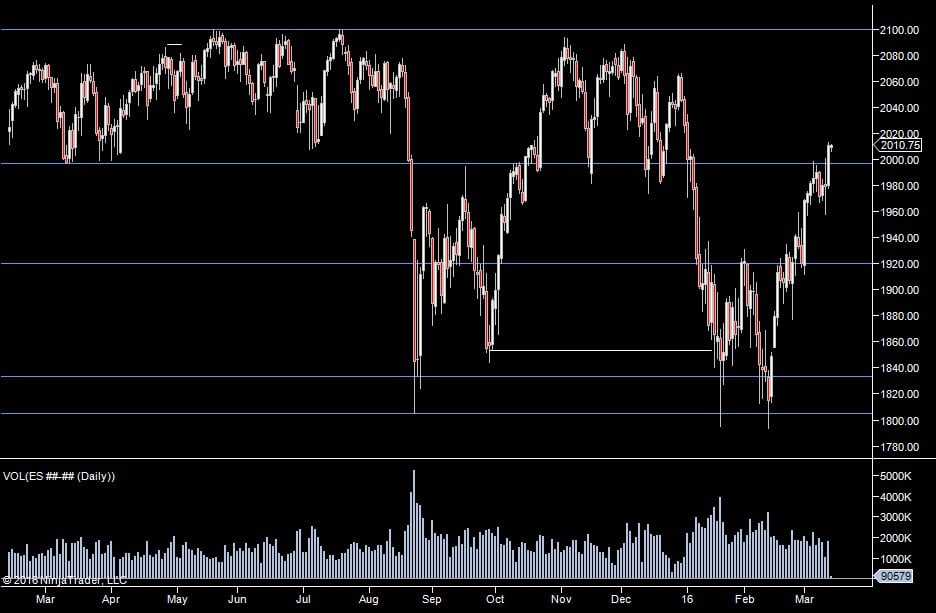

As we didn't do much of anything yesterday, I'm still looking for the same thing - whether we can hold above this 96.75 level and get speculators to take us up to 2100.

Yesterday we were looking for 2002.50 to hold. It turned out 2002 was the low yesterday but that's now broken overnight and we've moved down to 97.50 and it would be a beautiful thing if that held as it's nice and obvious and gives us the best chance of people joining into the upside. I'm watching 94.75 and 85 below as points we could hold too.

The 85 level is the top of that major distribution from last week. and the 94.75 is where the red line is.

We can see yesterday was a really tight range - after the first hour we'd just moved a little over 6 points. So of course, we have to be aware that we may be setting up for a range week. So eyes on the volume into the open.

So biased towards for a hold for more upside and that will be negated if we see sellers come in with volume. I don't particularly expect high volume to the upside at least till we clear yesterdays high.

Weekly Numbers

Range 1958 ->2012.75

Value - 1971.50 -> 1989

S1 - 1974.75 R1 - 2029.50

Daily Numbers

Range 2002 -> 2015

Value 2005 -> 2011.50

Globex 1997.50 -> 2010

Settlement - 2009.25

Today only - 1994.75, 1985

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75