That was quite an unusual rollover - anyway we are about done rolling, so now to trading June contract.

Our levels have moved down 9.25 points - so take note below.

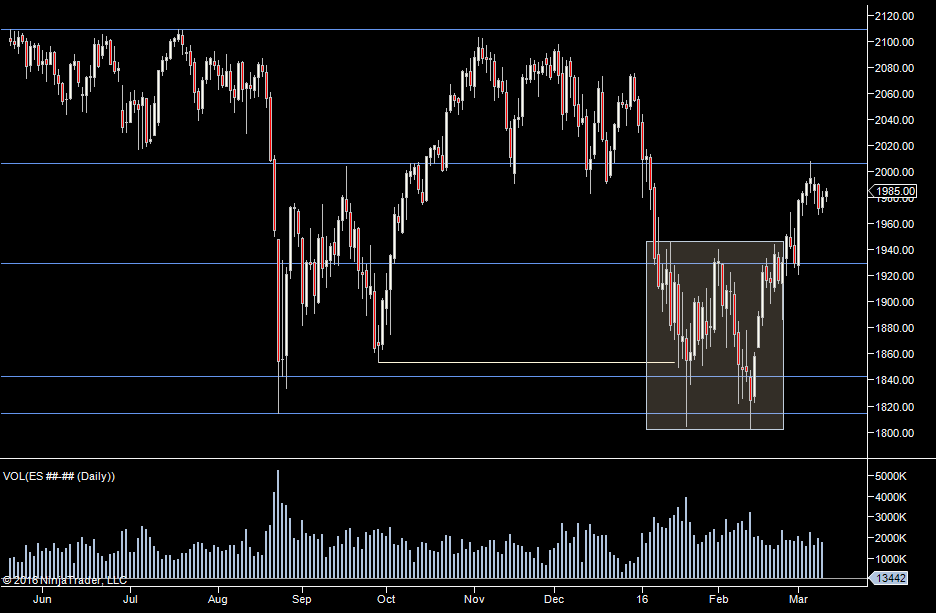

We are above our 1996.75 level, so looking for signs we can hold that, preferably on a pullback and then start our way up to 2100. So long biased above 96.75.

To the downside we have 2002.50 and 1994.75 as potential support as well as the 1985 level. Below that and I'm looking for signs of seller strength.

Fridays Value low was 2003 and the day session traded very much like a roll day. As we go into today, I'm watching for heavy selling right from the outset for a large down day. If we move down on moderate volume, I'm looking for the market to find support for the long. I will not participate in any average volume move down.

In terms of upside potential, it's pretty much open.

Weekly Numbers

Range 1958 ->2012.75

Value - 1971.50 -> 1989

S1 - 1974.75 R1 - 2029.50

Daily Numbers

Range 1978 / 1995.75 -> 2012.75

Value 2003 -> 2011.50

Globex 2006 -> 2011.50

Settlement - 2020

Today only - 2002.50, 1994.75, 1985

Long Term 2100, 1996.75, 1920, 1833.75, 1804.75