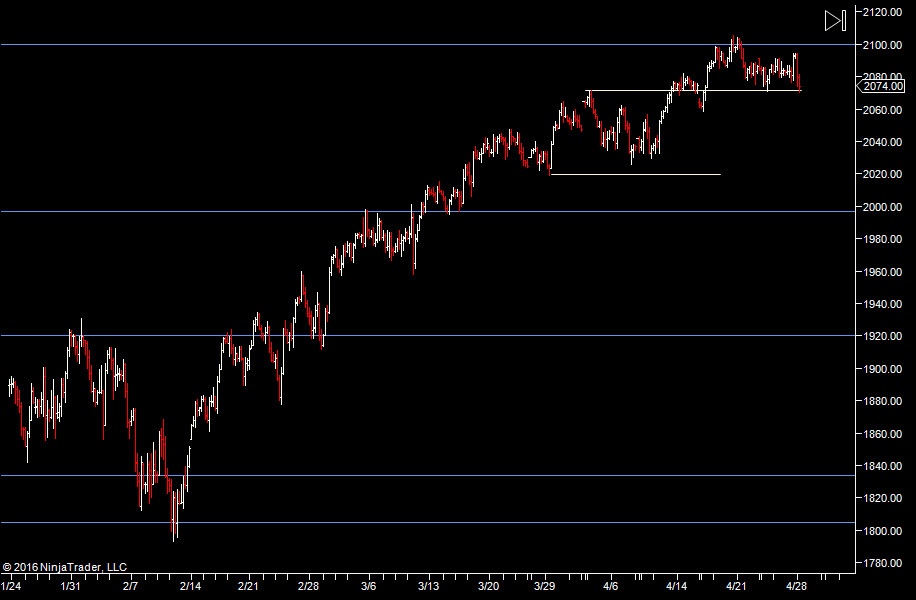

The market has come off with significant volume. So if there's more volume to the downside, I'm now biased towards a move back down to 2000. That's a bias, I'm not married to it.

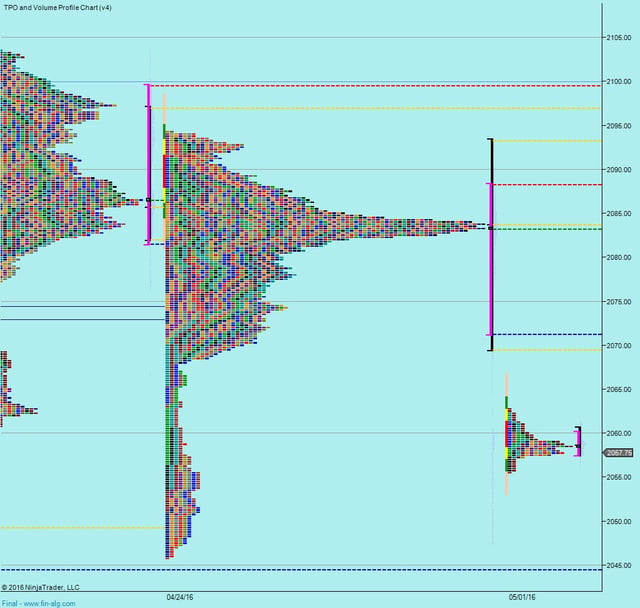

I'm still watching 2071.50 above and if we can get above that, my bias returns to a move up to 2100.

Last weeks value low is 71.25 which coincides with the level from the longer term chart. So on a move up past 71, I'll be looking for an initial move back to the top of value at 88.

It's a holiday today in most of Europe and some of Asia, hence not much significance can be drawn from the overnight action, nor can we red much into the lack of volume. It's not lack of interest, just lack of traders.

Here's the plan

- on the open - look for a snap back up - possible after a couple of down days

- otherwise look for shorts

- long term bias is to see 2000 again unless we go through 2071.50 in which case, I expect 2088 and then either a roll back to 71.50 or a move to 2100.

- look to play off Fridays range/value range

Weekly Numbers

Range 2045.75 -> 2094.25

Value - 2071.25-> 2088.25

S1 - 2038.50 R1 - 2086.75

Daily Numbers

Range 2045.75 -> 2067 / 2076

Value 2047.50 -> 2057.50

Globex 2055.50 -> 2062.75

Settlement - 2059

Today only - 2071.50

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75