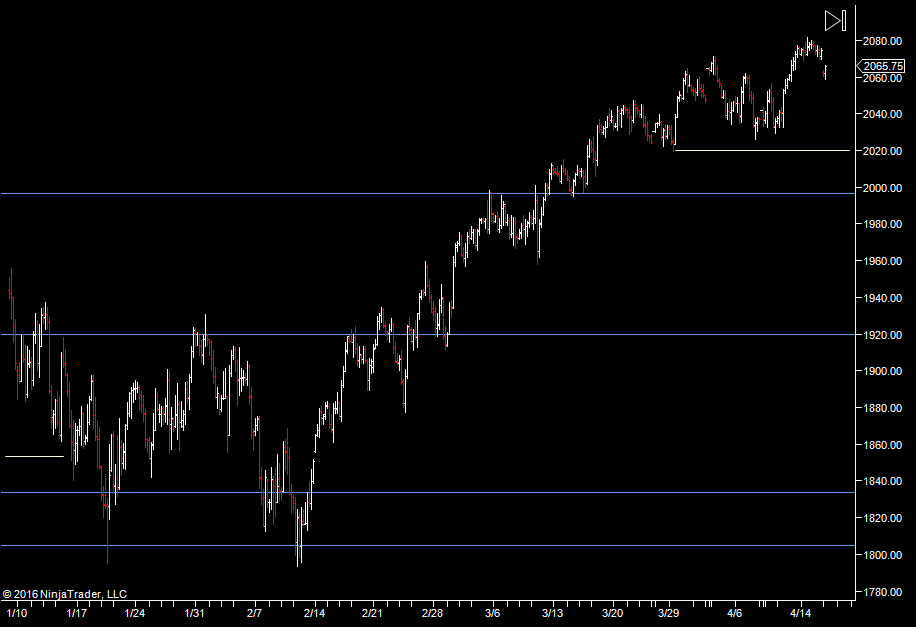

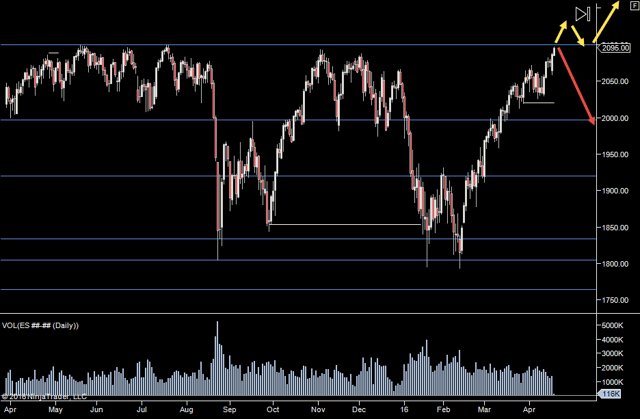

We are almost at the 2100 level. Scenarios from here on are a roll over and back to 2000 or we push up and move on to new highs. We could spin around here for a few days whilst the market decides what to do and we have to avoid getting caught up in any manipulation up here as reversal/breakout traders get nudged out of position.

My philosophy is to let everyone else do the the heavy lifting and then get on board once the market has sorted itself out. The first thing to look for is volume coming in after a touch or push through 2100.

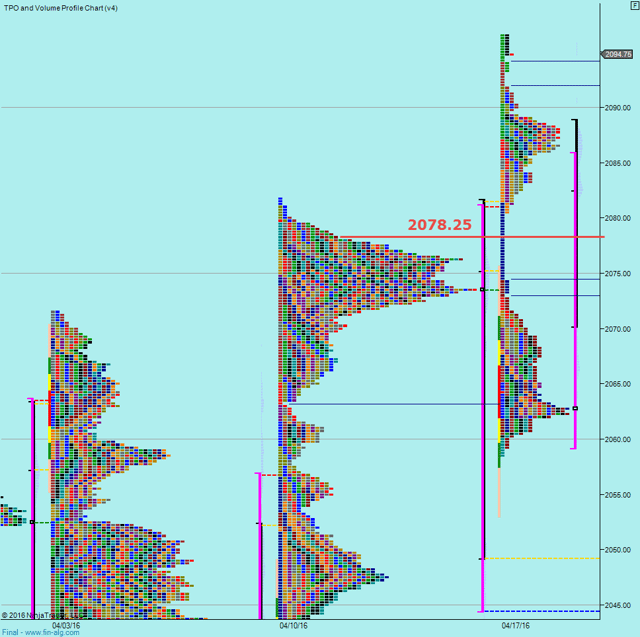

Below us we can see that the upper distribution from last week tops out about 2078.25. So if we move down, I'll be looking there for a hold and again, looking for volume to increase after the hold.

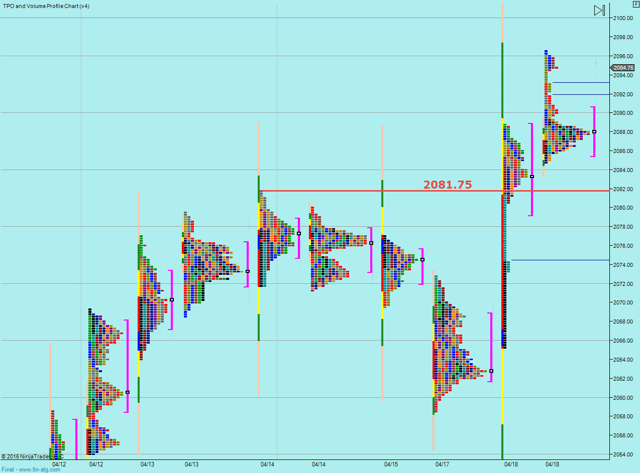

Similarly, 2081.75 is the break-out point/last weeks high, so again it's an area worth watching if we move down.

So the plan today

- be wary around 2100 as there's a chance of reversal/breakout traders getting nudged out of position

- look for volume to come in off a test - 2100 for a short, 78.25-81.75 for a long (plus yesterdays high/low/value area)

- Jump on any 'runaway' move that develops

If we do get through 2100, it's going to be very telling how many buyers there are up there.

Weekly Numbers

Range 2029.25 -> 2081.75

Value - 2044.50-> 2081

S1 - 2042.25, R1 - 2094.75

Daily Numbers

Range 2058.50/2065.25 -> 2088.75

Value 2079.25 -> 2088.75

Globex 2084.74 -> 2096.50

Settlement - 2086.75

Today only - 2078.75, 2081.75

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75