Markets still quite narrow, even with the Syria thing going on. We are potentially in a period of increased news risk so an eye on the market depth and be wary if it is low.

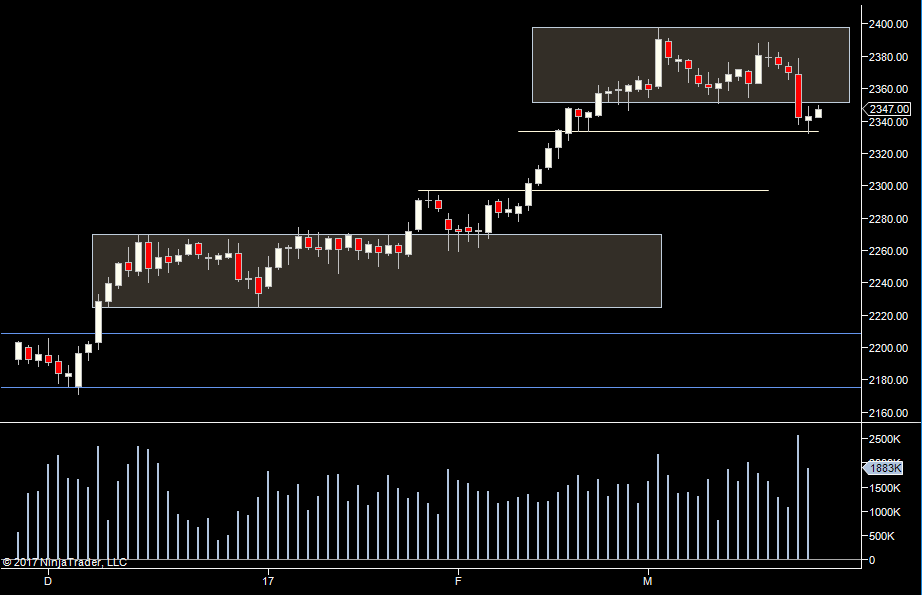

We potentially have a range here from 2333.50 to 2400. So eyes on any move back to 33.50

Last week saw a large distribution from around 2345 to 2361. So any moves to those extremes are could provide us with an opportunity to fade the market.

There's not much to take from the daily profiles.

We are in the middle of last weeks chop, so not really excited to play off Fridays range.

Plan

- no bias

- looking for a trade off the open, then not interested unless we get to 45 or 61, at which point looking to see if the range holds or breaks.

- will trade a range hold by default (with low interest)

- will play a continuation of a break only if we have good volume

- also an eye on 2333.50 if we break down

Weekly Numbers

Range - 2336.75 -> 2375

Value 2345.50 -> 2359

S1 - 2336.50, R1 - 2371.50

Daily Numbers

Range 2336.75/2347 -> 2260.75

Value - 2351.50 -> 2358

Globex 2349.75 -> 2359

Settlement – 2352.25

Today Only - 2333.50, 2345, 2361

Long Term Levels - 2178.75, 2129.50, 2099.75, 2084, 2078.75, 2000.75

Plan

- no bias

- looking for a trade off the open, then not interested unless we get to 45 or 61, at which point looking to see if the range holds or breaks.

- will trade a range hold by default (with low interest)

- will play a continuation of a break only if we have good volume

- also an eye on 2333.50 if we break down

Weekly Numbers

Range - 2336.75 -> 2375

Value 2345.50 -> 2359

S1 - 2336.50, R1 - 2371.50

Daily Numbers

Range 2336.75/2347 -> 2260.75

Value - 2351.50 -> 2358

Globex 2349.75 -> 2359

Settlement – 2352.25

Today Only - 2333.50, 2345, 2361

Long Term Levels - 2178.75, 2129.50, 2099.75, 2084, 2078.75, 2000.75