A sluggish day yesterday but I'm still biased upside, looking for 2100 and ideally looking for people to come in on a test to the downside.

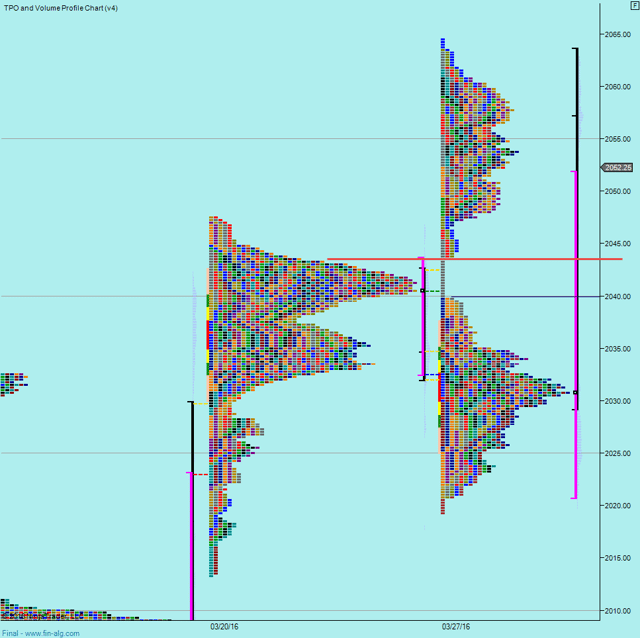

We have started to build an upper distribution above last weeks value high of 43.50, so I'm watching that on any downside move.

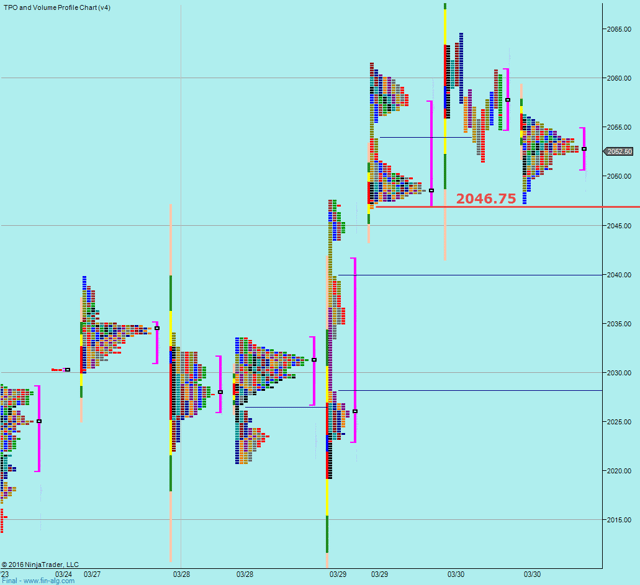

And also looking at yesterdays low at 46.75 to hold.

We really need to try to hold onto these gains, if we can, I think people will have more confidence to trade to the upside. If we slip below 43, then I think we could be looking at a test of Tuesdays low at 19.25.

If we discount Tuesday afternoon and the reaction from Yellen's statement, it's been a lackluster week. The upside of breaking yesterdays low is we should see a bit of volatility. So fingers crossed that the employment numbers help us out.

Be aware that it is the last day of the month, so we could get a push up from that today.

Weekly Numbers

Range 2019.25-> 2064.50

Value - 2020.75 -> 2051.75

Daily Numbers

Range 2046.75 / 2051.50 -> 2064.50

Value 2054.75 -> 2060.75

Globex 2047.25 -> 2056.25

Settlement - 2055.25

Today only - 2043.50

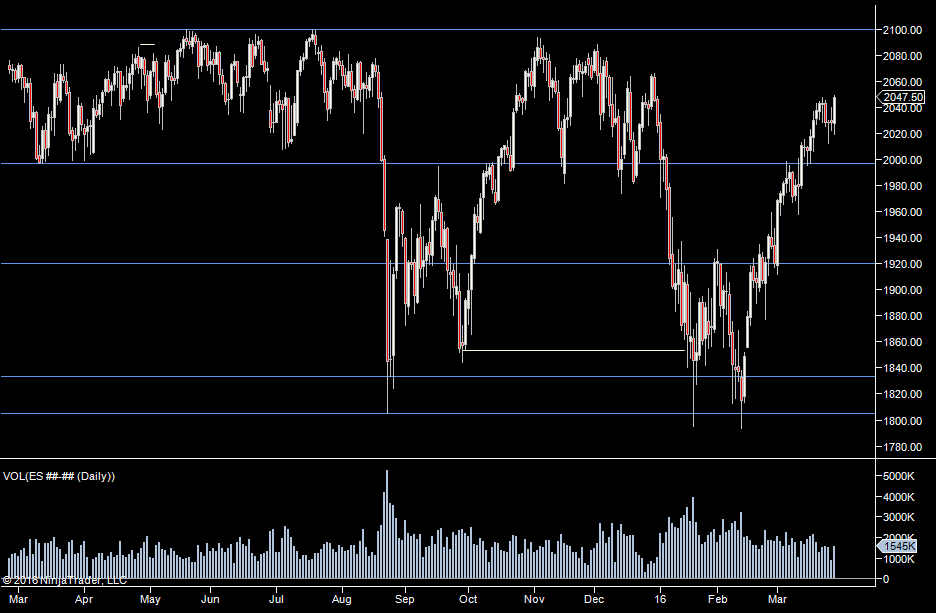

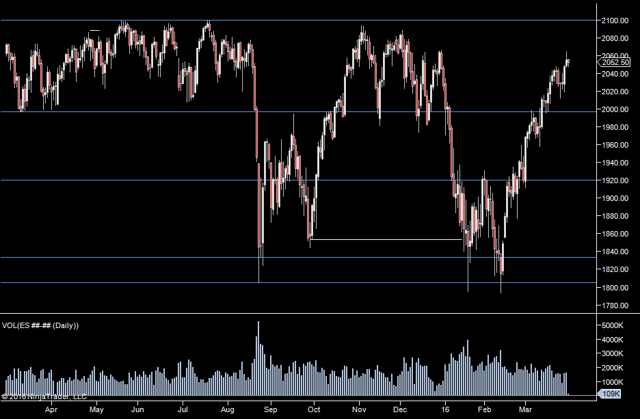

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75

We really need to try to hold onto these gains, if we can, I think people will have more confidence to trade to the upside. If we slip below 43, then I think we could be looking at a test of Tuesdays low at 19.25.

If we discount Tuesday afternoon and the reaction from Yellen's statement, it's been a lackluster week. The upside of breaking yesterdays low is we should see a bit of volatility. So fingers crossed that the employment numbers help us out.

Be aware that it is the last day of the month, so we could get a push up from that today.

Weekly Numbers

Range 2019.25-> 2064.50

Value - 2020.75 -> 2051.75

Daily Numbers

Range 2046.75 / 2051.50 -> 2064.50

Value 2054.75 -> 2060.75

Globex 2047.25 -> 2056.25

Settlement - 2055.25

Today only - 2043.50

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75