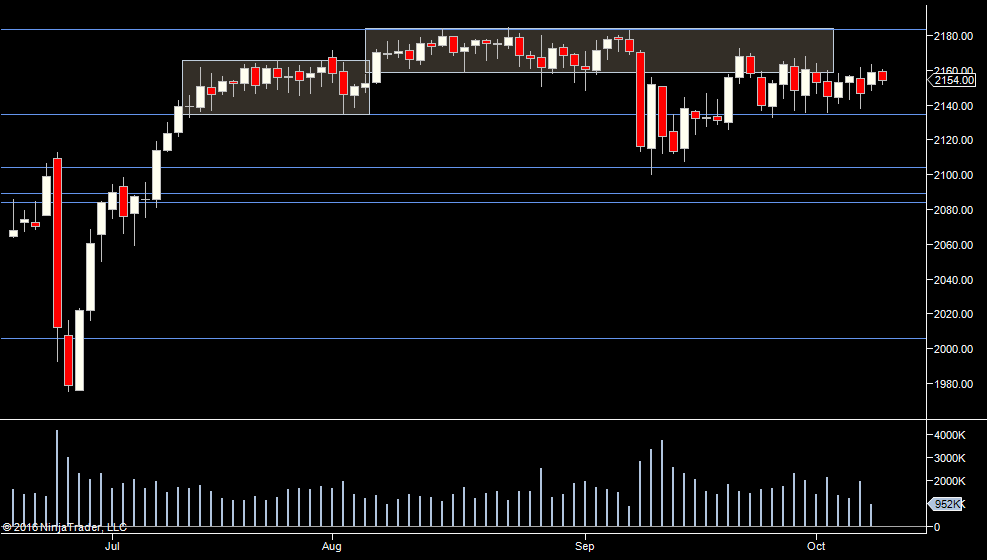

Excitement! We had a good sell off yesterday with a lot of chances to get on board. We dipped down past the 2 week low and we had very good volume.

So now we are at a decision point (the low of the past 2 weeks), so we can expect decent participation if the range low holds and even better participation if we carry on down.

One thing to look out for if we do move up is us topping out at 48 (the bottom of where most trading last week was)

Also - an eye on the late pullback/value high from yesterday (2139.50).

Plan

- Should be a decent day, we have broken the 2 week low (2132.75) - so go with trades away from that area to the upside or downside. Don't engage in that area

- To the upside, eyes on 2148 as resistance

- To the downside, targeting 2100

- I'd be amazed if this was a slow day but be aware of any chop off the open, there's no need to get in right at the start and if we do have a good run, it will be OK to let the market show it's hand first

- Eyes on yesterdays low for a hold too

Weekly Numbers

Range 2121.75 -> 2163.50

Value 2135> 2163.50

Daily Numbers

Range 2121.75 -> 2153.50/ 2160.75

Value 2124.25 -> 2139.15

Globex 2129.75 -> 2140.75

Upper Range - 2158.75-2184

Today only 2148, 2139.50

Settlement – 2134.50

Key Levels: 2184, 2134.75, 2104, 2089.25, 2084, 2006, 1950.75, 1904, 1817.75, 1788.75