Of course, after any big up day, we can get a quick counter-reaction off the open. That would be helped by any big continuation overnight - which we haven't had. So based on this alone, I'm neutral going in to today.

In terms of weekly profile we are currently right in the middle of the week - so not the best spot for value based traders. We could end the week on a low note and just chop around today. Based on this - I'll be watching the weekly value area 2055, 2075 for a reaction and not so interested in the middle.

I don't see much to play off. I think today it's a matter of taking cue's off intraday action.

Plan

- Neutral bias

- look for a snap down off the open & if it does happen - jump on it

- look for reactions at 2075 & 2055

- other than that, keep in mind that we could have a low volume low range day and wait for volume to give us a clue

On days where we start in the middle like this, I'd rather not have a couple of failed attempts as we might not have the volatility to make up for them.

Weekly Numbers

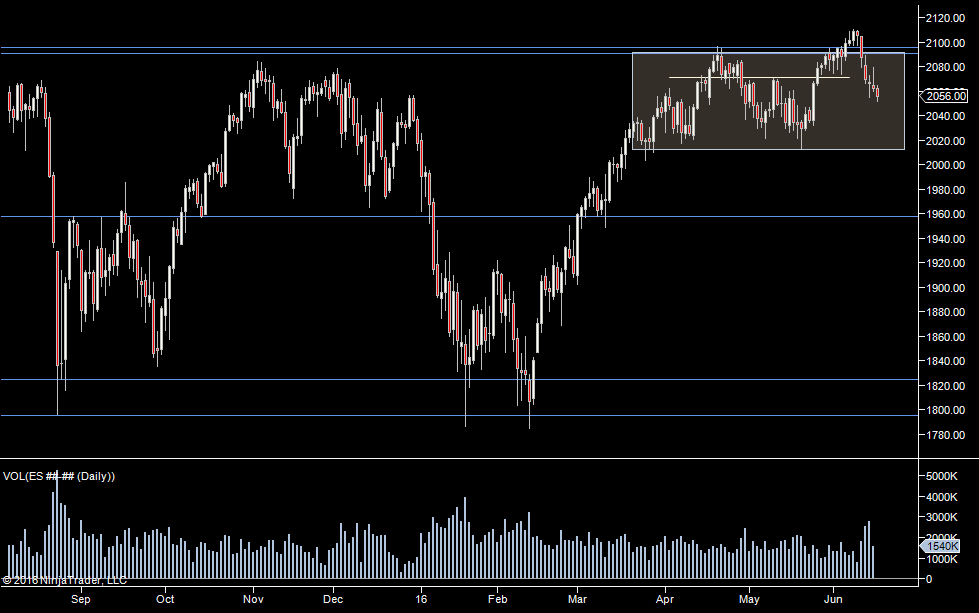

Range 2040.75 -> 2089.25

Value - 2055 -> 2074.75

S1 - 2074.25 R1 - 2105.50

Daily Numbers

Range 2040.75 -> 2071.50

Value 2048.75 -> 2067.25

Globex 2056.25> 2074.75

Settlement - 2070.50

Today only 2078-2079.25

Long Term 2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50

Plan

- Neutral bias

- look for a snap down off the open & if it does happen - jump on it

- look for reactions at 2075 & 2055

- other than that, keep in mind that we could have a low volume low range day and wait for volume to give us a clue

On days where we start in the middle like this, I'd rather not have a couple of failed attempts as we might not have the volatility to make up for them.

Weekly Numbers

Range 2040.75 -> 2089.25

Value - 2055 -> 2074.75

S1 - 2074.25 R1 - 2105.50

Daily Numbers

Range 2040.75 -> 2071.50

Value 2048.75 -> 2067.25

Globex 2056.25> 2074.75

Settlement - 2070.50

Today only 2078-2079.25

Long Term 2096, 2090.75, 2012.75, 1957.50, 1910.75, 1824.50, 1795.50