On Friday we had:

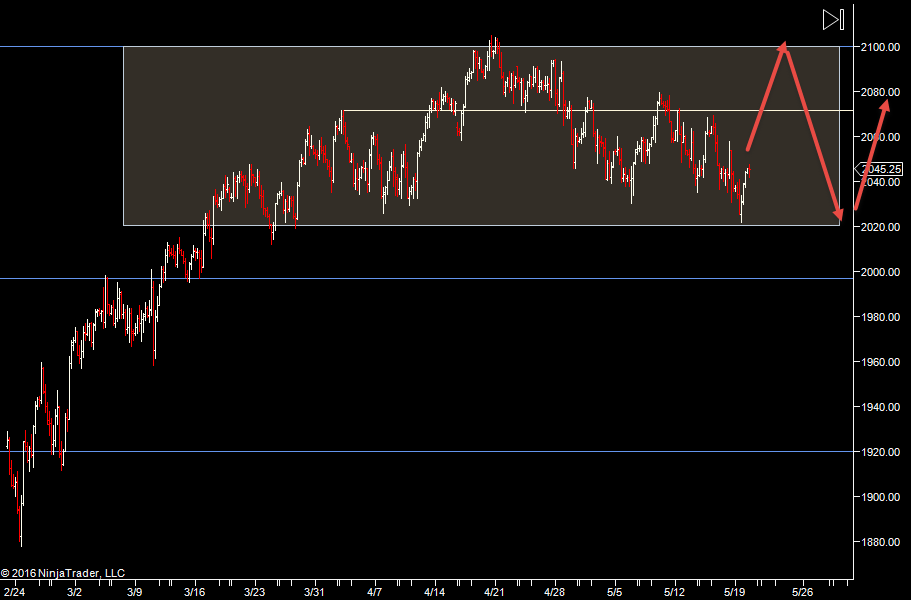

Our "presumed range" (white box) still appears to be holding but Friday was a tight day, so we didn't have follow through either way, just a small move up. So I'm still going in biased to the upside overall.

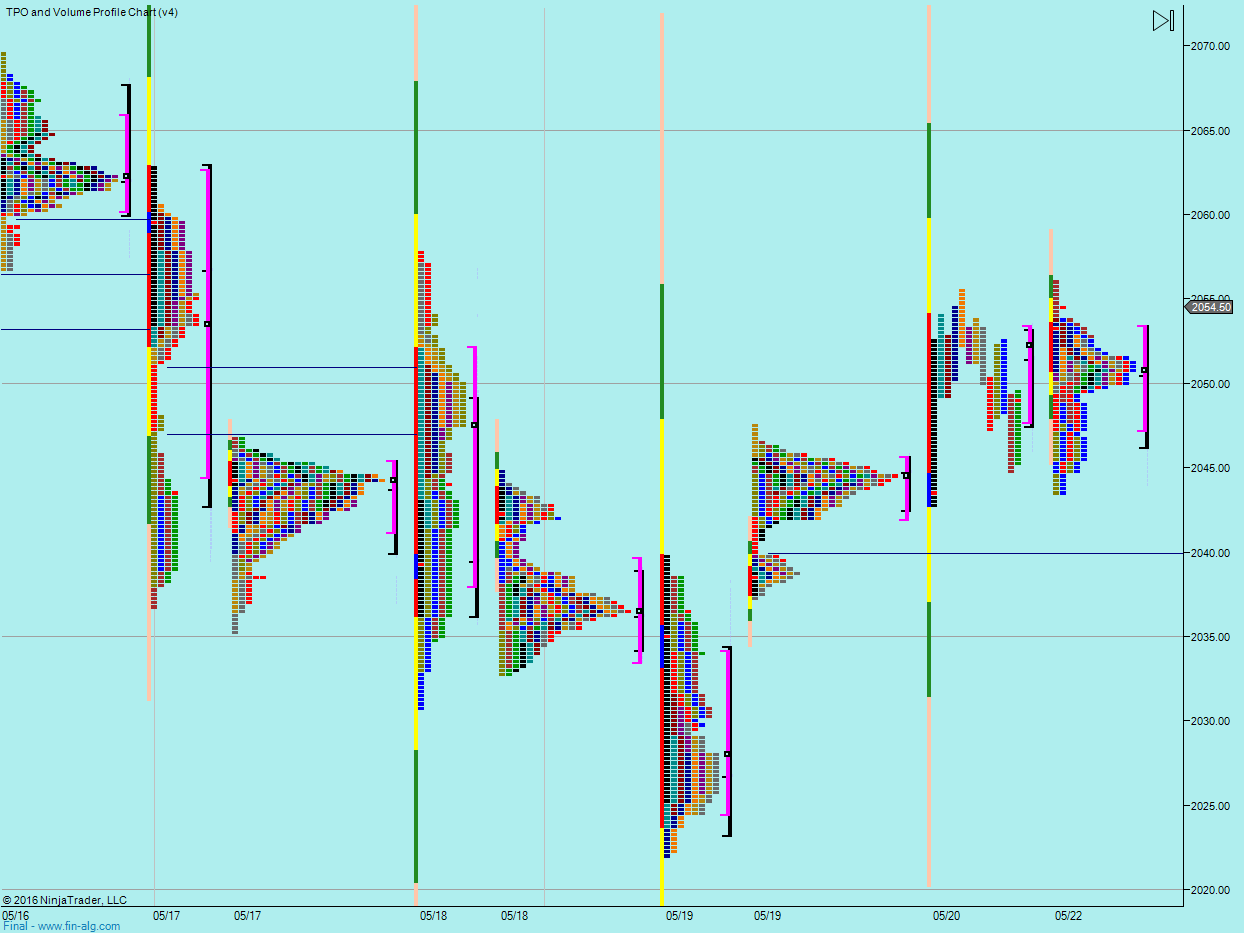

We spent the most time last week between 2041.75 and 2046.25. So looking at both areas as potentials for buyers to step in. Then also looking at the value low but above volume just tapers off, so not interested to much in the value high.

We are starting off the overnight session trading inside Fridays day session. When that occurs, I'm always on the lookout for a range day. Not saying it WILL happen but it often happens and it's enough to have a heads up just in case. So I'll be watching Fridays range and value area with interest.

Plan

- If we are still trading in Fridays range at the open, watch for low volume and a hold at Fridays day session extremes

- Overall a long bias (although expecting swings both ways as is the norm for the ES) with a view to hitting 2100 before rolling back over (the white box).

- expect a hold of a downside test of 41.75 or 46.25 areas to bring in more speculative buyers and give the chance for a run, similarly look for acceleration past Fridays high if we get above average participation

- not seeing any level below that looks like it will give us a run if broken, so play the downside with more caution

Plan

- upside bias, based on our presumed range holding

- look to scale into any fast paced move that develops close to the open

- don't get caught in the chop if the market settles into a range

Weekly Numbers

Range 2022 -> 2069.50

Value - 2034.50 -> 2054

S1 - 2025, R1 - 2071.50

Daily Numbers

Range 2037.25 -> 2042.75 / 2055.50

Value 2047.75 -> 2053.25

Globex 2043.50 -> 2056

Today only - 2041.75, 2046.25

Settlement - 2050

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75