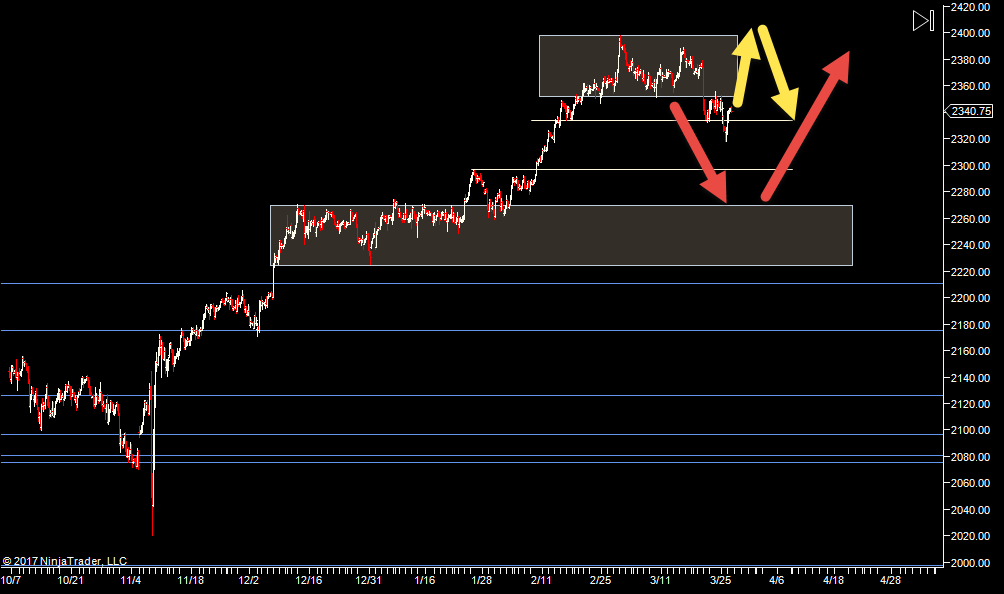

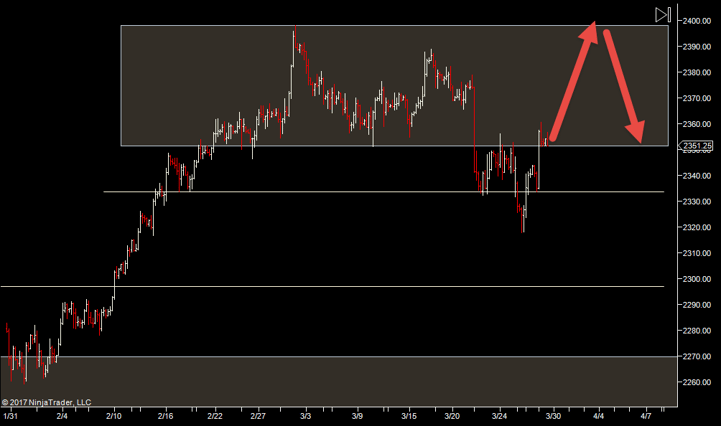

Another 'hard to call' day in my opinion. On the one hand, it does look like we are struggling to make headway into the upper range (top white shaded area). I just need a bit more move up to be confident to play the range (up to 2400 and back down). If we do hit 2400, we'll probably need to adjust the bottom of our range area.

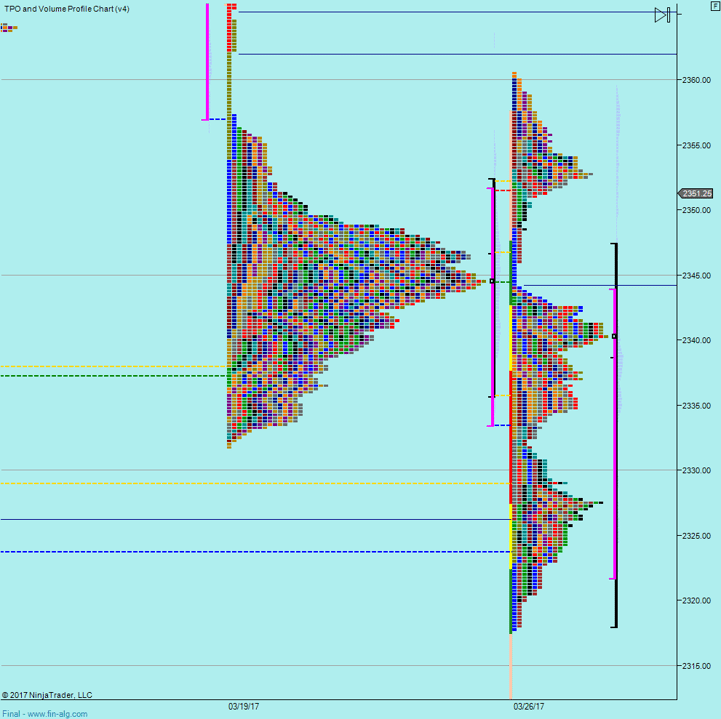

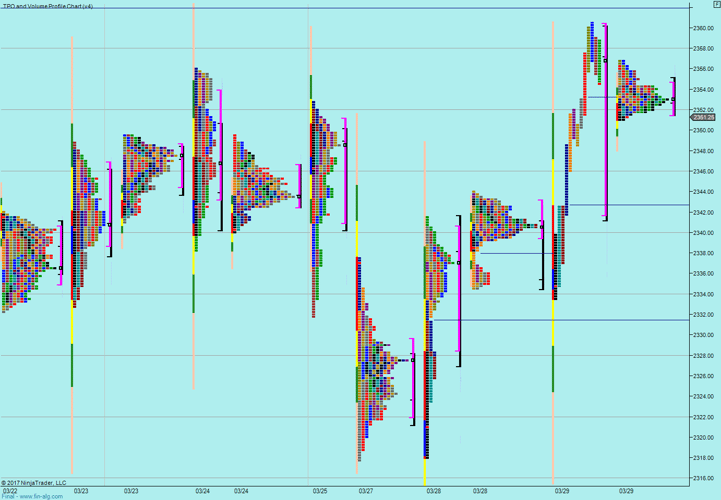

ot much from the profile other that it tends to confirm the move up. We need to hold this upper distribution in the US session when real volume comes in, so eyes on 51 if it doesn't break before 9:30am EST.

Looking left here, I wouldn't be at all surprised if we ranged 2318-2360. So that's another potential scenario to look out for.

Plan

- Long biased, will switch to short if we see downside volume trading below 51

- Volatility has been decent the past few days (albeit after a slow start), so no hurry to engage early

Weekly Numbers

Range - 2317.75 -> 2360.50

Value 2321.25 -> 2343.75

S1 - 2324.75, R1 - 2371.75

Daily Numbers

Range 2333.50 -> 2360.50

Value - 2341.75 -> 2360.25

Globex 2340.75 -> 2356.75

Settlement – 2351.50

Today Only - 2350

Long Term Levels - 2178.75, 2129.50, 2099.75, 2084, 2078.75, 2000.75

Plan

- Long biased, will switch to short if we see downside volume trading below 51

- Volatility has been decent the past few days (albeit after a slow start), so no hurry to engage early

Weekly Numbers

Range - 2317.75 -> 2360.50

Value 2321.25 -> 2343.75

S1 - 2324.75, R1 - 2371.75

Daily Numbers

Range 2333.50 -> 2360.50

Value - 2341.75 -> 2360.25

Globex 2340.75 -> 2356.75

Settlement – 2351.50

Today Only - 2350

Long Term Levels - 2178.75, 2129.50, 2099.75, 2084, 2078.75, 2000.75