A gap down day. Now I'm not really a big fan of trading gaps as I don't consider a "settlment to open" difference a significant occurrence. These gaps where we gap below the prior days range and stay out of it, I consider a bit more relevant and will be looking at Fridays low as a significant level. Of course, this could fill in from now to the open.

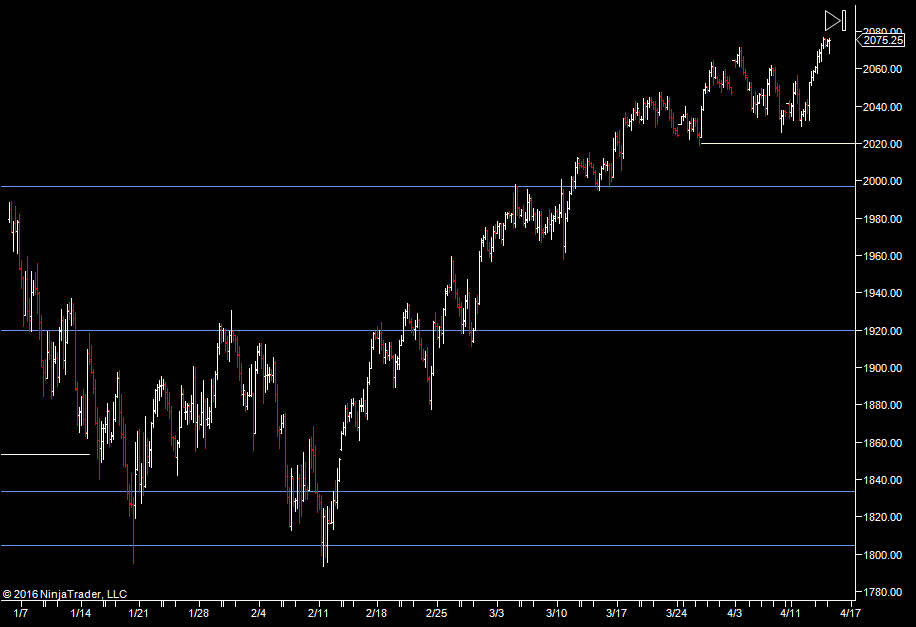

Looking left, from here down to 2020 is an area we have chopped around in. With that in mind, the best probability of clean trade is to the upside.

From a volume profile perspective, we can see that we ate in the middle of last weeks range and so there's not much to get excited about in this area.

Looking left we have Tuesdays day session low at 2054 and I'm keeping an eye on that if we move down. That acted as support after the pop up.

The plan.

- we are in the middle of the range from the past few weeks, so expectations are low. That means looking to join the first swing or two with the expectation that volatility will dry up mid-morning.

- Look for a hold at Fridays Low (2054) or Tuesdays low (2069.50) as occurrences that could bring in some speculators and give us a run

- As usual, look for areas of high volume from overnight to play off.

Other than that - not expecting too much but would like nothing more than to be pleasantly surprised.

Weekly Numbers

Range 2029.25 -> 2081.75

Value - 2044.50-> 2081

S1 - 2042.25, R1 - 2094.75

Daily Numbers

Range 2069.50 -> 2077 / 2080

Value 2072 -> 2075.50

Globex 2058.50 -> 2068

Settlement - 2075

Today only - 2020, 2054, 2069.50

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75