I'll cut & paste from yesterdays prep to save typing:

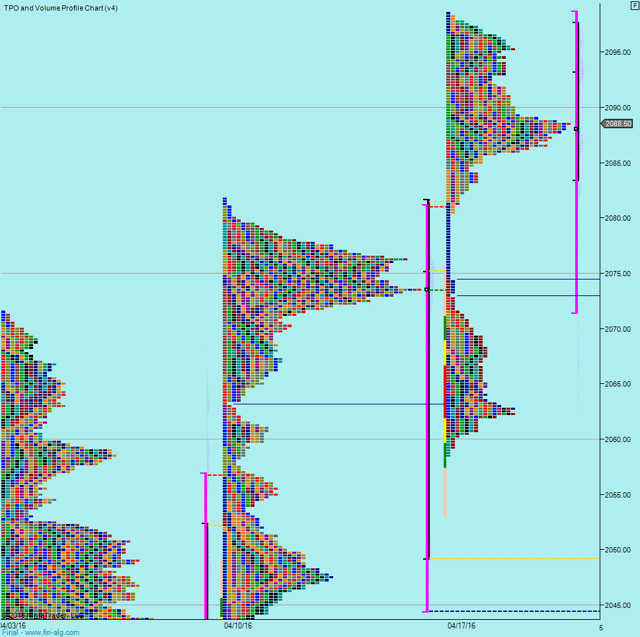

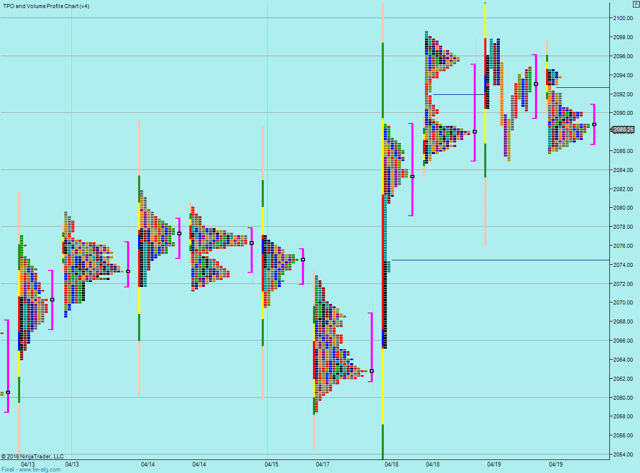

We can see an upper distribution building on this weeks developing profile.

And we can see we had good volatility on the push up on Monday but couldn't follow through on Tuesday and so I'm initially watching to see if Tuesdays range holds.

Plan

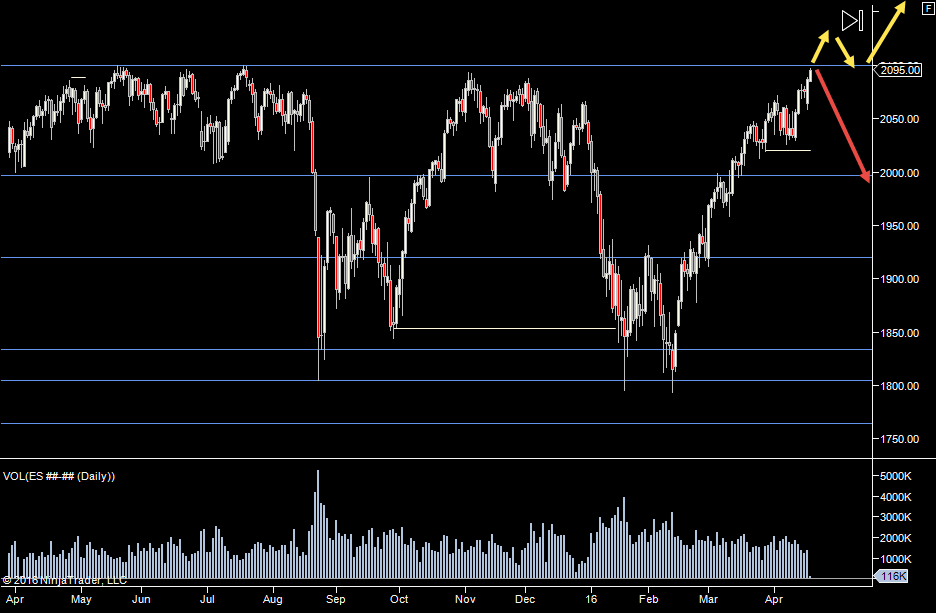

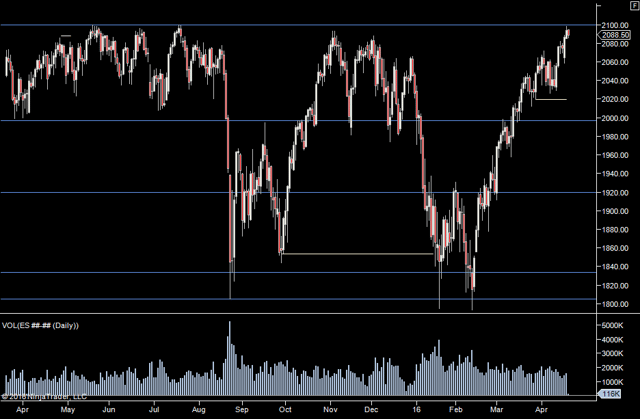

- Overal waiting for the market to resolve this 2100 level one way or the other

- Look to fade Tuesdays range but with confirmation as it's going to be an area prone for manipulation

- Let the market break and pull back and test before going with any break, again because of chances of manipulation

- On a push down watch for support at 2078.75 & 2081.75

Not much of a plan really! Just trying to avoid getting caught up in the excitement of a fake move, especially to the upside.

Weekly Numbers

Range 2058.50 -> 2098.50

Value - 2071.50 -> 2098.50

S1 - 2042.25, R1 - 2094.75

Daily Numbers

Range 2084.75 -> 2098.50

Value 2089.50 -> 2096

Globex 2085.75 -> 2094.50

Settlement - 2093.75

Today only - 2078.75, 2081.75

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75

Plan

- Overal waiting for the market to resolve this 2100 level one way or the other

- Look to fade Tuesdays range but with confirmation as it's going to be an area prone for manipulation

- Let the market break and pull back and test before going with any break, again because of chances of manipulation

- On a push down watch for support at 2078.75 & 2081.75

Not much of a plan really! Just trying to avoid getting caught up in the excitement of a fake move, especially to the upside.

Weekly Numbers

Range 2058.50 -> 2098.50

Value - 2071.50 -> 2098.50

S1 - 2042.25, R1 - 2094.75

Daily Numbers

Range 2084.75 -> 2098.50

Value 2089.50 -> 2096

Globex 2085.75 -> 2094.50

Settlement - 2093.75

Today only - 2078.75, 2081.75

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75