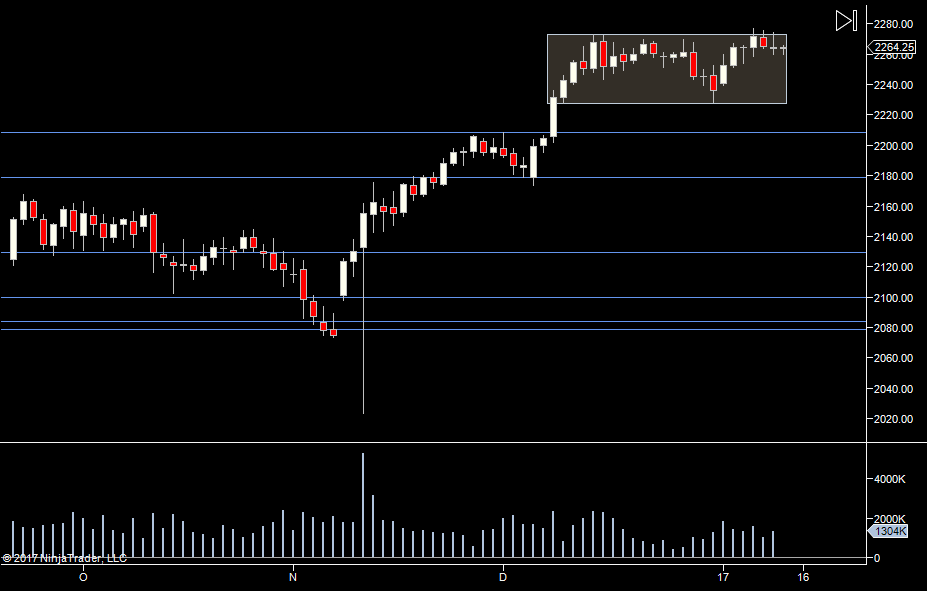

Volume is up but we are still stuck in a tight range for the week. We did extend the weeks range to the downside but we couldn't hold it. So while we are in a greater range, as defined by the white square, the weeks range is defining the action.

With that in mind, most of the volume is in the 2260-2270 area, which is most likely not the best area to take a trade (except off the open). If we probe out of that area, I'll be looking for a sign it's holding.

A decent range yesterday, which is obviously a benefit. We were looking for a move below 2260 to potentially shake us out of this range but that didn't happen yet.

Plan

- No bias - we are in a range week, so probes out, heafakes etc are likely. We will break the range at some point but have no idea of knowing when.

- No trades in the 2260-2270 area as I'm expecting chop, will look for fades back to the range if we move out of it

- Exception to the 2260-2270 rule will be if we get a move off the open. Despite the big moves of the past 2 days, I'd still prefer to get something close to the open as range weeks can have some awful days....

Weekly Numbers

Range 2255 -> 2275.25

Value 2260.75 -> 2268.25

S1 - 2248.50, R1 - 2286

Daily Numbers

Range 2255 -> 2270.25

Value 2260.75 -> 2268.25

Globex 2260.75 -> 2271.75

Settlement – 2270.50

Other levels – 2227.75, 2273

Key Levels – 2178.75, 2129.50 , 2099.75, 2084, 2078.75, 2000.75, 1945.5,1898.75,1812.5,1783.5