Kudos to Gary Norden calling the market as having "priced in a Clinton win". Markets dropped on the re-launch of the FBI investigation into her emails and has now gapped up on the "nothing to see here" from the FBI.

Next 2 days are at high chance of news risk, certainly trading tomorrow will be potentially risky - although I'm not sure what restrictions there are on election related news releases while the polls are open.

For today, well potentially we have some ground to make up to the upside based on where we were when the FBI dropped the news last week. On the other hand, we may find traders simply don't want to take the risk today.

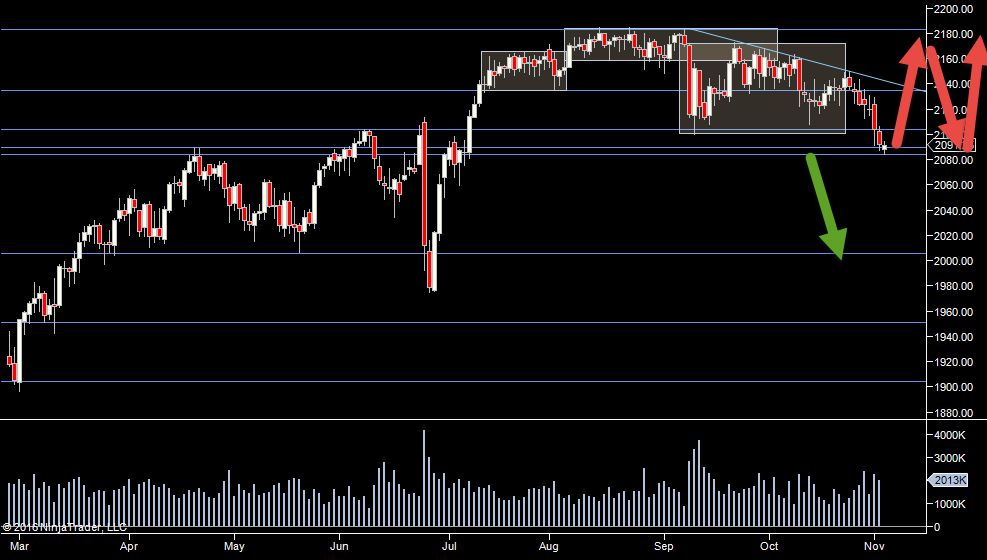

We have 2 distributions formed last week. The lower one seems to top out at 2102.50 and the upper one has a low of around 2120. If we pierce 2102.50, there's not much trade till 2120 - so look out for a pop if 02.15 breaks but be cautious as we approach 2120.' So we could pop to 2120 when the US traders come into the market.

Plan

- There's a lot of variables coming into play this week - so an ear on the news as much as the action

- I'm cautiously bullish heading into today, mostly from the fundamental view that Mrs C seems to be in the clear

- Wikileaks should be of particular interest

- In the absence of news, we may find a general lack of interest IF speculators decide they don't want to play this close to the election, so an eye on volume/market depth

Weekly Numbers

Range 2078.75 -> 2130.50

Value 2079.75 -> 2107.75

S1 - 2063.25, R1 - 2112

Daily Numbers

Range 2079-> 2094.25

Value 2084.50 -> 2093.50

Globex 2102.75 -> 2111

Settlement – 2080

Today only - 2102.50, 2120

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75