Yesterday we were looking for signs the market had bottomed out and we didn't get that. What we got indecisive. Overnight, we have seen a push up, so I'm looking for signs of continuation at the open. We settled very close to the prior days settlement.

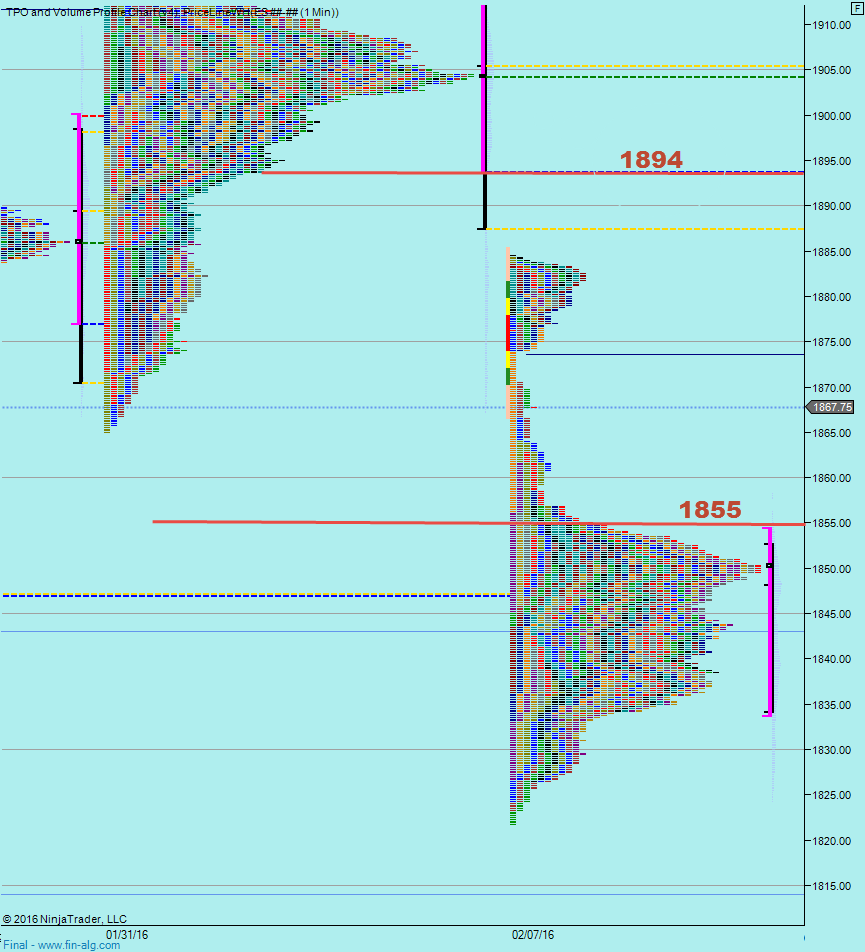

If we do move up, the first hurdle I have is 1894, which is the bottom of the distribution from last week. To the downside, we have the top of last weeks distribution which is at 1855.

Looking at the past few days, it looks like we are setting up for range bound behavior. So into the open today, I'm wary of the market dropping down back into the range of the past 2 days.

So my 2 scenarios for today

- continuation upwards to complete the range at 1929

- move down back into the range of the past 2 days and move sideways within it

Weekly Numbers

Range 1821.75 -> 1884.50

Value - 1833.75 -> 1854.25

S1 - 1847, R1 - 1922

Daily Numbers

Range 1825.75-> 1863.75

Value 1836.25 -> 18852.75

Globex 1838.50 -> 1870.50

Settlement - 1848.35

Today only - 1894, 1855

Long Term 2109.25, 2006, 1929.25, 1843, 1814, 1773.75