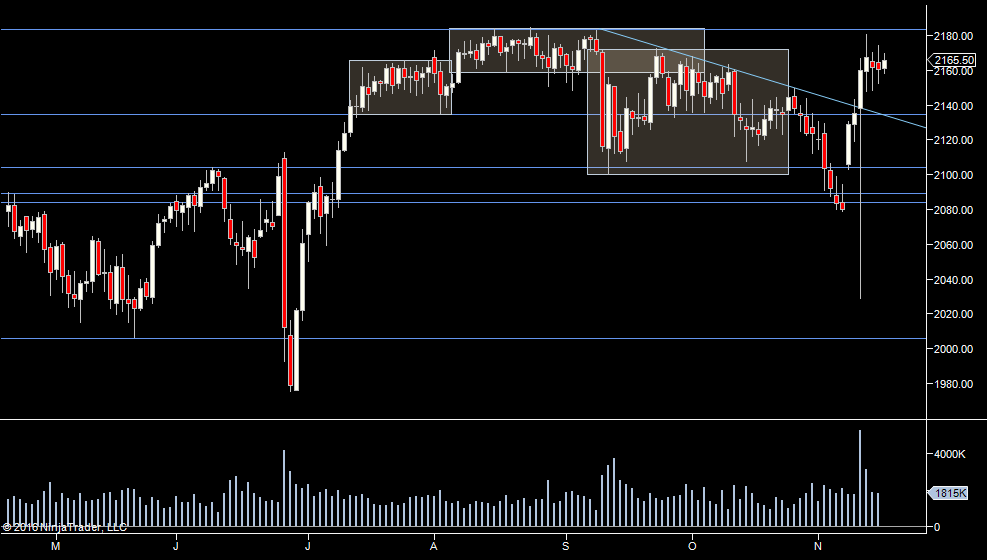

Volume dropping off. No great shock given the way the week started. We can't escape last Friday's range. On Monday we said:

And so far we are playing that out, although we did have a brief pop through the high but interest was pretty low.

We are still holding the upper distribution from last week, so eyes still on 52.50 if we have a retrace.

We can see the poke through the all time high yesterday and the reaction was pretty pathetic. In fact, the day session couldn't even retest it.

Plan

- A sit and watch it play our morning - that move off the highs could gather momentum and see us sell off down to 2100

- It's entirely possible that we take another test up there and possibly blow through it. I think we haven't come off enough to say we are done to the upside. There's no volume either side.

- So eyes on momentum, volume. Expectation still low overall, just looking for people to hand their hats on a move

Weekly Numbers

Range 2152.25 -> 2185

Value 2160.25-> 2175.25

S1 – 2063.25, R1 – 2112

Daily Numbers

Range 2161.50 / 2175.50 -> 2183 / 2185

Value 2178.25 -> 2182.75

Globex 2168.75-> 2178

Settlement – 2172.75

Today only - 2152.50

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75

Plan

- A sit and watch it play our morning - that move off the highs could gather momentum and see us sell off down to 2100

- It's entirely possible that we take another test up there and possibly blow through it. I think we haven't come off enough to say we are done to the upside. There's no volume either side.

- So eyes on momentum, volume. Expectation still low overall, just looking for people to hand their hats on a move

Weekly Numbers

Range 2152.25 -> 2185

Value 2160.25-> 2175.25

S1 – 2063.25, R1 – 2112

Daily Numbers

Range 2161.50 / 2175.50 -> 2183 / 2185

Value 2178.25 -> 2182.75

Globex 2168.75-> 2178

Settlement – 2172.75

Today only - 2152.50

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75