Struggling to keep up here - realized the other night that the wife stuffed my "decaf tea box" with regular tea.... I've had almost 2 weeks of insomnia... at least I know why now...

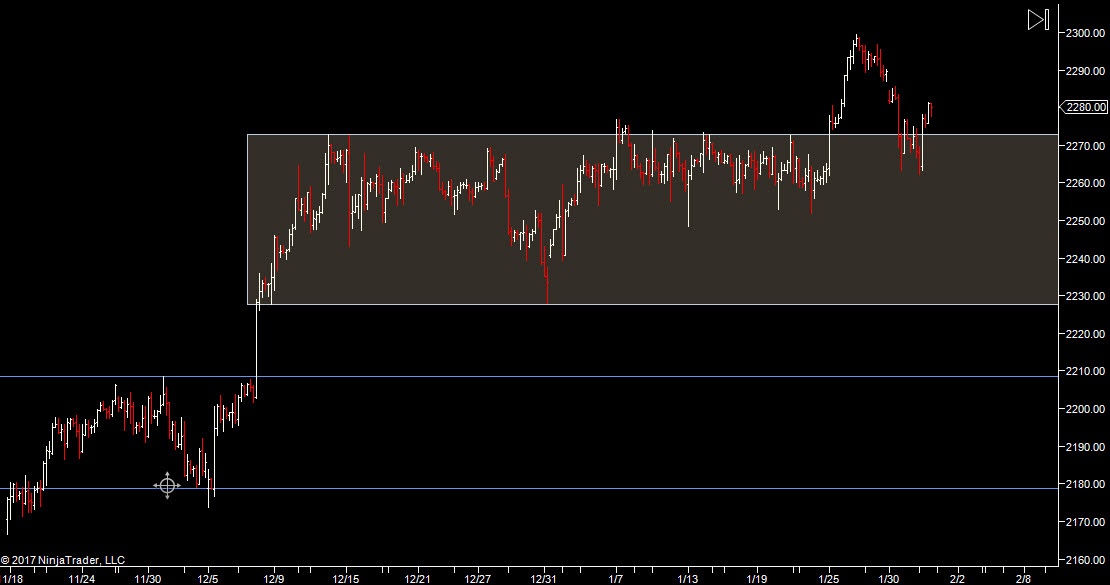

I'm still working on the premise of a bounce off the old high bringing in some buyers once it becomes clear. It's not done that yet - but it's still one of my scenarios. Volume is descending into the end of the week.

On Wednesday we had

And that seems to be playing out... Note the step in the weekly profile around 76.50.

And that seems to be playing out... Note the step in the weekly profile around 76.50.

Dailies show fairly narrow days within this range.

Plan

- Presume range 65-85 will stay intact but also look for shorts where the step is around 76.50

- look for headfakes on any break

- look for an early trade off any high volume areas from overnight

Weekly Numbers

Range - 2262.25 -> 2285.75

Value 2266 -> 2276.50

S1 - 2306.25, R1 - 2261.50

Daily Numbers

Range 2264.50 / 2266.75 -> 2279.75

Value 2271.25 -> 2276.25

Globex 2270.50 -> 2279.75

Settlement – 2275.50

Today only - 2263, 2288.25

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

- Presume range 65-85 will stay intact but also look for shorts where the step is around 76.50

- look for headfakes on any break

- look for an early trade off any high volume areas from overnight

Weekly Numbers

Range - 2262.25 -> 2285.75

Value 2266 -> 2276.50

S1 - 2306.25, R1 - 2261.50

Daily Numbers

Range 2264.50 / 2266.75 -> 2279.75

Value 2271.25 -> 2276.25

Globex 2270.50 -> 2279.75

Settlement – 2275.50

Today only - 2263, 2288.25

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5