I'll cut & paste from yesterdays prep to save typing:

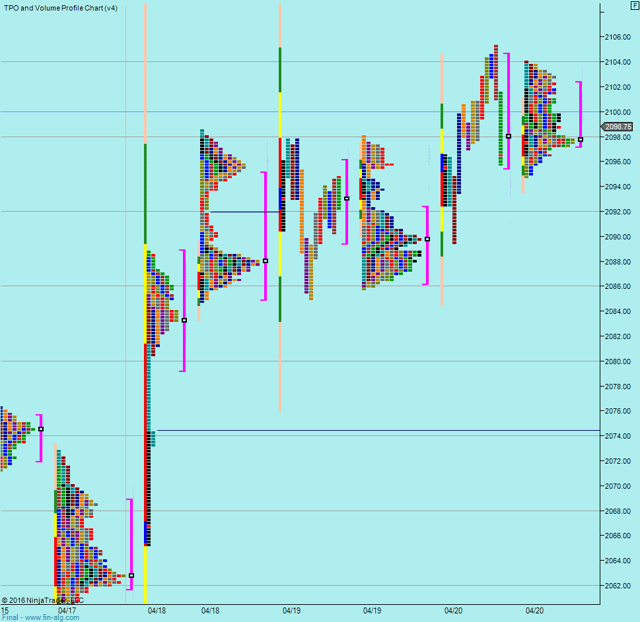

We have been above 2100 but had no real push up, so I consider it still unresolved.

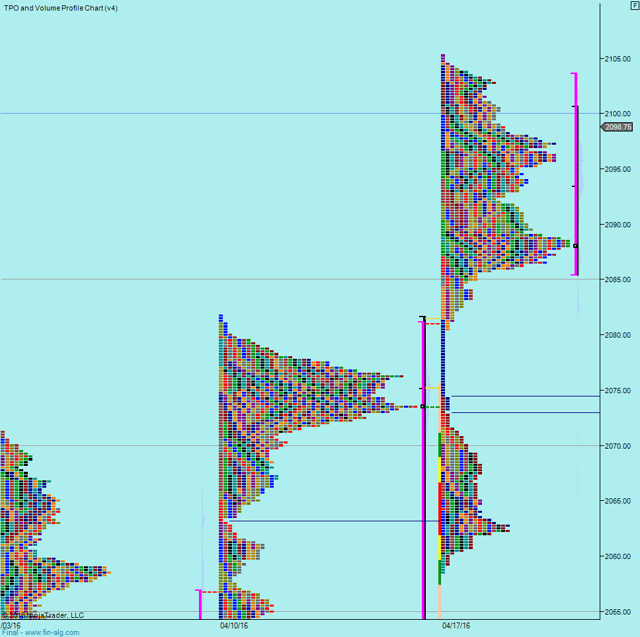

We can see the upper distribution was widened 2085.50 -> 2103.50, so I'm looking to see if we rotate around that. So watching those extremes into the open.

And we can see we had good volatility on the push up on Monday but couldn't follow through on Tuesday and so I'm initially watching to see if Tuesdays range holds.

We had a late pullback yesterday down to 95.75, which is just above the value area.

So scenarios are:

1 - bounce off 95.75/VAL for a push up through the highs

2 - lazy roll over to range around 2085.50 -> 2103.50

Obviously employment numbers could throw the plans out the window.

Weekly Numbers

Range 2058.50 -> 2105.25

Value - 2085.50 -> 2103.50

S1 - 2042.25, R1 - 2094.75

Daily Numbers

Range 2085.75 / 2089.50 -> 2105.25

Value 2095.50 -> 2104.50

Globex 2094.75 -> 2104

Settlement - 2098

Today only - 2078.75, 2081.75, 2095.75

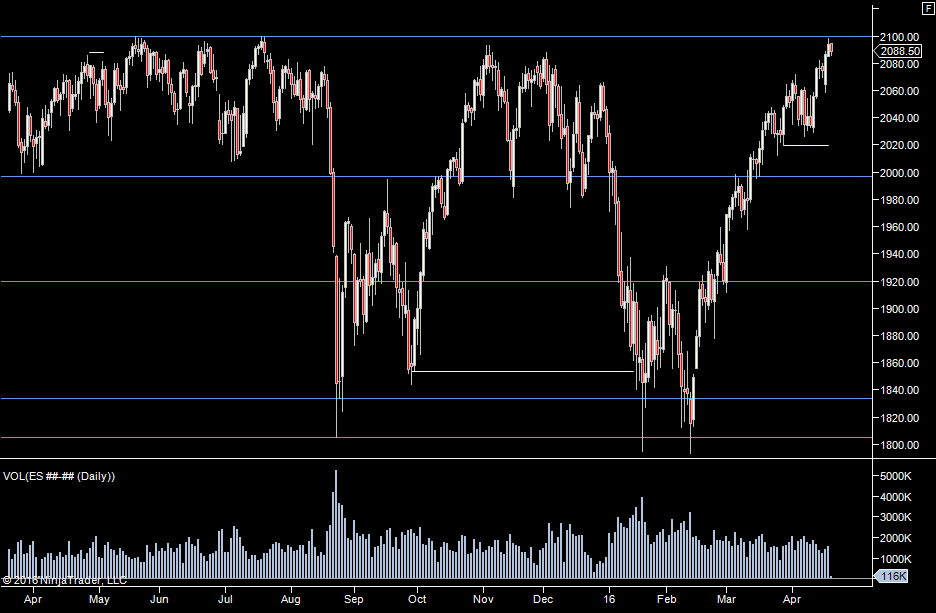

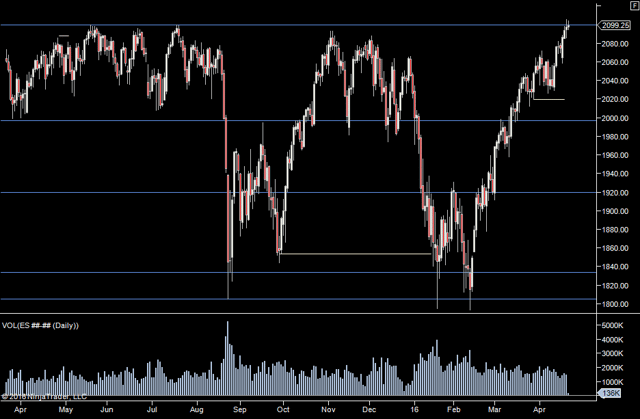

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75

1 - bounce off 95.75/VAL for a push up through the highs

2 - lazy roll over to range around 2085.50 -> 2103.50

Obviously employment numbers could throw the plans out the window.

Weekly Numbers

Range 2058.50 -> 2105.25

Value - 2085.50 -> 2103.50

S1 - 2042.25, R1 - 2094.75

Daily Numbers

Range 2085.75 / 2089.50 -> 2105.25

Value 2095.50 -> 2104.50

Globex 2094.75 -> 2104

Settlement - 2098

Today only - 2078.75, 2081.75, 2095.75

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75