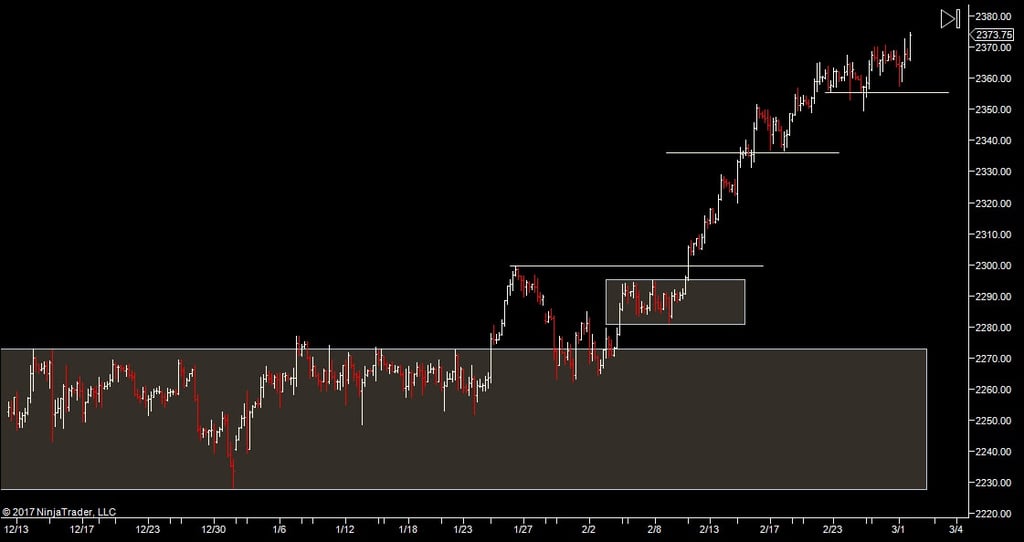

Decent volume yesterday and we've escaped the range - but only overnight. So first order of the day is whether we can hold these new prices into the day session.

We can see that we dropped into the range and have now popped out the top. Expectation in Mondays prep was that if we dropped below 63.50 - we'd end up ranging around 55-63.50.

We actually tested bottom of the range (well 57.50) and then back up to 64.50 in the day session.

We actually tested bottom of the range (well 57.50) and then back up to 64.50 in the day session.

And overnight we've spiked up to 74.50.

Plan

- Into the open - look for a snap back down, which may be just a re-balance after this pop up overnight OR it could be a rejection of the move up.

- If a re-balance, we should find support after an initial push down.

- If a rejection, we'll go back into the range.

- On the other hand if we move straight up with no downside move, I have no idea how that upside move will play out. So caution to the upside but trade to the long side if we move up off the open.

- A more confident long will come off a downside test (e.g a gap fill)

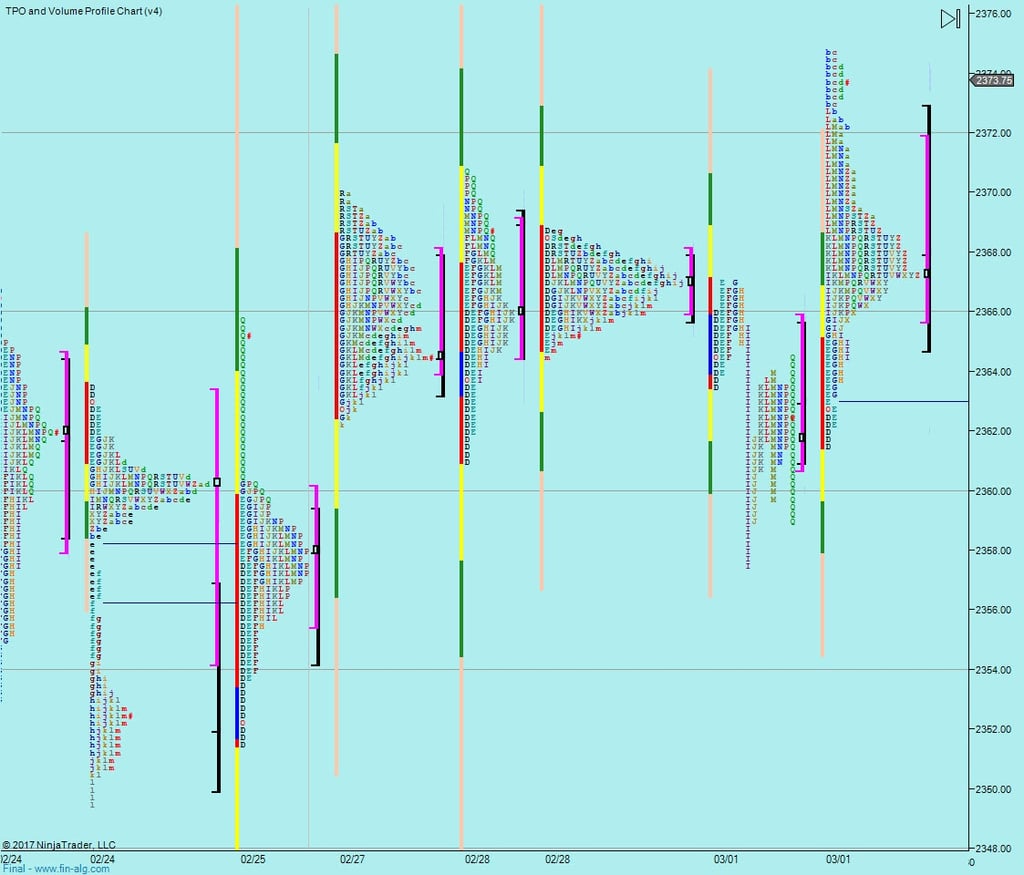

Weekly Numbers

Range - 2357.50-> 2375.50

Value 2363.25 -> 2368.75

S1 - 2355.25, R1 - 2370.50

Daily Numbers

Range 2357.50 -> 2367 / 2368.75

Value 2360.75 -> 2365.75

Globex 2361.50 -> 2375.50

Settlement – 2362.75

Today Only - 2355, 2363.50

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

- Into the open - look for a snap back down, which may be just a re-balance after this pop up overnight OR it could be a rejection of the move up.

- If a re-balance, we should find support after an initial push down.

- If a rejection, we'll go back into the range.

- On the other hand if we move straight up with no downside move, I have no idea how that upside move will play out. So caution to the upside but trade to the long side if we move up off the open.

- A more confident long will come off a downside test (e.g a gap fill)

Weekly Numbers

Range - 2357.50-> 2375.50

Value 2363.25 -> 2368.75

S1 - 2355.25, R1 - 2370.50

Daily Numbers

Range 2357.50 -> 2367 / 2368.75

Value 2360.75 -> 2365.75

Globex 2361.50 -> 2375.50

Settlement – 2362.75

Today Only - 2355, 2363.50

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5