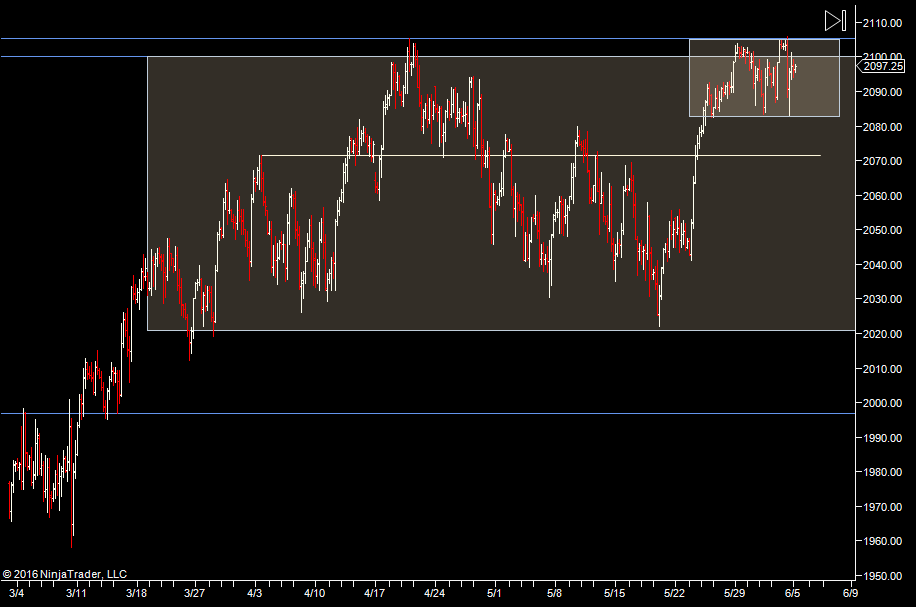

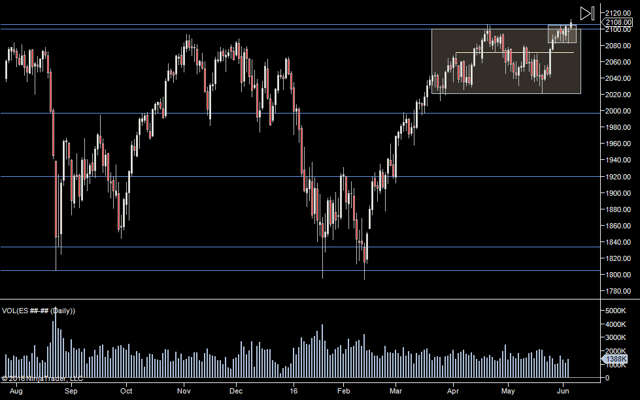

We had a pop through the top yesterday. There wasn't much volume up there and we traded just under 1.4million. Traditionally, it's quite normal for a new high to generate excitement and for that in turn to generate a decent run up. In fact, back in the pit audio days, you could hear the pick up in activity as the market popped up.

The fact that this didn't occur yesterday doesn't mean we won't go up more but it does mean we have to be aware that we may actually grind up, which is something that traditionally leaves many traders (like me) behind because we look for pullbacks.

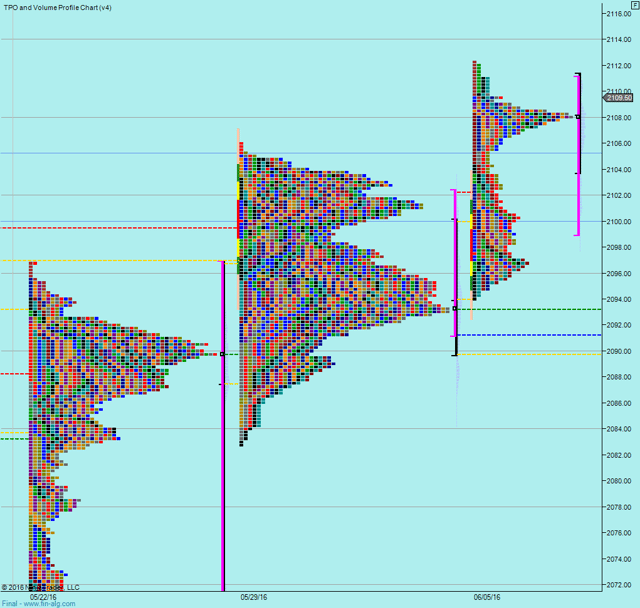

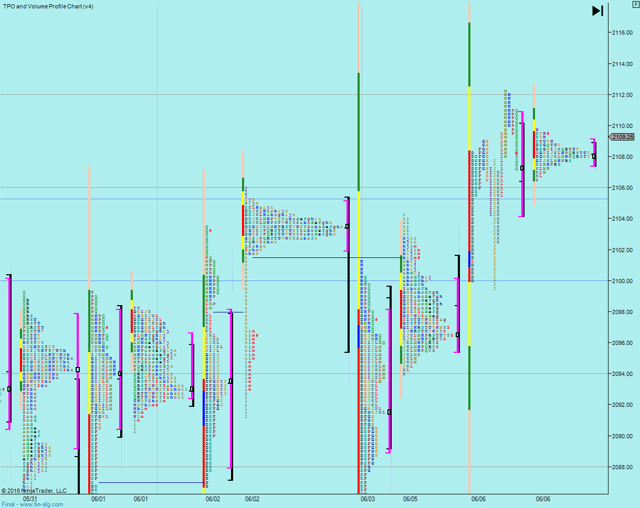

No real profile built this week yet. The spike at the top is the upper range from yesterday that we are sitting in overnight but as it's just 1 trading day, I'm not giving it much significance.

It was a really slow start yesterday, churning thousands of contracts off the open but that volume broke upside and we got a nice run up. That move up left lots of people behind because the open had all the appearance of a summertime chop day. There were swings both ways and money to be made both sides.

It's not exactly decisive, but I am going to watch 2105-2106 on the way down as that's the old all time high/last weeks high and a logical place for it to hold after testing 2100 twice.

Overnight is low volume once again and within yesterdays value area, so could be a slow start.

Plan

- no bias

- if we open in yesterdays value area - look for shorts of VAH, YH

- on any moves down, watch the 2105-2106 area (and 2104.25) for a hold for some more upside activity

- other than that, just take cue from the volume and jump on breaks of any high volume nodes that develop

Weekly Numbers

Range 2082.75 -> 2106

Value - 2091.25 -> 2102.25

S1 - 2085.75 R1 - 2107.25

Daily Numbers

Range 2094 / 2099.50 -> 2112.25

Value 2104.25 -> 2110.75

Globex 2106.50 -> 2109.75

Settlement - 2108.25

Long Term 2105.25, 2100, 1996.75, 1920, 1833.75, 1804.75