Excuse my absence, I had the flu. Not that I missed much by the look of things. I had an article in my inbox today which very nicely sums up the pre-election "holding pattern" we are in right now....

Macro Event Trading Article

That's a great article if you are holding into the election or wondering what will cause volatility in the next 8 days (hint: Trump).

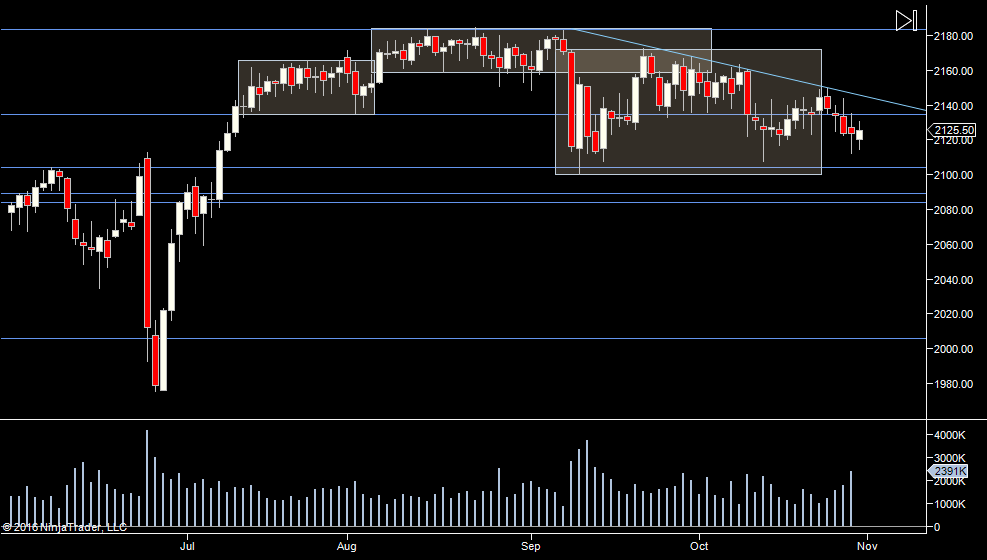

We are still in the holding pattern, having trouble to the upside but I don't see that as a hard ceiling at this point.

Friday range was over 20 points, so whilst the market is choppy, we still have a good intraday range.

Plan

- A balanced market - so go with trades to the end of the range, then fades at the extremes of price OR value.

- News risk is high considering the Feds announcements on Friday

- Still looking for early trades

- an eye on the longer term range means anything below 2011 is worth fading for a long

Weekly Numbers

Range 2107.75-> 2163.50

Value 2116.25 -> 2141.75

S1 - 2102, R1 - 2157.75

Daily Numbers

Range 2120.25/ 2129 -> 2135.25

Value 2118.50 -> 2132

Globex 2114.75 -> 2130.50

Settlement – 2123.75

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75

Plan

- A balanced market - so go with trades to the end of the range, then fades at the extremes of price OR value.

- News risk is high considering the Feds announcements on Friday

- Still looking for early trades

- an eye on the longer term range means anything below 2011 is worth fading for a long

Weekly Numbers

Range 2107.75-> 2163.50

Value 2116.25 -> 2141.75

S1 - 2102, R1 - 2157.75

Daily Numbers

Range 2120.25/ 2129 -> 2135.25

Value 2118.50 -> 2132

Globex 2114.75 -> 2130.50

Settlement – 2123.75

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75