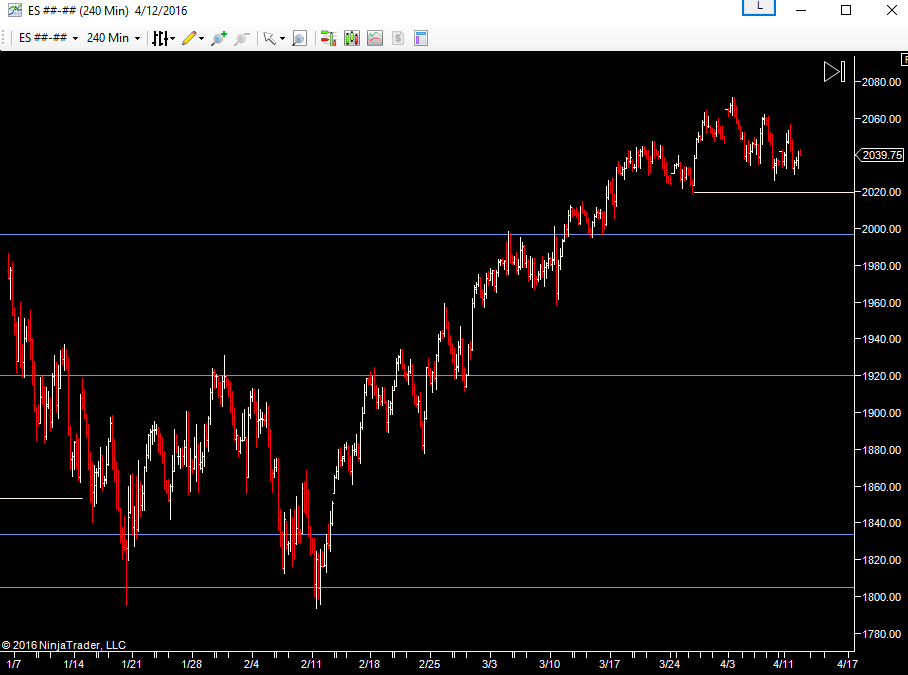

Up to the top of the range and it does look like it's going to break. Then again, I always think that at the top of every range. So today, the job is to watch what happens up here and then join the break or the reversal. My preference is to let the area resolve one way or the other before jumping on the resulting move.

Not much to show on the profiles yet, other than we are close to last weeks high.

This has been an elongated move up - we didn't make it all the way to the bottom of the range yesterday on the push down which is positive but there's no real pullpack/support area on the way. We didn't build positions/volume anywhere, so it's going to be fairly easy for it to go back down too. I'm watching yesterdays value area as well as the late pullback to 2052.

The plan today.

- watch for a fast move off the open and join it

- any move down may be short lived and just a shake out of overnight longs. So ready to cut shorts on sign of a failure.

- after the opening swing, I'm not too interested in engaging between 2065 and 2075. That's where I see the highest likelihood of short term manipulation. I'd rather let it play out first.

Weekly Numbers

Range 2029.25 -> 2069.25

Value - 2032.50 -> 2049.50

S1 - 2022.50, R1 - 2063

Daily Numbers

Range 2029.25 / 2032.50 -> 2058.50

Value 2041-> 2057.50

Globex 2054 -> 2069.25

Settlement - 2055.75

Today only - 2020

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75

The plan today.

- watch for a fast move off the open and join it

- any move down may be short lived and just a shake out of overnight longs. So ready to cut shorts on sign of a failure.

- after the opening swing, I'm not too interested in engaging between 2065 and 2075. That's where I see the highest likelihood of short term manipulation. I'd rather let it play out first.

Weekly Numbers

Range 2029.25 -> 2069.25

Value - 2032.50 -> 2049.50

S1 - 2022.50, R1 - 2063

Daily Numbers

Range 2029.25 / 2032.50 -> 2058.50

Value 2041-> 2057.50

Globex 2054 -> 2069.25

Settlement - 2055.75

Today only - 2020

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75