Index futures have had a bit of a roller-coaster ride over the past few days during and since the election. So how do we adjust our approach to trading over the next few weeks?

Prior to the election, we’d been in a holding pattern. In fact as we left the summer time, we didn’t stop ranging, we just had larger daily moves but were still without direction. Now that Trump is President elect, we enter a period of perceived uncertainty. At this point, let’s step back and become a-political. It does not matter who you wanted to be President, it does not matter what you think about Trump. It only matters what the market thinks about Trump. So whether you think Trump brings certainty or uncertainty, the market seems uncertain. So personal opinions aside as you trade!

We enter a period of increased news risk. Trump does have a tendency to shoot from the hip and in turn the media does get into a frenzy. Again – don’t take this as political opinion, just as an observation of facts. So if Trump is being interviewed on mainstream TV, there is a possible that something he says initiates a move. Over the next few months, as he reveals his team and more details on policies, these announcements, will impact the market.

If you are trading Index Futures, Interest Rates or in fact, pretty much anything, you need to keep on your toes, keep an ear to the news squawks and keep an eye on liquidity. You can’t watch every news channel, so if you do feel liquidity is thinning out and the market is starting to show signs of odd behavior and you are in a trade, it might be a time to be a bit more aggressive about closing out.

Other than that, we should have a period of higher volatility. Which is good IF we adjust for it.

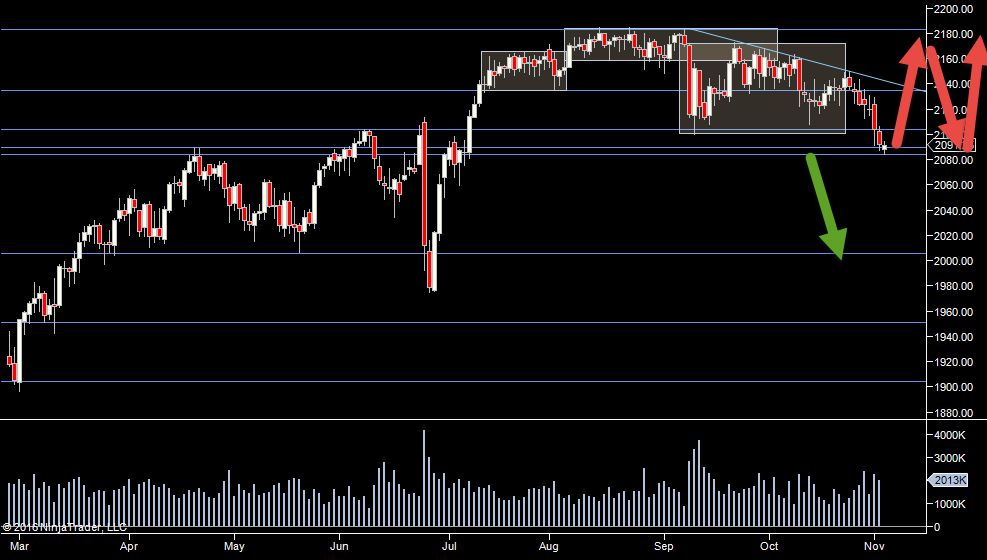

Now that the election is over, our first thing to consider is the overall range and whether we can escape it or not. So 2104-2183.75 (all time high) is my presumed range for the moment. If it breaks, I’ll be looking for a retrace back to the range extreme for a continuation trade.

Trading after a big move day can be a bit tricky. We can often have a snap back (although yesterday WAS a snap back) and give back all the gains/losses. We can get a continuation and we can get the market go into a shock, small range day.

So on days like this, the best approach is to wait for the volatility and take a "go with" trade. That potentially puts us towards the all time highs.

What we do have today is the late pullback yesterday to 2147.50, so watch that today.

So the plan for index futures today and the coming week is:

Plan

- Watch out for the market taking a breather because that could happen any time.

- If we get decent volume, and signs of volatility, take "go with trades" with a presumption of a decent run

- Be wary as we approach 2104 & 2183.74

- Let the range play as we get to the extremes. There's risk of a lot of nudging around there.

- If the range breaks, look for the market to fall back to the range and hold (not necessarily all the way), expect good participation on a continuation trade if that holds.

- If the range doesn't break - play to the other extreme.

Weekly Numbers

Range 2028.50 -> 2170.75

Value 2089.75 -> 2168.25

S1 - 2063.25, R1 - 2112

Daily Numbers

Range 2028.50 / 2118.25 -> 2166.75

Value 2136.75 -> 2166.75

Globex 2155.25 -> 2170.75

Settlement – 2160.25

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75