FOMC day today so of course, that can throw our prep out - but here goes...

As expected we progressed upwards yesterday and as expected we went up, down and up again in the process! We found support at the prior days high, retested it again before we got the pop to new all time highs. So an eye on 47.25 today.

Not much to say about the weekly profile other than it's still worth keeping an eye on the 43 area.

YWe had a late pullback yesterday to 65.50 and that is holding overnight, so we could push up from here.

Plan

- As per yesterday, upward bias

- best trade will be long off a test (but 65.50 holding may be that test) - pereferably off one of our levels below

- FOMC does muddy the waters though

- I'm an AM trader, so plan is to see how the first 45 mins play out and if it's dead, give the day a pass

Weekly Numbers

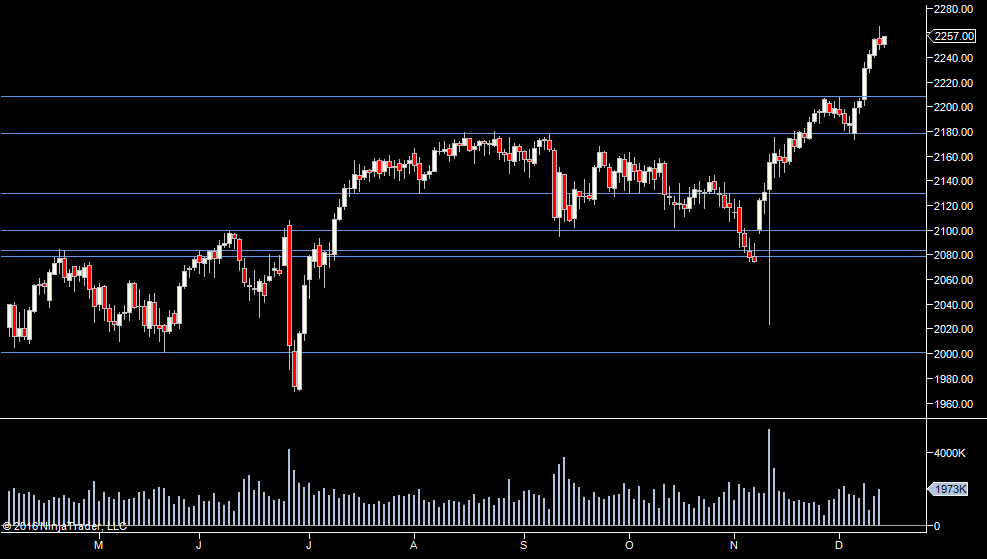

Range 2173.50-> 2246

Value 2248.25 -> 2261.75

S1 - 2213.75, R1 - 2275.50

Daily Numbers

Range 2247.75 / 2259 -> 2273

Value 2263 -> 2270

Globex 2265.25 -> 2268.25

Settlement – 2273.25

Other levels – 2208.50, 2243, 2247.25, 2265.50

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5

Plan

- As per yesterday, upward bias

- best trade will be long off a test (but 65.50 holding may be that test) - pereferably off one of our levels below

- FOMC does muddy the waters though

- I'm an AM trader, so plan is to see how the first 45 mins play out and if it's dead, give the day a pass

Weekly Numbers

Range 2173.50-> 2246

Value 2248.25 -> 2261.75

S1 - 2213.75, R1 - 2275.50

Daily Numbers

Range 2247.75 / 2259 -> 2273

Value 2263 -> 2270

Globex 2265.25 -> 2268.25

Settlement – 2273.25

Other levels – 2208.50, 2243, 2247.25, 2265.50

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5