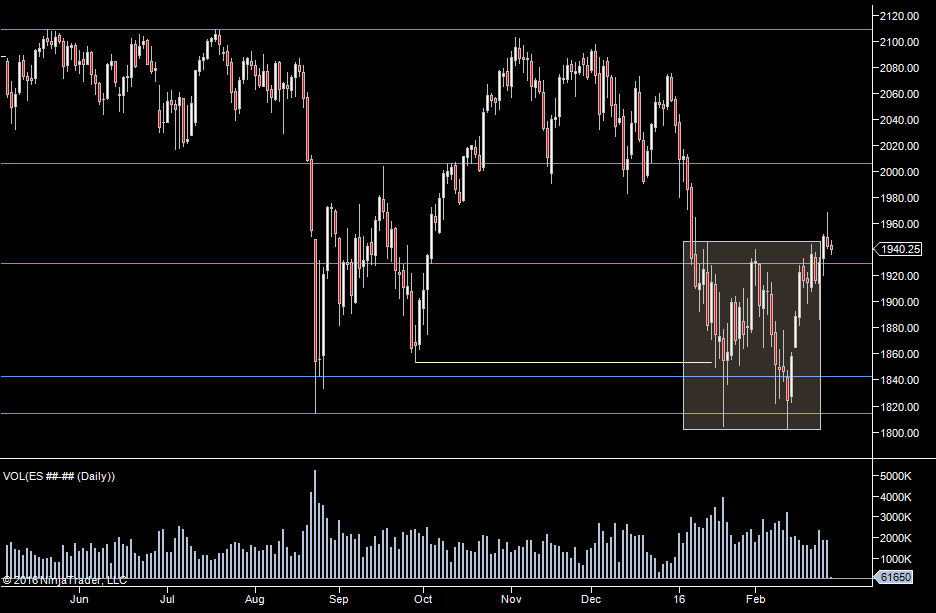

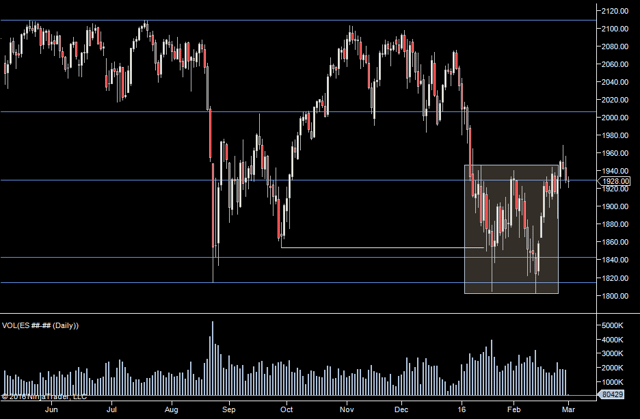

Yesterday we had "I'm looking for a hold anywhere from here down to 1929 with a view to buyers jumping on when they see that hold. If not, then my presumption will be a trip back to 1800 and more time in the white box."

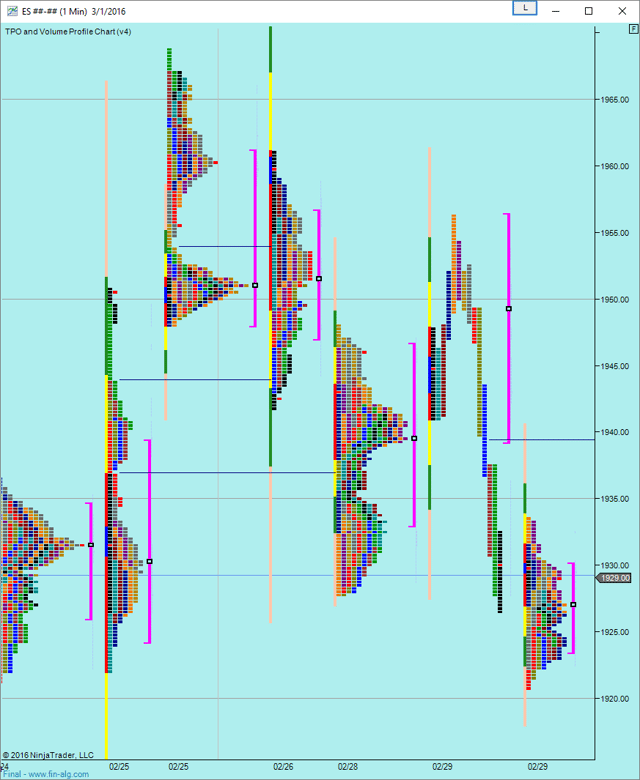

We poked down to 1927.75 yesterday in the overnight session and did see a move up to 56.25 but we couldn't hold it. So now we are back into the top of the range. So once again, I'm looking to see if we can hold for a proper run upside or if we fall back into the range.

I couldn't tell you which and there is an argument for us being in an upwards channel now but I still have us as "undecided". Now we could put some of yesterdays action down to end of month and there was a massive offer yesterday of over 5000 contracts that got completely taken out and pretty much ignored thereafter. So fingers crossed, that we may be a little more free to make a proper move today.

Today - I'll be watching how we do on any move up to yesterdays value low or daily low. If they get rejected then it's a downside bias. For upside, well in theory anything above 1929 is bullish but we are in an indecisive area, so I wont try to gain too much meaning from the bigger picture today and it'll be a case of joining in on the side of volume.

Weekly Numbers

Range 1886.75 ->1968.75

Value - 1905.75 -> 1942.25

S1 - 1896.75 R1 - 1978.75

Daily Numbers

Range 1926.50 -> 1956.25

Value 1939.25 - > 1956.25

Globex 1920.75 -> 1933.59

Settlement - 1929.50

Long Term 2109.25, 2006, 1929.25, 1843, 1814, 1773.75