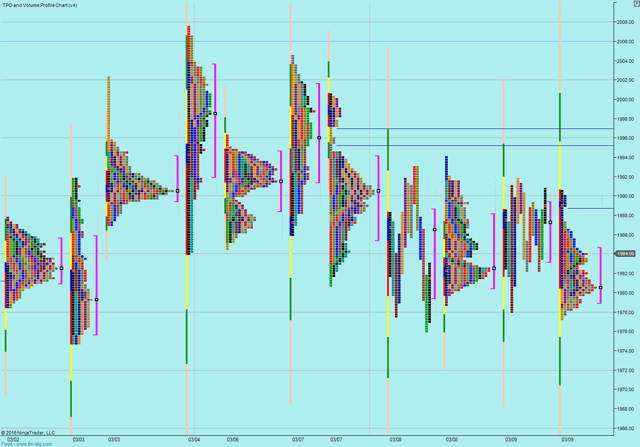

At risk of repeating myself - I'm not bearish till we get below the 71-74. So once again, anywhere below 74 I'm looking for 1945 fairly quickly and I think we'll see more buyers come in if we pop through 2006. Between that I think it's less decisive.

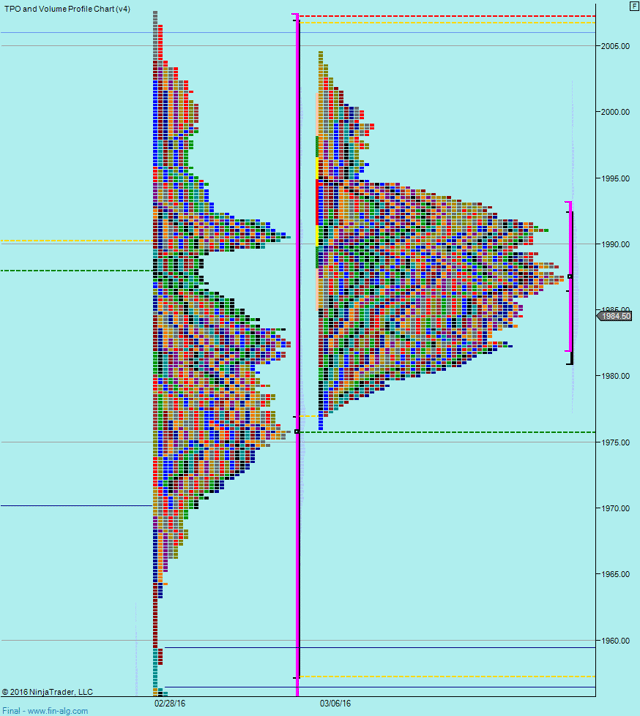

The volume profile for this week looks very typical of a range week, so look out for rotation up and a potential failure as we get to 1995.

Again, this is very rangebound action. My presumption is that 71-74 is the breakdown point and that this should be the range low. I am flexible on that but I'm definitely looking to get on a move up today with a first target of 95 (weekly value high). If we move below 71, then I'm expecting acceleration to the downside. I don't see much prospect for a rapid move up from here but we do have the unemployment numbers out today and any big surprise there could change people's perspectives but right now it's hard to see what'll bring buyers in quantity until we pop 2006.

Weekly Numbers

Range 1976 ->2004.50

Value - 1982 -> 1993

S1 - 1945 R1 - 2026

Daily Numbers

Range 1978 -> 1991.75 / 1994

Value 1983.25 -> 1989.25

Globex 1977.25 -> 1990.50

Settlement - 1989

Today only - 1971->1974.75

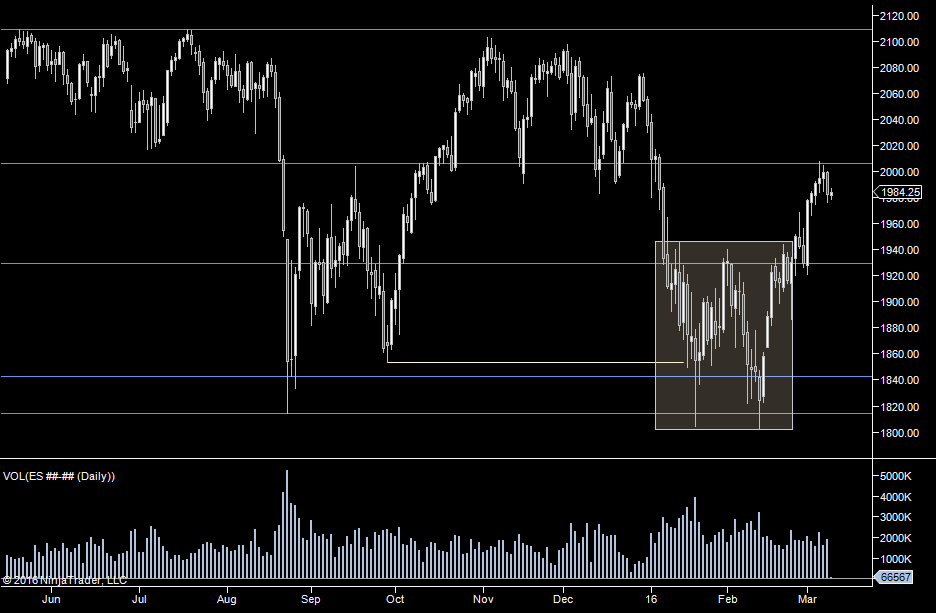

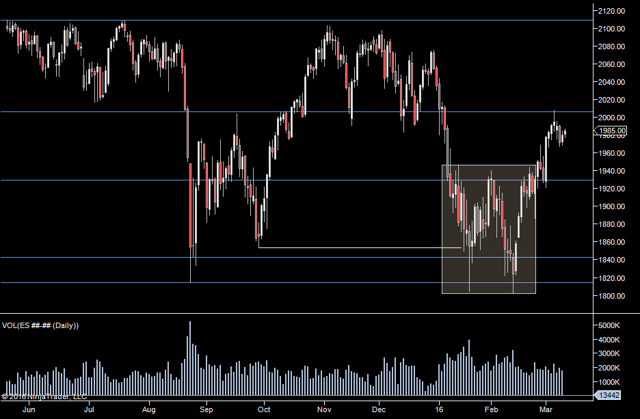

Long Term 2109.25, 2006, 1929.25, 1843, 1814, 1773.75