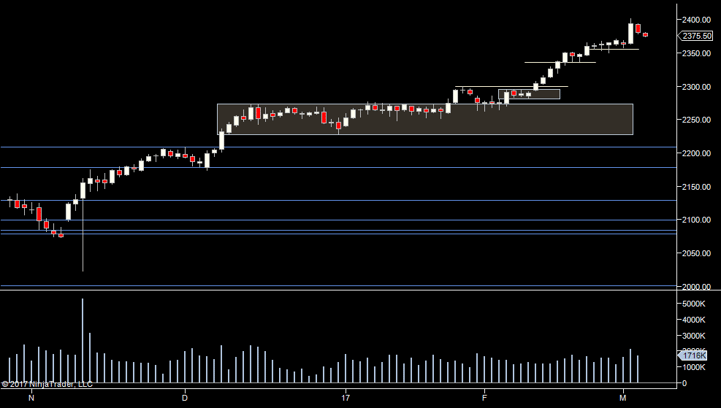

Decent volume again and a pullback.

If you look at yesterdays prep, we noted both the resistance at 2395 as well as the likelihood of a drop to 2370 because of how little volume traded there.

We also mentioned the prospect of a larger tradeable range developing.

So for me, I'm not of the opinion that this is the start of a huge move down but I am hoping it's the beginnings of a larger range developing.

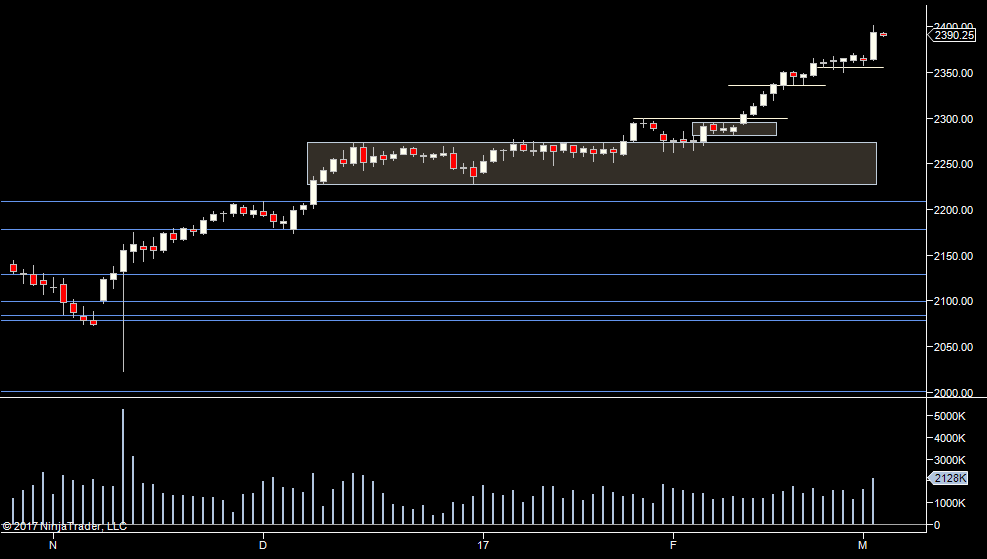

I have my eye on 2375 as being the potential high of any larger range as it's the top of the old Dec-Feb range we had.

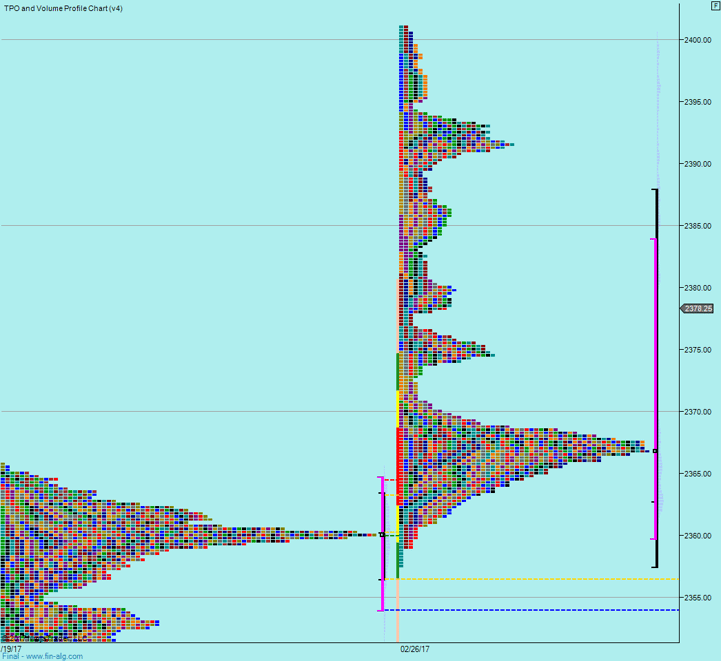

We can see we've filled in the weekly profile a bit more. On any down move, I'd expect us to find at least temporary support at 2370.

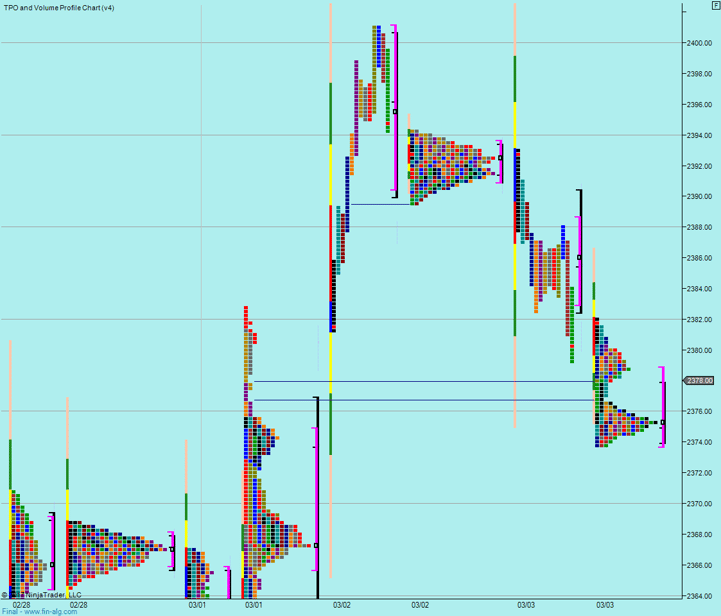

We can see we didn't make it down to 2370. I'll be watching yesterdays levels for resistance as we open.

Plan

- neutral bias. Could go either way

- If we move up off the open, take longs but be wary of yesterdays range/value range for resistance

- If we move down be wary as we approach 2370 for support

- Other than that, follow the moves

Weekly Numbers

Range - 2357.50-> 2401

Value 2360 -> 2383.25

S1 - 2355.25, R1 - 2370.50

Daily Numbers

Range 2379.25 -> 2393 / 2394.25

Value 2383 -> 2388.50

Globex 2373.75 -> 2382

Settlement – 2382

Today Only - 2395, 2370

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

- neutral bias. Could go either way

- If we move up off the open, take longs but be wary of yesterdays range/value range for resistance

- If we move down be wary as we approach 2370 for support

- Other than that, follow the moves

Weekly Numbers

Range - 2357.50-> 2401

Value 2360 -> 2383.25

S1 - 2355.25, R1 - 2370.50

Daily Numbers

Range 2379.25 -> 2393 / 2394.25

Value 2383 -> 2388.50

Globex 2373.75 -> 2382

Settlement – 2382

Today Only - 2395, 2370

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5