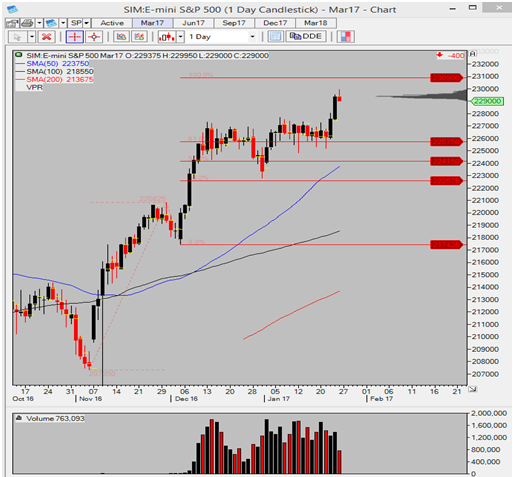

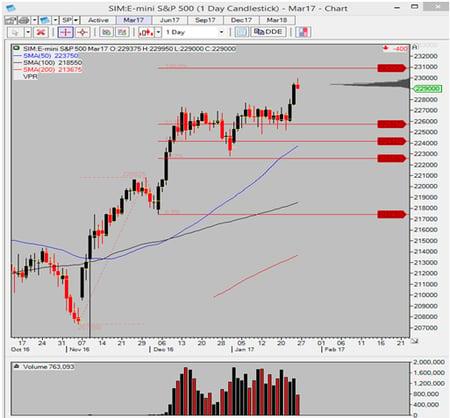

Shown in the chart below, the ES seems to be following suit as far as the volume is concerned in this spike to the upside. Volume means power in relation to directional conviction, and while I would be more comfortable with increasing volume, so far I’m not that worried about the lack of it in this move to all-time highs. It just seems to be the way the ES moves. Since there is nothing to frighten the market, it is just drifting higher. Barring any news, this is just following suit.

Being in new territory, projections for targets on the upside may be hard to come by, but I have a initial Fibonacci extension target of 2309.00 that has been on my charts since mid-December. The more time we spend time above about 2275.00, the more confident I am that that target will be reached soon, and that higher prices are being accepted, paving the way for more upward price action.

Open interest is not giving me any clues this week, perhaps hinting that the shorter time frame is the most active and the longer time frame is positioned and in a ‘wait and see’ mode. I am looking for a pullback down to 2275-2270 and will be monitoring for a fall off of activity to look for longs. Failure to maintain price above these levels will mean we will need to put a new game plan in place.

Trade well.