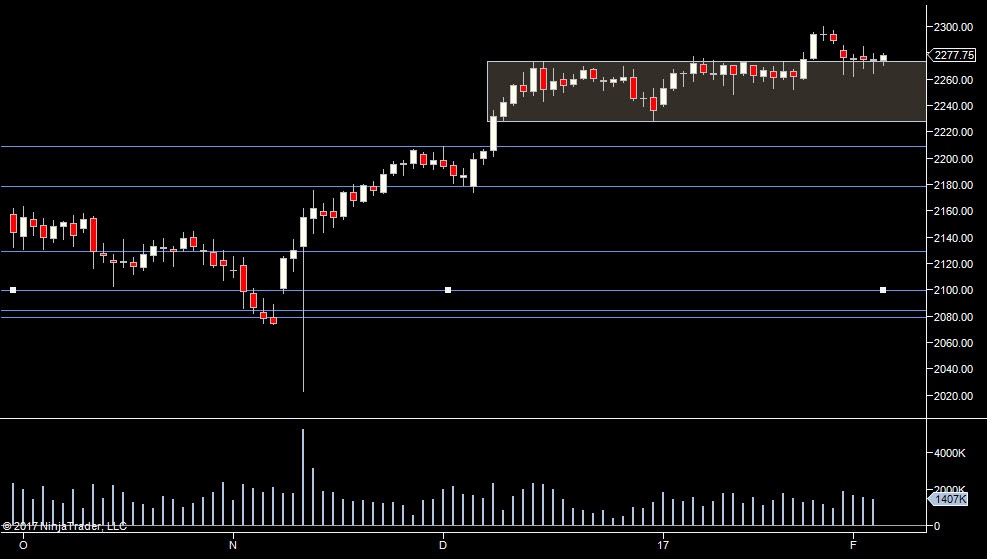

We had a good push up on Friday, although most of it was overnight. We still haven't popped the high yet, so today is a simple day. Looking for signs of downside volume coming in on a failure or upside volume on a break.

Last week is showing a typical range week profile. We really need to stay above that 2283.50 or we are likely back to range bound behavior.

We have a few levels to watch today - Fridays high because we've held it so far which is 'fuel' for people to go short. Also Fridays day session low is just below the 2283.50 and so is also a line in the sand for shorts.

Plan

- At a decision point, looking to join volume either side (breakout or fail to break)

- Expecting range bound behavior below 2283/2283.50

- Obviously, on day like this watching for signs of lower volatility will scupper the plan, so an eye on the depth/avg volume/pace of trading

Weekly Numbers

Range - 2262.25 -> 2294

Value 2265.50 -> 2278.50

S1 - 2271, R1 - 2302.75

Daily Numbers

Range 2270.50 / 2283 -> 2294

Value 2289.75 -> 2293.75

Globex 2287.50-> 2293.50

Settlement – 2291

Today only - 2283/2283.50

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

- At a decision point, looking to join volume either side (breakout or fail to break)

- Expecting range bound behavior below 2283/2283.50

- Obviously, on day like this watching for signs of lower volatility will scupper the plan, so an eye on the depth/avg volume/pace of trading

Weekly Numbers

Range - 2262.25 -> 2294

Value 2265.50 -> 2278.50

S1 - 2271, R1 - 2302.75

Daily Numbers

Range 2270.50 / 2283 -> 2294

Value 2289.75 -> 2293.75

Globex 2287.50-> 2293.50

Settlement – 2291

Today only - 2283/2283.50

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5