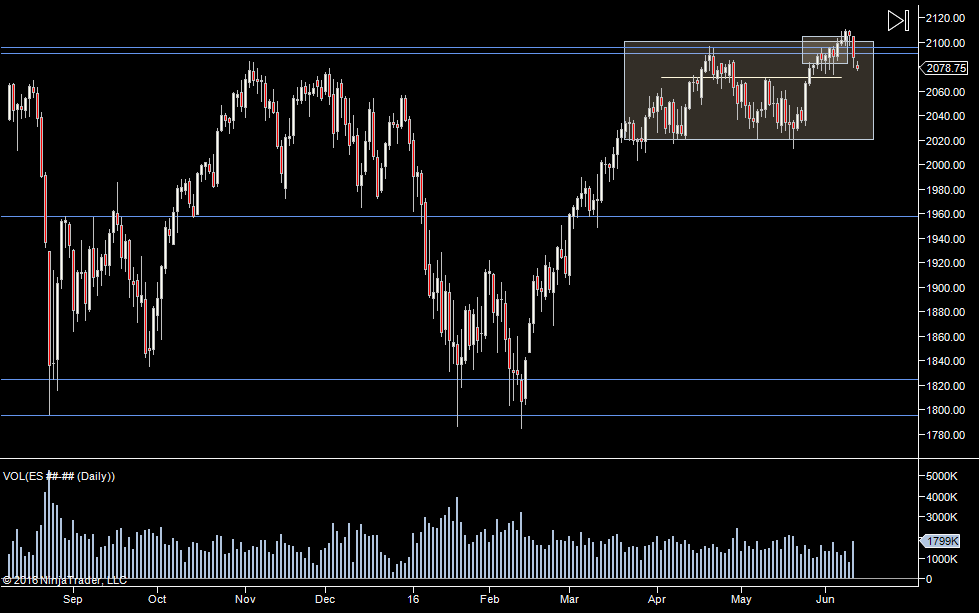

Decent volume again and another down day, this is what we were looking for yesterday to confirm that we are likely to head to the bottom of the white box. So I'm biased short with a target of 2013 (slightly adjusted up from 2011.50).

Obviously, the market swings both ways on most days, so the bias doesn't mean I'll only take longs - it's just my contextual bigger picture.

We had a decent push down, so of course, we could pause a day or have a small up day and the bias would still be intact.

Looking above we have a step in the profile around 2078 and last weeks low to look our for as potential resistance if we take a move up.

On the split daily profiles, I'll be watching yesterdays low and the value area as potential resistance.

Plan

- Continued expectation of decent volatility

- Downside bias

- Would prefer an upside test of one of our levels and then to see sellers come in - that would be my highest participation scenario

- very cautious with any trades to the long side today

- also wary of missing the boat on any high volume down move off the open, so looking to scale into that

Weekly Numbers

Range 2079.50 -> 2110.75

Value - 2094.25 -> 2109.25

S1 - 2074.25 R1 - 2105.50

Daily Numbers

Range 2068.75 -> 2089.25

Value 2075.75 -> 2085.25

Globex 2060.25 -> 2071.75

Settlement - 2087.25

Today only 2069.75

Long Term 2096, 2090.75, 1957.50, 1910.75, 1824.50, 1795.50