An interesting day today. We had FOMC yesterday and as expected rates went up. Now, you could say that the market reacted negatively but you could also say it was a typical post-FOMC knee jerk. In theory the rate increase was alreadyu expected and priced in.

But - there is the offchance that the technicals are irrelevant today that they we have a fundamentals driven day.

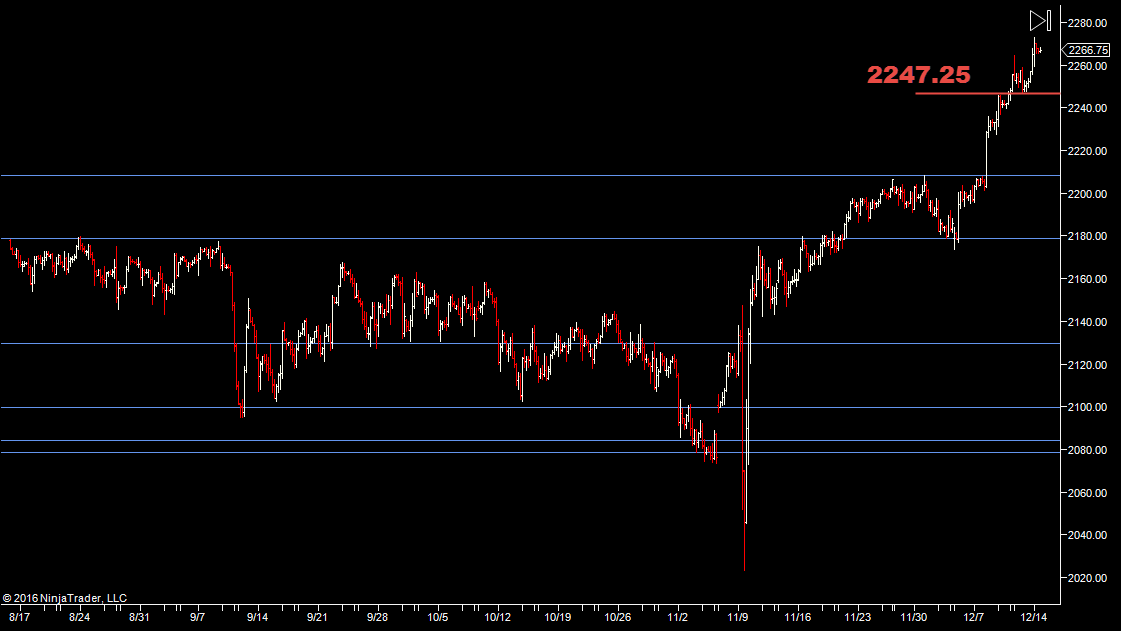

We are still above the upper distribution from last week, so that's still a reference point.

I think today is just a matter of one issue - will it be volatile or not. After a big day like that we could just sit in a range and that's what is happening overnight or it could put in a decent move. I think it's a coin toss as to which way any "decent move" will be.

Plan

So the plan today is simple. Watch for a high participation move and go with it, otherwise play the range. We do have good potential either way, or rather, we have the potential for people jumping on board whichever way it moves.

Weekly Numbers

Range 2143-> 2273

Value 2248 -> 2263.50

S1 - 2213.75, R1 - 2275.50

Daily Numbers

Range 2243 -> 2272.50

Value 2253 -> 2267.50

Globex 2248 -> 2257

Settlement – 2252.75

Other levels – 2208.50, 2243, 2247.25

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

So the plan today is simple. Watch for a high participation move and go with it, otherwise play the range. We do have good potential either way, or rather, we have the potential for people jumping on board whichever way it moves.

Weekly Numbers

Range 2143-> 2273

Value 2248 -> 2263.50

S1 - 2213.75, R1 - 2275.50

Daily Numbers

Range 2243 -> 2272.50

Value 2253 -> 2267.50

Globex 2248 -> 2257

Settlement – 2252.75

Other levels – 2208.50, 2243, 2247.25

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5