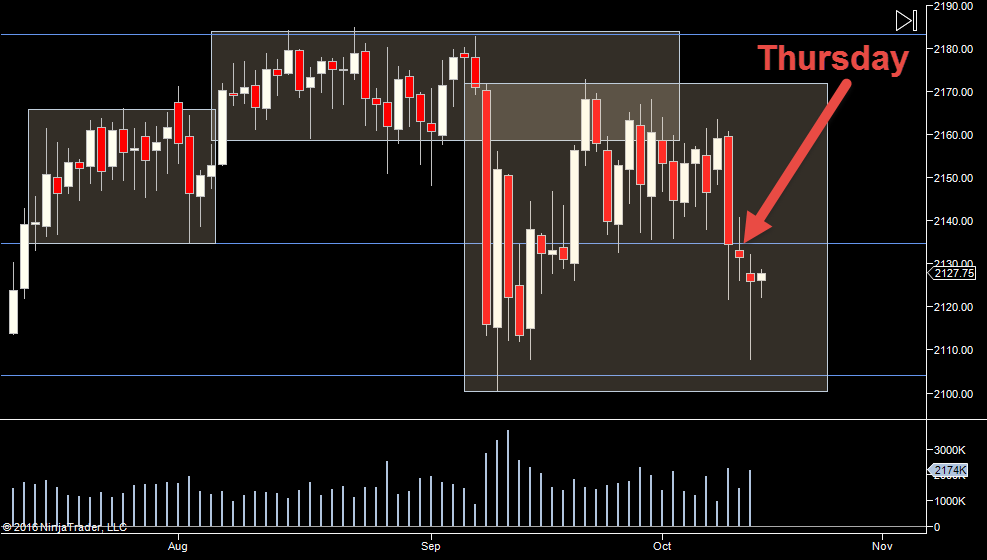

The market went sideways after the drop. I don't think think the long term picture gives us a setup unless we move to 2100 again. At that point we are at a make or break point again.

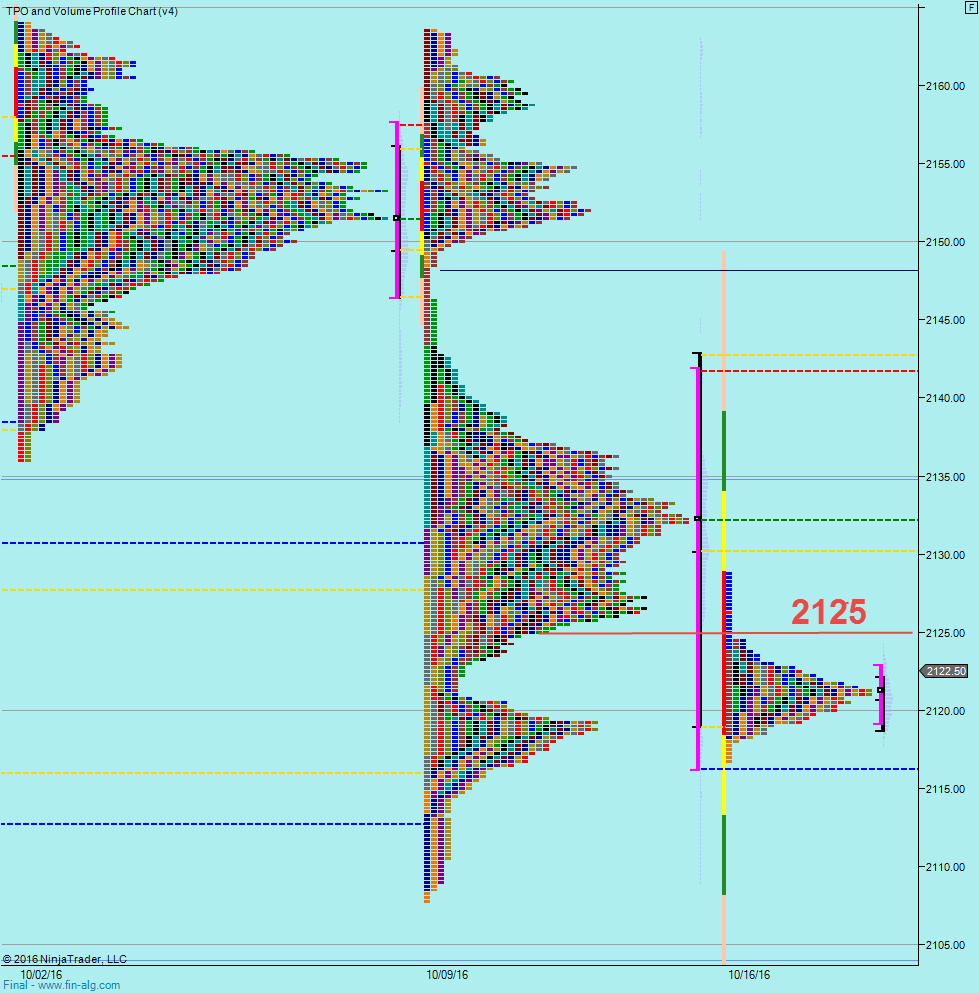

Zooming in a little, we can see that we are still below major distribution of trade last week. So if we test 2525 after the open, I'll be looking to see if sellers come in there.

I'll also be watching for a bounce at Fridays day session low - 2126.50. Other than that the plan is basically the same while we are ranging...

Plan

- A balanced market - so go with trades to the end of the range, then fades at the extremes of price OR value.

- on the lookout for a break out of the range (it'll happen some time)

- an ear on the news in case something happens with DB (seems the fine is going down)

- no bias - just looking to take advantage of momentum on a short term moves that occur before we finally breakout

Weekly Numbers

Range 2107.75-> 2163.50

Value 2116.25 -> 2141.75

S1 - 2102, R1 - 2157.75

Daily Numbers

Range 2122.25/ 2126.50 -> 2143.25

Value 2127.25 -> 2136.25

Globex 2116.75 -> 2128.75

Upper Range - 2158.75-2184

Today only 2125

Settlement – 2127

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75

Plan

- A balanced market - so go with trades to the end of the range, then fades at the extremes of price OR value.

- on the lookout for a break out of the range (it'll happen some time)

- an ear on the news in case something happens with DB (seems the fine is going down)

- no bias - just looking to take advantage of momentum on a short term moves that occur before we finally breakout

Weekly Numbers

Range 2107.75-> 2163.50

Value 2116.25 -> 2141.75

S1 - 2102, R1 - 2157.75

Daily Numbers

Range 2122.25/ 2126.50 -> 2143.25

Value 2127.25 -> 2136.25

Globex 2116.75 -> 2128.75

Upper Range - 2158.75-2184

Today only 2125

Settlement – 2127

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75