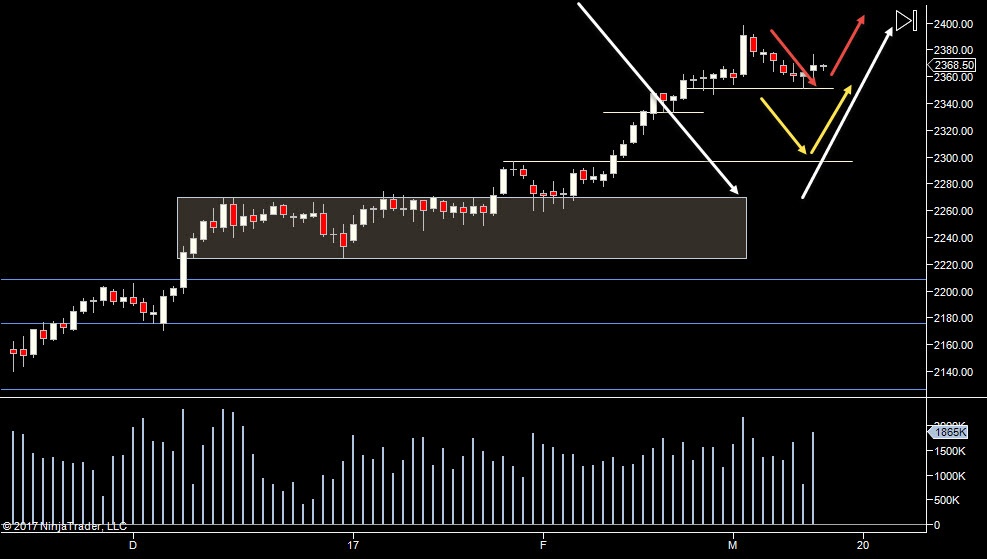

Still looking at 2 scenarios

1 - Market finds support at a recent level (may have already happened)

2 - Market moves into a nice 100 point range

We may not get an answer till after the FOMC - rates are supposed to go up so we could start the week in a holding pattern till that happens.

Just one fat distribution last week. 2358.25-2373 are the extremes.

The daily profiles show the same thing. With overnight action in the middle of Fridays range, not the thing you want to see for a breakout.

Plan

- Expecting a tight range till FOMC

- looking to fade moves to 2373 and 3258.25

- Follow a break on extreme volume only

Weekly Numbers

Range - 2351 -> 2377.75

Value 2361.75 -> 2372.25

S1 - 2354.75, R1 - 2378.50

Daily Numbers

Range 2359 -> 2374 / 2376.25

Value 2363 -> 2370.50

Globex 2364.75 -> 2369.25

Settlement – 2367.50

Today Only - 2333.25, 2351.25, 2358.25, 2373

Long Term Levels - 2178.75, 2129.50, 2099.75, 2084, 2078.75, 2000.75

Plan

- Expecting a tight range till FOMC

- looking to fade moves to 2373 and 3258.25

- Follow a break on extreme volume only

Weekly Numbers

Range - 2351 -> 2377.75

Value 2361.75 -> 2372.25

S1 - 2354.75, R1 - 2378.50

Daily Numbers

Range 2359 -> 2374 / 2376.25

Value 2363 -> 2370.50

Globex 2364.75 -> 2369.25

Settlement – 2367.50

Today Only - 2333.25, 2351.25, 2358.25, 2373

Long Term Levels - 2178.75, 2129.50, 2099.75, 2084, 2078.75, 2000.75